Increase in renewables deals provides boost to infrastructure M&A

Authors

A choppy year in Canadian infrastructure M&A has benefited from one notable outlier: renewable energy projects. And renewables deals are not only driving dealmaking in the space. They are experiencing a longer term maturation as a category, against the backdrop of an energy transition environment taking next steps.

This article shares important data points from Canadian infrastructure M&A activity this year—and then narrows the focus to analyze renewables deals and their breakthrough success.

Canadian infrastructure M&A: value or volume?

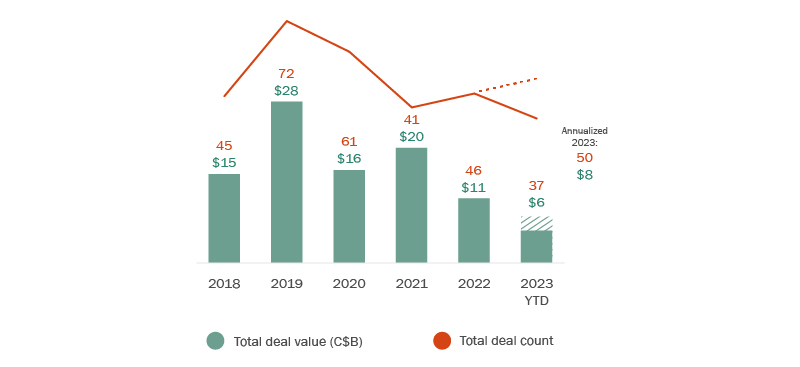

Canadian infrastructure deal activity this year has split along a value-volume divide. Volume remains robust, with 37 deals to date and a projected count of 50 deals by year-end. This compares to the 46 deals in 2022 and 41 deals in 2021. Yet annualized deal value is set to reach just $8 billion this year, a plunge from over $11 billion last year and $20 billion the year before.

Figure 1 - Transactions involving Canadian infrastructure projects

The trend reflects increased activity in the mid-market segment of deals valued between $100 million and $500 million—and a decrease in deals of over $1 billion.

Also noteworthy is the cadence of deals. While dealmakers are executing transactions, deals take longer to close, with parties stepping up their diligence in uncertain financial times. High interest rates remain a factor too, and any deal with a U.S. component faces the added headwinds of a market looking ahead to the 2024 election cycle.

Surge in renewables M&A

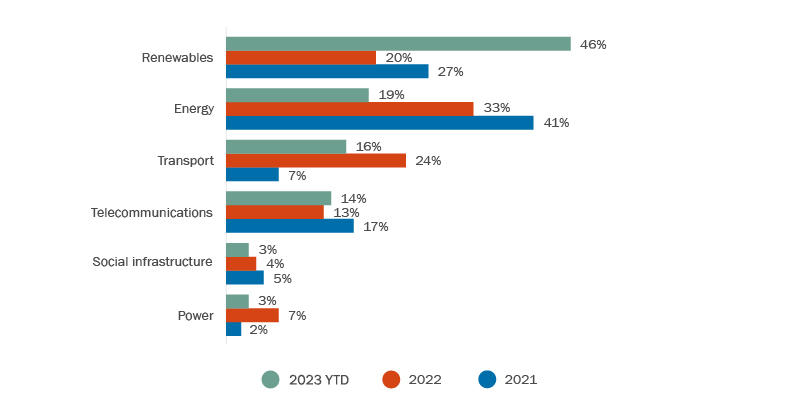

Canadian infrastructure M&A is being paced by a surge of deals in the renewables sector, which in 2023 account for almost half (46%) of all deals in the infrastructure space—up from a fifth (20%) last year and a quarter (27%) the year before.

Figure 2 - Infrastructure deal activity by industry

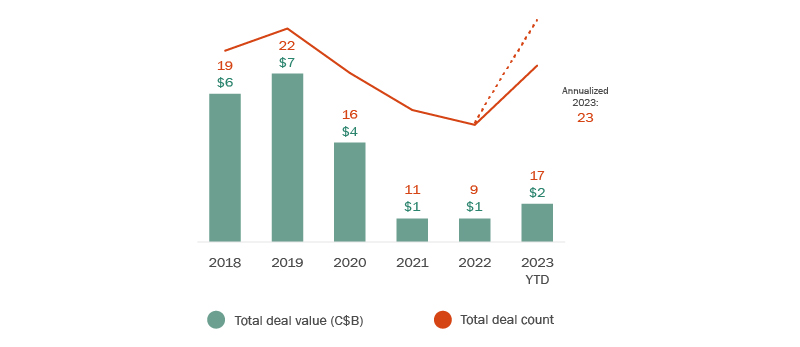

The absolute deal numbers show a similar trajectory. The 23 projected renewables deals would be the highest count in the six years tracked by this study (though the $2 billion in deal value would rank below the totals seen a few years ago).

Figure 3 - Renewables transactions involving Canadian infrastructure projects

Four trends in renewables

We are seeing four trends drive activity in the renewable energy projects space: shifting from one-off plays to platform growth, mega projects in Ontario, growth in Alberta, and expanding beyond renewables.

From one-off plays to platform growth

Not only are investors allocating more capital to renewables—they are also shifting focus from one-off plays to platform growth. Many are looking to acquire or finance a developer with a pipeline of assets that can produce thousands of renewable energy megawatts. This maturing of the space is most noticeable among institutional investors and bodes well for the sector’s long-term sustainability.

Mega projects in Ontario

The announcement (i) of the Oneida Energy Storage Project, which once operational will be among the largest energy storage facilities in the world, (ii) that Ontario’s Independent Electricity System Operator (IESO) is moving forward with the procurement of seven new energy storage projects, and (iii) that the IESO is moving forward with its Long-Term Request for Proposals all signal a significant change to the province’s electricity system and establish Ontario as the national leader in energy storage.

While energy storage initiatives like these are not themselves renewables, they do play a key role in enabling the adoption and success of renewable energy. Underpinning these large-scale initiatives is a recognition by senior policymakers that the province needs to source new energy capacity, due to both supply and demand considerations.

These large-scale initiatives are not the only ones recently announced in the province. In a development that generated wide-ranging discussion, the Canadian and provincial governments will provide incentives to support the building of two battery facilities: one by Stellantis and LG Energy Solution, the other by Volkswagen. These incentives were necessitated in part by competing incentives provided by the Inflation Reduction Act in the United States.

Growth in Alberta

Alberta has by far outpaced the rest of Canada in new renewables capacity over the last few years. When the Alberta government announced a seven-month pause on approving new renewables projects this summer in order to examine rules for new projects, it created immediate uncertainty in the market. However, the freeze is unlikely to subdue the province’s renewable momentum.

Renewables M&A has continued to grow in line with the province’s growing wind and solar capacity. A business-friendly environment combined with a deregulated electricity market has eased entry for proponents, and large European developers, among others, have made capital available.

The large oil and gas companies in the province have committed to net-zero targets, but also largely sold-off their renewables assets in order to focus on their core business and carbon capture and storage (CCS). With industry accounting for nearly half of Alberta’s power demand, this should continue to bolster an active market for third-party renewables developers and associated M&A activity.

Expanding beyond renewables

If dealmakers look back even two years ago, they will recall that renewables such as wind and solar energy dominated deals related to energy transition. That has changed. Now proponents have expanded their focus to non-renewable businesses and platforms that are also involved in other aspects of energy transition and decarbonization. This is especially common in transportation and the property development space—for example, using wastewater to heat and cool facilities.

The future of energy transition in infrastructure M&A

The transition to clean energy will be a significant driver of infrastructure M&A in the coming years. Yet the path to net zero won’t follow a straight line. It will require a strategic, multi-pronged approach across the board, utilizing a range of energy sources.

While renewables will continue to play a key role in this energy mix, going forward we are likely to see a more balanced contribution to M&A than in this year’s deals count. Developing technologies may also see increased activity in new industries such as energy storage and CCS. This mix of sources will help diversify Canada’s energy grid and provide myriad opportunities for infrastructure dealmakers across the board.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.