Is 2026 the year of Canadian infrastructure and energy M&A?

Last year was a banner year for Canadian infrastructure and energy M&A, with no sign of slowing down in 2026. Major trends are driving activity in this area. Notably, geopolitical events are spurring historic levels of investment as extensive government initiatives aim to fast-track projects and encourage infrastructure spending. In addition, the digital infrastructure, in particular data centres (and the huge demand for power related to data centres), and projects related to infrastructure resiliency and decarbonization continue to attract vast amounts of capital. This article shares 2025 M&A results for the sector and the trends that will shape the year ahead for dealmakers.

Setting the stage in 2025: bigger deals, and more of them

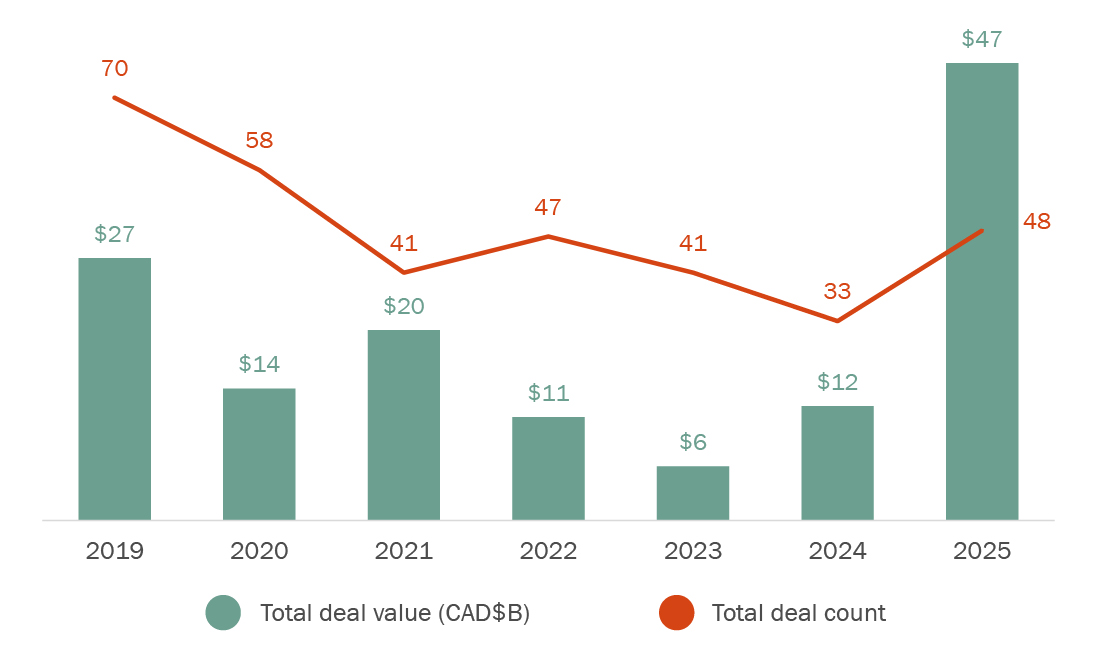

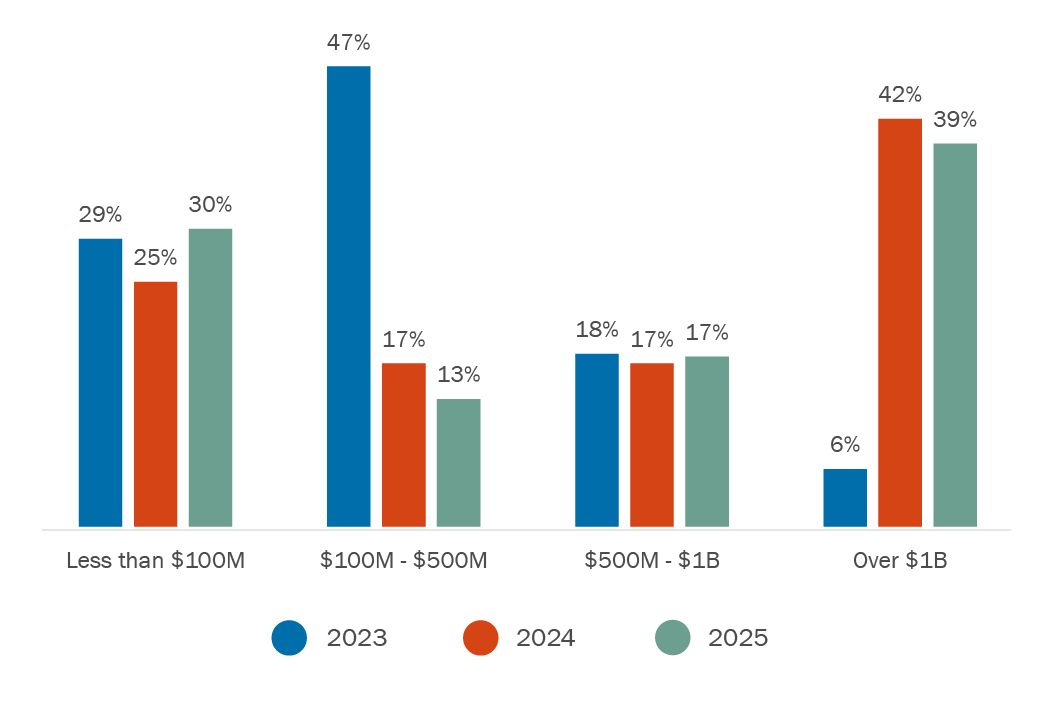

In 2025, M&A activity in Canadian infrastructure and energy saw record-breaking numbers, with a notable spike of 48 deals, up from 33 in 2024 (See Figure 1), an increase of 45%. Deal value has also soared, reaching $47B in 2025, almost four times the 2024 total of $12B—and with nearly 40% of transactions in infrastructure and energy projects in 2025 crossing the $1B mark in value (See Figure 2). Several high-value transactions contributed significantly to this total, including Neoen’s $6.6B sale to Brookfield and Temasek1.

Figure 1: Transactions involving Canadian infrastructure projects

Macro-level influences—from trade and tariff tensions to a renewed focus on Canadian economic sovereignty—have set into motion a flurry of activity supporting infrastructure and energy projects, notably, regulatory reforms and historic levels of public funding. This includes the Building Canada Act and the federal government’s Budget 2025, which promises $115 billion in generational investments in infrastructure and initiatives to reduce regulatory red tape and delays. Response from governments at all levels to expedite projects, incentivize proponents and facilitate deal activity have been effective in attracting growing investment, including from institutional investors like Canadian pension plans. Several energy-related projects referred to the newly launched Major Projects Office for consideration as national interest projects include two LNG projects, the Darlington Small Modular Reactor project, the Iqaluit hydro project, the North Coast transmission line and the Northwest Critical Conservation Corridor (which includes clean power transmission development). We anticipate this overall acceleration of infrastructure and energy projects in Canada to continue to yield a high level of investment activity into 2026 as more projects across asset classes are announced and as those already underway are advanced.

Figure 2: Deal value range: M&A transactions involving Canadian infrastructure projects

Dealmaking hot spots

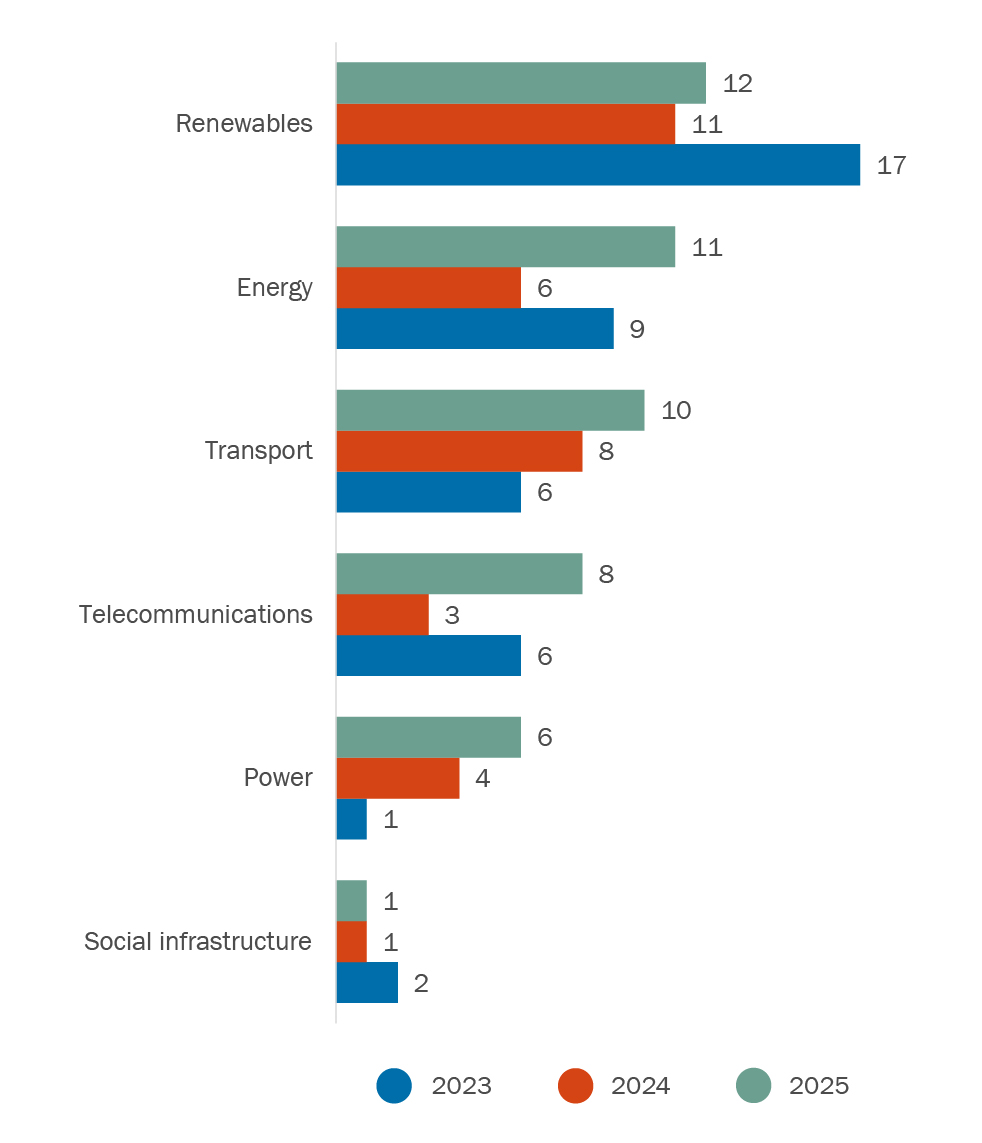

In 2025, the surge in M&A activity was led in roughly even measure across renewables, energy and transportation, followed closely by telecom projects and power, with social infrastructure remaining relatively flat YOY (see Figure 3). We expect an increase in digital infrastructure and data centre investment, defence M&A and activity across power and renewables to be particular bright spots in what may be another significant year for deal activity in the space.

Figure 3: Infrastructure deal activity by industry

Digital infrastructure and data centres

Investment in digital infrastructure continues to gain momentum in Canada, including in data centres and the energy that powers them; AI and data sovereignty infrastructure, such as Microsoft’s $19B investment in AI and digital infrastructure2; as well as investment in major telecommunications transactions, such as La Caisse’s 49.9% interest in Telus’s Canadian wireless tower infrastructure operator Terrion3. In Canada, Ontario and Alberta are leading in data centre projects with over 6,500 MW of new data centre projects requesting grid connection in Ontario and over 11,800 MW of new data centre grid connection requests in Alberta4. 2026 is poised for further growth: one early example is the federal government’s recently launched “Enabling large-scale sovereign AI data centres” RFP5, requesting industry proposals for AI data centres with planned capacities greater than 100MW.

Defence and dual-purpose infrastructure

The federal government has pledged $80 billion in defence and security investment—bringing forecasted defence spending to 5% of GDP by 2035. New spending initiatives are expected to result in an influx of investment across the defence infrastructure ecosystem, including for dual-use infrastructure projects with the potential to support both civilian and military applications. Canada’s Arctic has been earmarked for federal funding to this end, and we expect to see an influx of infrastructure projects, deal activity and trade partnerships in the region, like the recently announced Ports Manitoba trade partnership between Arctic Gateway Group, Prairies Economic Development Canada, the Province of Manitoba, Winnipeg Airports Authority and CentrePort Canada6.

Oil and gas

Canada is a top five producing country for both oil and natural gas and production continues to grow. 2025 was the busiest the sector has been in eight years, with over $30B in activity7. Deal activity on the E&P side has been driven primarily by consolidation, including Whitecap and Veren’s $10B combination8, Cenovus’s $8B acquisition of MEG Energy9 and Ovintiv’s $3B acquisition of NuVista, as companies look to achieve scale. We also expect an increase in activity in the midstream space over the coming years, driven by private equity fund closures on the sell side and the ongoing need for increased pipeline capacity. LNG is also an area of growing investment, including the $30B Ksi Lisims LNG Facility, which will become Canada’s second-largest LNG facility if constructed, and Cedar LNG10. We have observed a broad shift in tone among governments across Canada in driving renewed support for oil and gas projects—including a landmark Memorandum of Understanding between Alberta and Canada to, among other things, advance energy projects and strengthen collaboration across governments and stakeholders—and expect this to further facilitate activity in the sector11.

Renewable energy

Renewable energy continues to represent a significant area of investment and interest. A recent report from the Canada Energy Regulator predicts that by 2030, renewables will make up nearly 73% of Canada’s electricity capacity, with 70% of the increase in overall renewable capacity over the next 5 years to come from wind (through such large-scale wind projects like the anticipated $60B Wind West Atlantic project12, designated a project of national interest by the Major Projects Office), followed by solar and hydroelectricity13. Other notable renewable M&A in 2025 includes La Caisse’s $10B deal to buy Innergex Renewable Energy and Connor, Clark & Lunn Infrastructure’s acquisition of a significant interest in the 180 MW Armow Wind and 149 MW Grand Renewable Wind projects in southern Ontario from Pattern Energy Group LP. We anticipate dealmaking in this space to be robust as existing asset owners look to recycle their investments in order to participate in new procurement opportunities that have arisen in recent years. For example, Ontario and British Columbia are both undertaking significant procurements for new energy and capacity resources—in Ontario, the Long-Term 2 Request for Proposals14, and in British Columbia, the Call for Power15.

- “Brookfield enters deal to buy France’s Neoen for $6.6 billion”. Reuters, May 2025.

- “Microsoft Deepens Its Commitment to Canada With Landmark $19B AI Investment”. Microsoft, December 2025.

- “TELUS closes deal with La Caisse, which has acquired a 49.9% interest in Canadian wireless tower infrastructure operator Terrion” Cision Newswire, September 2025.

- AESO Update on Data Centres (PDF). Alberta Electric System Operator, March 2025.

- “Enabling large-scale sovereign AI data centres” Government of Canada, January 2026.

- “Air, land and sea join forces as Manitoba launches Arctic trade corridor plans” Western Investor, Jan. 20, 2026.

- “Varcoe: ‘A modest slowdown’: Consolidation in Canadian oilpatch hits eight-year high, but likely to ease in 2026” Calgary Herald, January 2026.

- “Cenovus announces agreement to acquire MEG Energy” Cenovus, August 2025.

- “Pembina and PETRONAS Enter Long-Term Agreement for Cedar LNG Capacity” Pembina, November 2025.

- “Canada-Alberta Memorandum of Understanding” Prime Minister of Canada, November 2025.

- “N.S. government provides details about $60B ‘Wind West’ as feds give nod” CBC News, September 2025.

- “Wind power to drive Canada’s renewable energy growth through 2030” Canada Energy Regulator, November 26, 2025.

- “Long-Term 2 RFP”, IESO.

- “2025 Call for Power” BC Hydro.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.