A blockbuster year for private equity

On the heels of record-breaking dealmaking in 2021, we expect a number of factors to continue to support the current momentum of deal activity in the private equity sector.

Canadian market overview

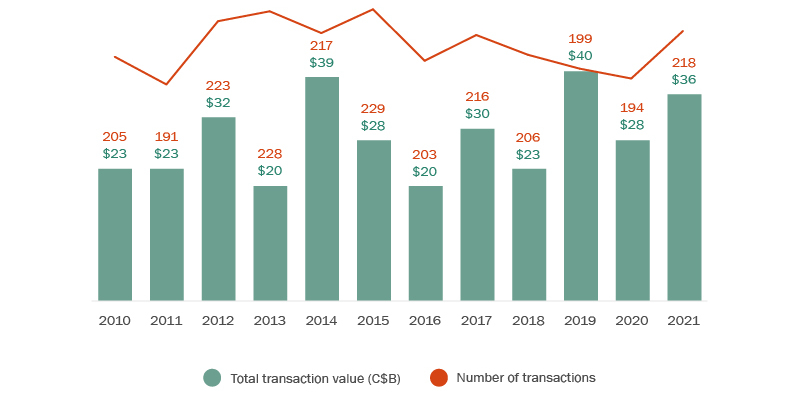

In 2021, the volume of Canadian domestic M&A activity by financial investors reached a five-year high, as financial players put capital to work in a frothy deal environment. While aggregate transaction values totaled $36 billion last year, slightly down from the decade high of $40 billion in 2019, the total value of deals by financial investors represented a 28% increase over 2020 levels (Figure 1). All these indicia point to the bull market for private equity—and in particular for North American private equity firms—which held, as of August 2021, about 50% of the over $2 trillion of dry powder available globally for investment activity1.

Figure 1 – Canadian market overview

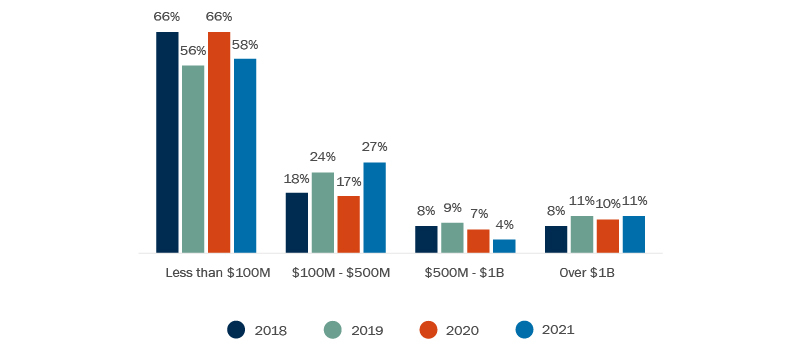

Much of the deal activity has been concentrated in the mid-market, with approximately one third of transactions falling in the C$100 million - $500 million value range—which is historically the sweet spot for Canadian private equity transactions (Figure 2).

Figure 2 – Deal value range

Role of private equity players

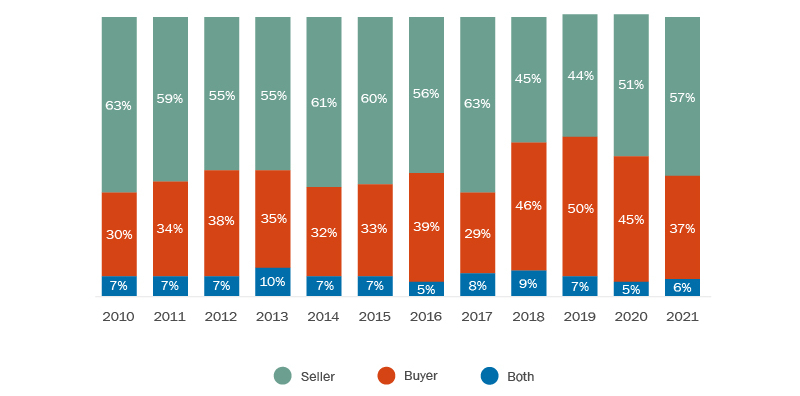

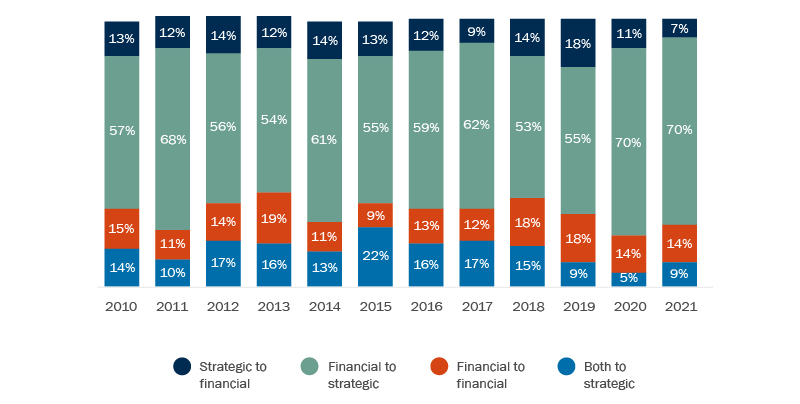

While many financial investors continued to be highly acquisitive last year, 2021 also saw the ongoing rise of sell-side transactions by financial sponsors, which reached a four-year high that accounted for 57% of overall domestic deal activity (Figure 3). While we saw many sponsor-to-sponsor transactions (a trend we have been writing about over the last seven years or so), in 2021, strategic buyers were certainly part of the deal frenzy. In fact approximately 70% of the exits by financial sponsor firms entailed a strategic buyer (though of course, some of them were in turn backed by private equity firms) (Figure 4). This comes as no surprise as last year continued to show businesses actively pursuing growth strategies and executing on strategic plans through acquisitions, amid the ongoing confidence of boards and CEO in the current deal environment (read more about the Canadian M&A outlook for 2022 here).

Figure 3 – PE role

Figure 4 – Exit strategies: seller to buyer role as a percentage of overall transactions

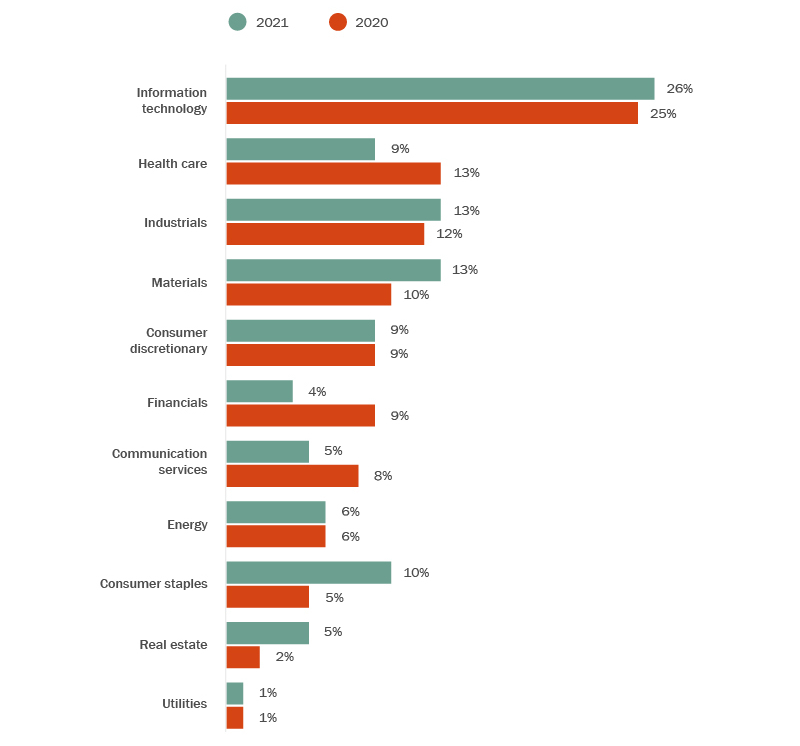

Especially in the current business landscape, technology reigned as the sector of choice for dealmakers. Transactions in the sector accounted for one quarter of M&A dealmaking last year, followed by deals in the industrials, materials and healthcare industries (Figure 5).

Figure 5 – Industry breakdown

Predictions for 2022

As we look to the year ahead, we see the following trends shaping deal activity in 2022:

- Dealmaking will continue. As we kick off the year, deal activity shows no sign of abating. Private equity investors continue to have large amounts of deployable capital and investment horizons that they must abide by. The dry powder, coupled with a low interest rate market and readily available of debt financing, should result in a robust deal market in 2022. Of course, this prediction doesn’t account for a black swan event, a disclaimer that feels appropriate given the pandemic times we live in.

- More acquisition growth for portfolio companies. In the current robust deal environment, we anticipate that investors will continue to actively pursue acquisitions as a growth strategy for their portfolio companies—as a means of expanding into new markets and geographies, acquiring talent and new technologies.

- ESG-focused businesses. Businesses and investors are increasingly focused on ESG and sustainable investing. Global private equity firms are raising sustainability-focused funds and we expect ESG-focused businesses to represent a growing area of interest for investors.

- More secondary buy-out transactions. With competition for quality assets remaining strong, private equity funds face challenges in deploying unfunded capital and we anticipate that more secondary buyouts (the sale of a portfolio company by a PE firm or pension fund to another financial buyer) deals will continue.

- Infrastructure focus. Infrastructure projects are set to be a critical source of government investment in the coming years (read more here). Private equity funds are investing in infrastructure-like assets and raising dedicated infrastructure funds—focusing on direct investments in core infrastructure and related businesses and operations that support them. We expect this trend will continue.

- Cyber risks remain front and centre. The accelerated digitization of businesses and their supply chains has meant that organizations are increasingly at risk of cyberattacks. Private equity players transacting in the year ahead will need to account for the growing risk that cyber breaches pose for their portfolio companies, ensuring regulatory compliance and deterring privacy breaches, facilitating and conducting adequate due diligence of privacy and data governance-related matters—and drafting deal documents thoughtfully to properly allocate risk.

- GP-led secondaries for liquidity. General partners of private funds have been increasingly looking to GP-led secondary transactions to provide liquidity solutions and to secure pre-emptive extensions of fund terms to maximize the value of fund assets. We expect this trend will continue in 2022.

- More earn-outs. Valuation multiples paid for new platform investments are high, especially in the current competitive deal market. As the pandemic continues and uncertainty around the long-term economic outlook increases, we expect to see more earn-outs used on deals as a tool to bridge misalignments in pricing expectations with buyers and sellers.

Conclusion

With an ongoing abundance of capital to deploy and a strategically robust private equity sector in Canada, we expect high levels of dealmaking activity to continue for so long as we are in a low interest rate environment and have relative economic stability.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.

Tags

Private Equity and Principal Investors

M&A

Buyout Transactions

Fund Formation and Investments

Transactions

Board Advisory and Governance

Advisory and Regulatory

Technology

Industrial and Manufacturing

Life Sciences

Sustainability

Infrastructure Energy and Resources

Infrastructure

Government and Crown Corporations