After a volatile end to 2018 and despite fears of a global downturn, Canadian M&A activity remained steady in the first half of 2019.

Watch partner and co-head of our M&A practice Cornell Wright provide highlights from our mid-year update.

The momentum appears set to continue with a positive economic climate, strong markets and favourable interest rates anticipated to drive more dealmaking in Canada for the rest of 2019.

Larger deals continue

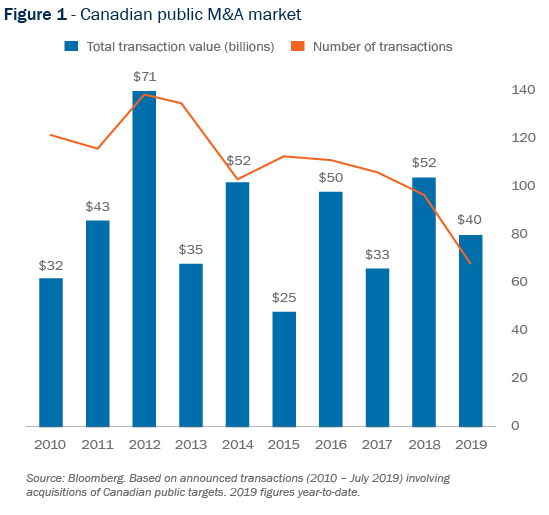

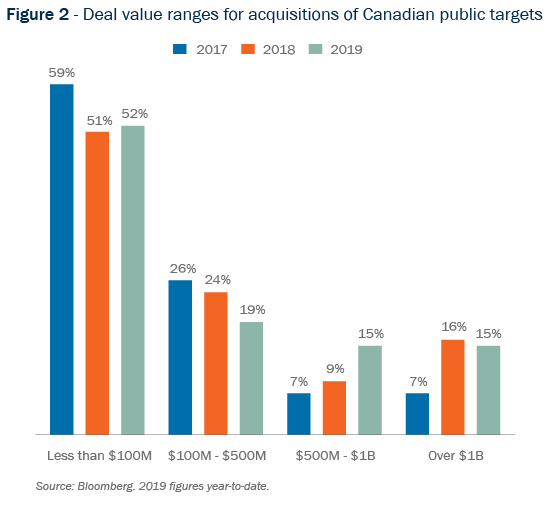

The number of acquisitions of Canadian domestic public targets continues to decline since a peak of deal activity in 2015 (figure 1). Meanwhile, average transaction sizes are getting bigger. Aggregate deal values have been following an upward trend in that same timeframe, and 2019 is expected to compare well with 2018, as the pipeline for the rest of the year remains promising. Larger deals are driving this trend: so far this year the number of transactions valued in excess of $1 billion has almost reached the same level recorded for all of 2018, and there has been a marked rise in deals falling in the $500 million to $1 billion value range (figure 2).

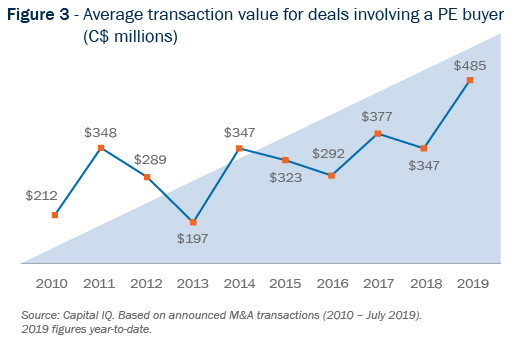

The Canadian private equity market also experienced its own surge in larger deal sizes: 13% of public company acquisitions by private equity buyers were valued above $1 billion. Together with an increase in deals over $500 million, the average value of a deal involving a private equity buyer has skyrocketed to $485 million, the highest in 10 years (figure 3).

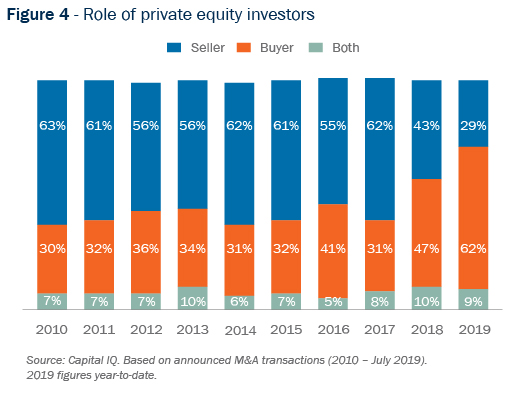

Year to date, private equity investors are focused on buy-side deal activity, with 62% of their deal activity involving acquisitions so far in 2019, up from 47% in 2018. Meanwhile, exit activity continues to decline significantly (figure 4). Onex Corporation’s acquisition of Gluskin Sheff + Associates Inc.1 is just one example of a high-profile deal involving a private equity buyer.

Despite trade tensions, cross-border M&A at historic high

Inbound activity

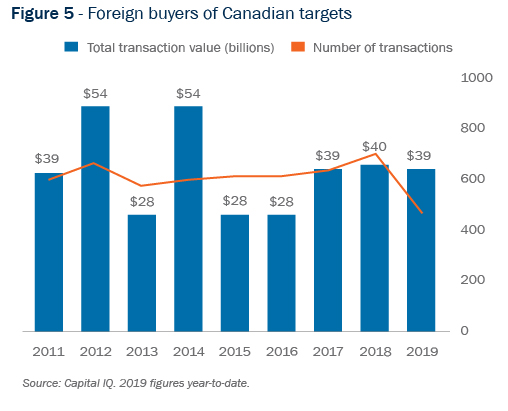

Foreign investment in Canadian M&A (figure 5) remains at historically high levels. Despite a slight decrease in the volume of transactions in the first half of 2019, aggregate deal value reached $39.34 billion—compared to 2018’s aggregate annual deal value of $40.24 billion for the entire year. While this number is partly attributable to one mega-deal (Newmont Mining’s acquisition of Goldcorp for $17.4 billion), 2019 may reach new records in terms of inbound foreign investments. Inbound activity from the U.S. is also keeping pace with 2018, though aggregate deal values so far in 2019 are markedly higher (figure 6). And amid ongoing international trade tensions, appetite from U.S. corporates to invest in Canada appears to remain high; according to one Deloitte survey, Canada is at the top of the list for cross-border M&A. With a favourable exchange rate in play, we expect to see continued activity from U.S. buyers.

Foreign investment climate

Economic “net benefit” reviews under the Investment Canada Act are becoming less frequent following the implementation of significant increases in the thresholds required to trigger reviews (for most investors, a review will only be required if there is the direct acquisition of a Canadian business with an enterprise value of more than C$1.5 billion). Hence, there were only two reviews in the first half of 2019, Altria Group’s C$2.4 billion investment in cannabis company Cronos Group and Newmont Mining’s US$10 billion acquisition of Goldcorp. Both acquisitions were approved in the ordinary course.

The government has instead been in general focusing its foreign investment efforts on “national security” reviews (rather than “net benefit” reviews). Although there are no thresholds for national security reviews, they typically only involve investors from China. And, as discussed below in greater detail, inbound investment from China has tailed off in the first half of the year, reducing the pool of potentially reviewable investments this year.

The ongoing strained relations involving China have had a dampening effect on deal activity. Halfway through 2019, inbound investment from China is at less than a quarter of 2018’s total. With geopolitical, trade and other issues between Canada, China and the U.S. continuing to make headlines, it is likely that this slowed pace of activity will continue through the year until there is a material improvement in the Canada-China political relationship. It is widely expected that once that occurs, inbound investment from China’s large economy should resume its previous growth trajectory. And even amid the current political tensions, we are seeing a significant number of enquiries from Chinese companies regarding potential investments in Canada and Canadian companies operating abroad.

Outbound activity

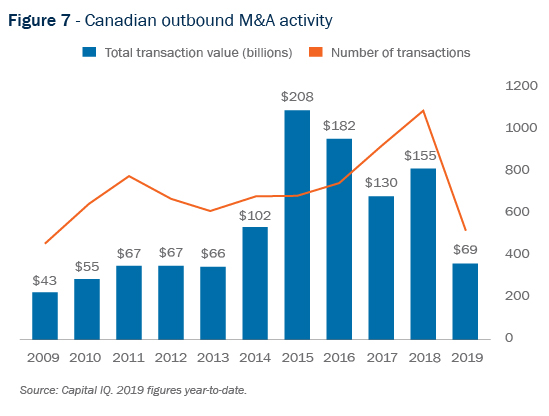

Outbound activity slowed in the first half of 2019 (figure 7), which may be attributed to the volatile markets at the end of 2018 and into 2019. Despite the overall slowdown, Canadian investors such as Canadian Pension Plan Investment Board and the Caisse de dépôt et placement du Québec, as well as Canadian businesses continue to make investments abroad. A notable example was NFI Group’s £320 million (C$540 million) acquisition of UK-based Alexander Dennis Limited.2 In the absence of any unexpected short-term barriers to growth in the next half of the year, we expect outbound investment to continue as investors in Canada look for growth opportunities.

Sector impact

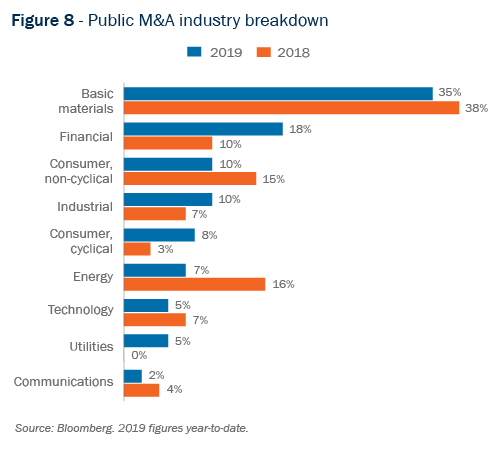

Sector activity from Canadian investors in the public markets remains consistent with 2018 numbers (figure 8). In the first half of 2019, the materials sector (which includes metals, mining, steel, chemicals and agriculture) continued to be the most active. This was followed by financials, reflecting, among other things, the ongoing importance of fintech acquisitions in the financial services industry.

M&A in the mining sector was active in 2018, including with the contested takeover bid for Nevsun and the blockbuster combination of Barrick and Randgold. The momentum has continued into 2019 with the combination of Newmont and Goldcorp and the proposed unsolicited acquisition of Newmont by Barrick. We expect dealmaking activity to grow through 2019 with further consolidation in the gold space and the desire of large and mid-tier base metals producers to bulk up with further acquisitions, particularly of new copper projects. We also expect to see further dealmaking in the battery minerals space to support the continued growth of electric vehicles and battery storage. A notable example is Pala Investments’s proposed C$501 million acquisition of Cobalt 27 Capital Corp.3

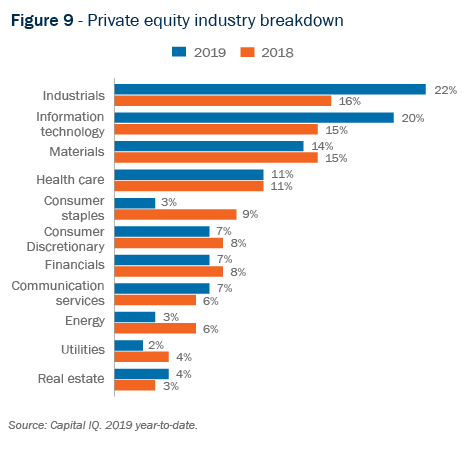

On the private equity side, industrials—the top sector for growth in private equity in 2018—has markedly surpassed the information technology sector so far this year (figure 9). And PE deal volume in the materials sector has been on the decline, a trend that has not shown any sign of stopping through the first half of 2019.

Oil and gas update

M&A activity in the upstream oil and gas sector ground to a halt in 2019, due to a number of factors creating uncertainty and a lack of capital for Canadian projects, most notably:

- continued uncertainty regarding Canadian pipeline takeaway capacity and, most prominently, the ongoing saga for the approval of the Trans Mountain Pipeline;

- production curtailment, which was introduced by the Alberta government in late 2018 to address deepening oil price discounts for Western Canadian Select;

- license transfer uncertainty with the Alberta Energy Regulator and the negative impact on debt facilities in the wake of the Supreme Court’s decision in the Redwater insolvency case; and

- continued regulatory uncertainty regarding carbon pricing rules, Bill C-69 changes to the environmental assessment and approval process for major infrastructure projects and Bill C-48 instituting a crude oil tanker moratorium on a portion of the west coast.

The starkest example of the impact of these headwinds on M&A activity in Alberta was evident in early January 2019 when Husky Energy elected not to proceed with its C$2.8 billion hostile takeover of MEG Energy, citing curtailment and lack of progress on pipelines in Canada. After over 20 years in Canada, Devon Energy announced in late May that it was exiting Canada and selling its oil sands and heavy oil assets to Canadian Natural Resources for C$3.8 billion. Some of the announced sales processes have been terminated, including Cenovus’ announcement earlier this year that it suspended its sale of non-core assets due to insufficient offers.

There has been notable deal activity in the mid-stream sector, with pension funds and private equity buyers playing prominent roles. For example, in January 2019 KKR partnered with SemGroup Corp to create a new midstream platform in connection with the acquisition of Meritage Midstream from Riverstone Holdings.4

Even with strong oil prices and fundamentals, in order to achieve meaningful improvement in deal activity, investors will need to rebuild their confidence in the Canadian regulatory and political climate and prioritize capital spending in the sector. While there have been some positive signals in recent months, the general sentiment is that deal activity may not improve until after the federal election in October, when another element of uncertainty is resolved.

Credit markets update

After an extremely slow end to 2018, in early 2019 we saw the credit markets start to improve, but only slightly. According to the Loan Pricing Corporation, leveraged loan volume in January 2019 was down 63% compared to 2018, the lowest volume since 2012. By the end of the second quarter, volume improved overall at 53% compared to the prior year. Meanwhile, according to the Loan Syndication and Trading Association, B+/B Term Loan B spreads increased. We can continue to point to economic uncertainty globally with Brexit, trade wars and increased tension in the Middle East as contributing factors. The practical effect of this volatility is that underwriters are able to price deals higher at the commitment letter stage and require that the flex provisions are broad enough to protect the lender group against market risk. And in counterpoint to this trend, the market is seeing an uptick in high-yield bond issuances. in addition, we are seeing more activity in debt fund investment.

On the documentation side of things, the big topic of discussion continues to be the end of LIBOR. With the release of the SEC’s Staff Statement on LIBOR Transition, market participants have been given strong guidance on the need to assess the risk to their existing portfolios of a rate replacement. We hear from our clients that they are struggling with whether to be in the first wave that commits to SOFR instead of just relying on sufficient fallback language.

Another development that could significantly impact our Canadian clients is the growing pressure to allow for the financing of cannabis companies in the United States. The U.S. House of Representatives’ Financial Services Committee has cleared a cannabis financing bill, and hearings on the Senate’s companion bill have been scheduled for late July. Whether this will turn into a purely partisan debate is unclear at this point, but Republican support is growing. If the bill is passed, financing for cannabis companies in the U.S. will present opportunities for Canadian financing sources, but competition for cannabis companies in Canada.

While overall volume is down, as noted above, we have seen a surge in acquisition size in Canada, and with Chinese investment down in the U.S., potential opportunity is there for Canadian investors. The acquisition pipeline in the U.S. looks promising so we are optimistic that the second half of the year will see an improvement for the credit markets in Canada and globally.

Conclusion

While changes in investment strategy across all sectors in the Canadian markets can be seen as part of a response to the looming fear of a downturn that has pervaded headlines in recent months, we nonetheless expect to see the rest of 2019 benefit from the current positive dealmaking environment in Canada.

_________________________

1 Torys acted as counsel to Onex Corporation on the transaction.

2 Torys acted for NFI Group.

3 Torys is acting for Pala Investments.

4 Torys acted for KKR.

Subscribe and stay informed

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Stay in the know. Get the latest commentary, updates and insights for business from Torys.

Subscribe Now