Retail investors and access funds: “hey, we want to invest in private funds, too!”

Authors

It is well known that the private markets, including private funds that invest in privately held companies, have been experiencing exponential growth over many years. While private funds have historically been the domain of large institutional investors, such as pension plans, endowments and other institutional investors, retail investors, in their search for investment yield and portfolio diversification, are increasingly interested in alternative assets such as private equity, hedge funds, venture capital and private debt strategies—and the increased interest from this market segment is contributing to the exponential growth in private fund investing.

According to a report by Boston Consulting Group and iCapital entitled “The Future is Private: Unlocking the Art of Private Equity in Wealth Management” from March 2022, retail investors are expected to increase their capital commitments to private funds at a compound annual growth rate (CAGR) of 18.8% by 2025 to an absolute number of $1.2 trillion, significantly outpacing institutional growth. As a result, to tap into this large and growing market segment, private fund sponsors are increasingly establishing themselves as integral parts of the private wealth management ecosystem and are making their offerings more attractive and accessible to retail investors.

In this article, we consider retail investors (RIs) to include:

- smaller institutions, including family offices;

- high-net-worth individuals (HNWIs), generally with assets between $1-25 million (often making private fund investments in the $1 million range); and

- other RIs who are not HNWIs but nevertheless meet the “accredited investor” test as described below (often making private fund investments in the $25-250 thousand range). To invest in private funds in Canada, RIs generally must be “accredited investors”, as defined in National Instrument 45-106 – Prospectus Exemptions.

There are different methods that fund sponsors may use to admit RIs to their private funds—and in our experience, we have found the following methods to be effective.

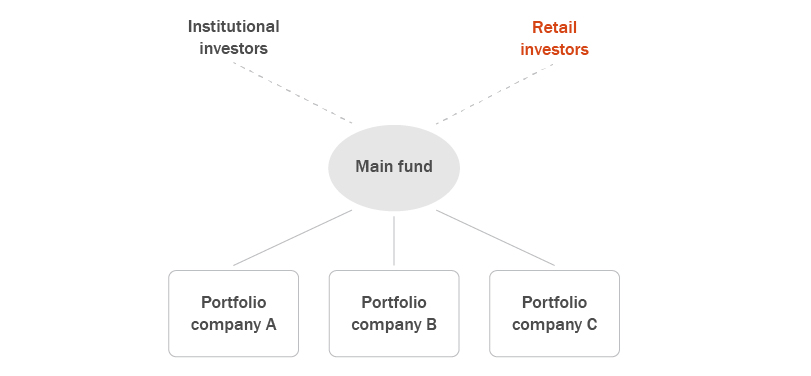

Method 1: invest directly into main fund

With the first method, RIs invest directly in the main fund alongside institutional investors (see figure 1 below).

Figure 1: Direct investment in main fund

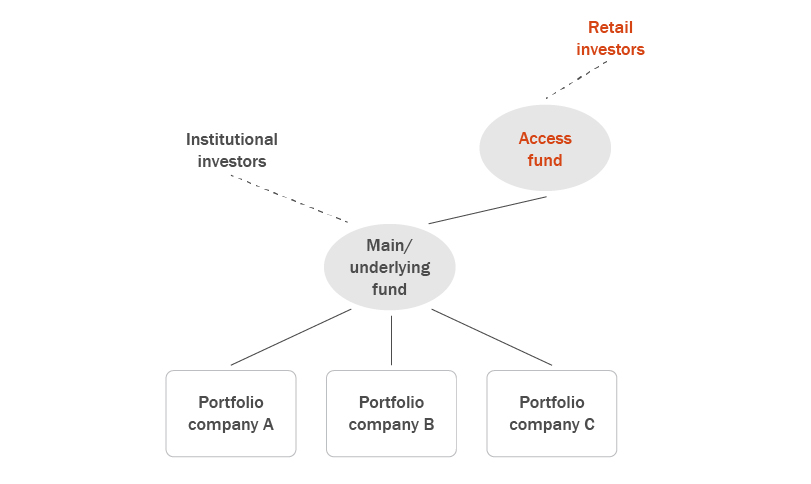

Method 2: invest indirectly via access fund

With the second method, RIs invest in the main underlying fund indirectly, by investing directly in an “access fund”, which acts as a feeder fund to the underlying fund. An access fund can be managed by the sponsor of the underlying fund or by a third-party manager (see Figure 2 below).

Figure 2: Indirect investment via access fund

Fund sponsors often appreciate using an access fund to bring in RIs to their private funds, particularly if the access fund is managed and marketed by a third-party manager.

Fees and expenses

When RIs invest in an underlying fund through an access fund, they are typically subject to an added layer of fees and expenses than if they had invested directly in the underlying fund (as discussed below). While the added fees and expenses eat into RIs’ returns, this is often the price to pay for access to this asset class.

- Organizational expenses. Forming and raising capital in an access fund generally results in higher organizational expenses at the access fund level given there is another vehicle in the fund structure to establish and maintain (and the access fund is also still responsible for its pro rata share of organizational expenses as a limited partner at the underlying fund level). Contrary to the organizational expenses of the underlying fund, those of the access fund are often not subject to any cap.

- Administration fee. If an access fund is formed, typically the administrator/manager of that vehicle charges an administration fee, which is in addition to any management fee charged by the underlying fund manager. The justification for the added layer of fees is that access funds can require a lot of hands-on involvement from the administrator/manager, as RIs often need more assistance in understanding fund mechanics, processing transfers, seeking withdrawals, processing voting procedures, etc.—and with a relatively high volume of investors, each with a relatively low cheque size, this can result in significant administrative burden for the administrator/manager. In addition, certain operating expenses are sometimes paid for out of this administration fee at the access fund level; however, whether these operating expenses come out of an administration fee or are borne by the access fund itself, access fund investors would generally have extra fees and expenses for the maintenance of the extra vehicle.

Voting considerations

In addition to the added fees and expenses for access funds, there are also unique voting considerations for RIs in access funds. While voting rules and procedures vary among access funds, in our experience, RIs frequently get a voting right at the access fund level, which is then aggregated to dictate how the access fund as a limited partner in the underlying fund should vote. Depending on a given RI’s commitment amount (i.e., in relation to the total capital commitments of the access fund), that aggregation of votes at the access fund level may be more or less appealing to a RI (as generally at the underlying fund level, their relatively low commitment amount will get them relatively low voting influence as voting is generally based on pro rata capital commitments). However, regardless of the structure employed, it is generally the case that RIs have limited voting rights when they make private fund investments (which we note, however, is not atypical from their more traditional investments in public markets, but it is atypical relative to large institutional investors investing in private funds).

RI considerations for private fund sponsors

While many fund sponsors want to get increasingly more into the RI landscape, admitting these investors raises specific issues that are unique from those of traditional institutional investors.

- Increased administrative burden. As discussed above, RIs are typically viewed as being more work for less dollars. They write relatively small cheques and typically need more assistance with making and maintaining their investment. However, RIs generally do not look to negotiate the fund’s governing documents or require a side letter.

- Increased default risk. Under the fund’s limited partnership agreement, capital contributions called under a funding notice typically require a specified number of business days to fund. For various reasons, RIs are at increased risk of missing a payment, which would generally put them in “default” under the fund’s limited partnership agreement; this can be problematic for the general partner, the limited partner in default and the other limited partners in the fund who may need to make up for the difference in missed contribution. This may also create the risk of the access fund itself defaulting with respect to the underlying fund’s corresponding funding notice, if the access fund does not have quick access to alternate sources of capital in the context of a RI’s default.

- Potential for increased regulatory scrutiny. When RIs, particularly those who are not family offices or HNWIs, are making private fund investments under prospectus exemptions, securities regulators may increase their scrutiny in respect of the fund sponsor and/or the fund accepting such commitments (in comparison to if the fund was mostly comprised of large institutional investors with sophisticated business and legal departments).

- Desire for liquidity. The traditional private fund model is a “closed-end” fund with a term of 10 years. This means that investors commit capital at the beginning of the term and are generally locked in until the fund dissolves at the end of the term in accordance with the fund’s limited partnership agreement. The nature of this long hold requirement can be off-putting for RIs, who often have more significant liquidity needs. Partially in response to RIs increasingly entering the private markets landscape, and also partially in response to the broader private market landscape moving increasingly this way, many fund sponsors are launching “open-ended” or “evergreen” funds, which do not have a fixed term but are of indefinite lifespan and typically provide for (generally limited) redemption rights. Open-ended funds are more liquid in nature than closed-end funds as investors theoretically have redemption rights and can exit at their leisure1. We also note that the desire to cause an access fund to qualify for registered retirement savings plan (RRSP) and tax-free savings account (TFSA) eligibility may also lead to the necessity of providing for enhanced redemption rights to allow the access fund to qualify as a mutual fund trust under the Income Tax Act (Canada).

- Desire of institutional investors to ensure no special terms for RIs. When an access fund is involved in a fund structure, institutional investors, who do not generally have visibility into the access fund’s governing documents, are often particularly concerned to ensure that access fund investors do not enjoy more preferential economic or liquidity rights. As a result, sometimes most favoured nation (MFN) provisions in a main fund governing document will cover the access fund governing documents.

- Tax residency considerations. When necessary to maintain Canadian partnership status under the Income Tax Act (Canada), fund sponsors must ensure that all partners are and continue to be considered Canadian residents for tax purposes. Individuals investing directly in access funds are more likely than institutional investors to inadvertently lose their Canadian tax residency status; as a result, access fund sponsors generally need to be more careful in respect of communicating and monitoring this requirement.

- French language considerations for Québec RIs. Given RIs typically do not have the ability to negotiate the terms of the fund documentation (including by way of side letters), there is generally an increased likelihood that an access fund that has Québec-based RIs may trigger the requirements of the Charter of the French Language, which require that contracts of adhesion must be drawn up in French, except for agreements concluded prior to June 1, 2023 where prior consent is explicitly given by the adhering party, or for agreements concluded on or after June 1, 2023, if the adhering party has given its express consent to be bound by the other-language version and only after the French version has been provided to the adhering party. Such requirements may lead to added translation expenses in the context of an access fund with RIs (which expenses are typically be borne by the access fund).

Despite the above-noted issues that can arise from admitting RIs to private funds, we are seeing increased interest from our fund sponsor clients and the market more generally in establishing access funds to tap into the RI market to diversify and enhance fundraising efforts.

- You can read our three-part series on open-ended funds for more on this topic:

1. Open-ended funds: a new way forward for private market funds,

2. Pros and cons of open-ended funds for LPs and

3. Open-ended funds: Pros and cons for GPs.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.