Canadian M&A outlook for 2026

In our previous M&A report, we said fortune would favour the bold and, at the outset of 2026, we’re seeing that come to pass in a variety of ways. In our outlook for the year, we expect the Canadian M&A market to continue its recovery, building on the key trends that helped spur deal activity in H2 2025.

Canadian domestic M&A

Public M&A

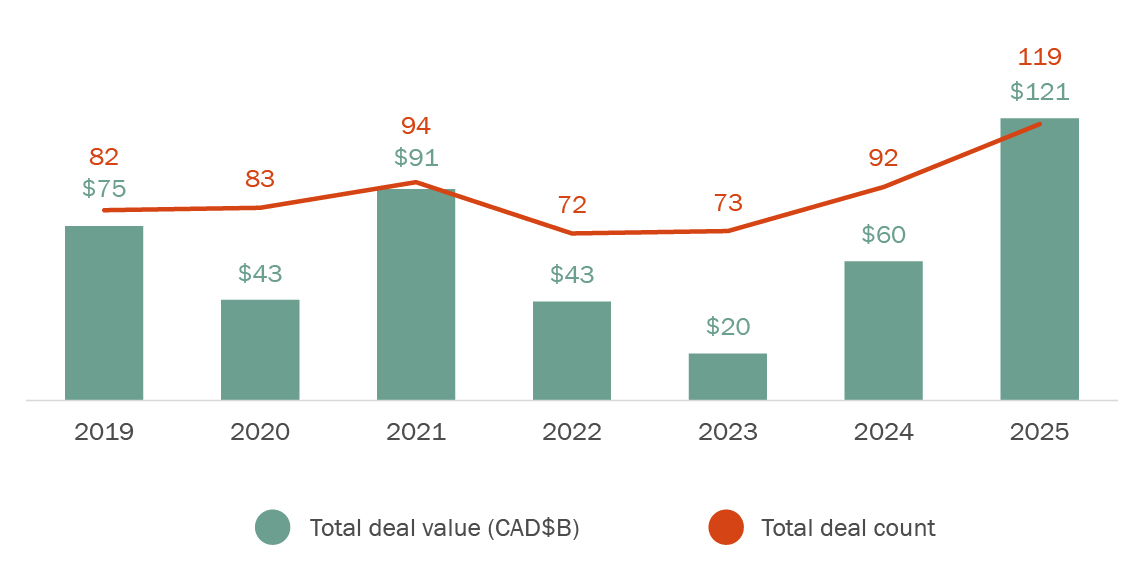

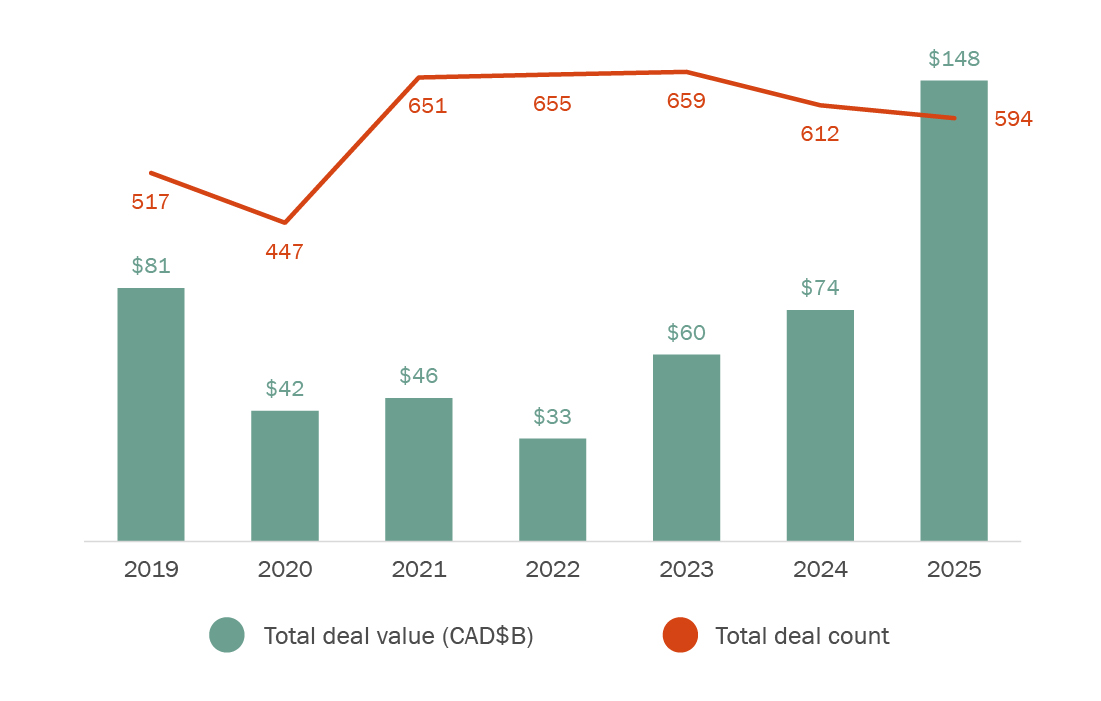

Public M&A deal activity continues to gain strength after a rebound in transactions in Q3 of 2025. Both deal value and deal count showed significant growth compared to the previous five years (see Figure 1), even surpassing the record-breaking levels seen in 2021. Macroeconomic factors and market trends, such as a lower interest rate environment, consolidation plays across sectors (such as mining), stronger valuations and the stabilization following tariff shocks, encouraged a return to more robust M&A deal activity—a momentum we expect to continue building through 2026.

Figure 1: Canadian M&A by value and volume

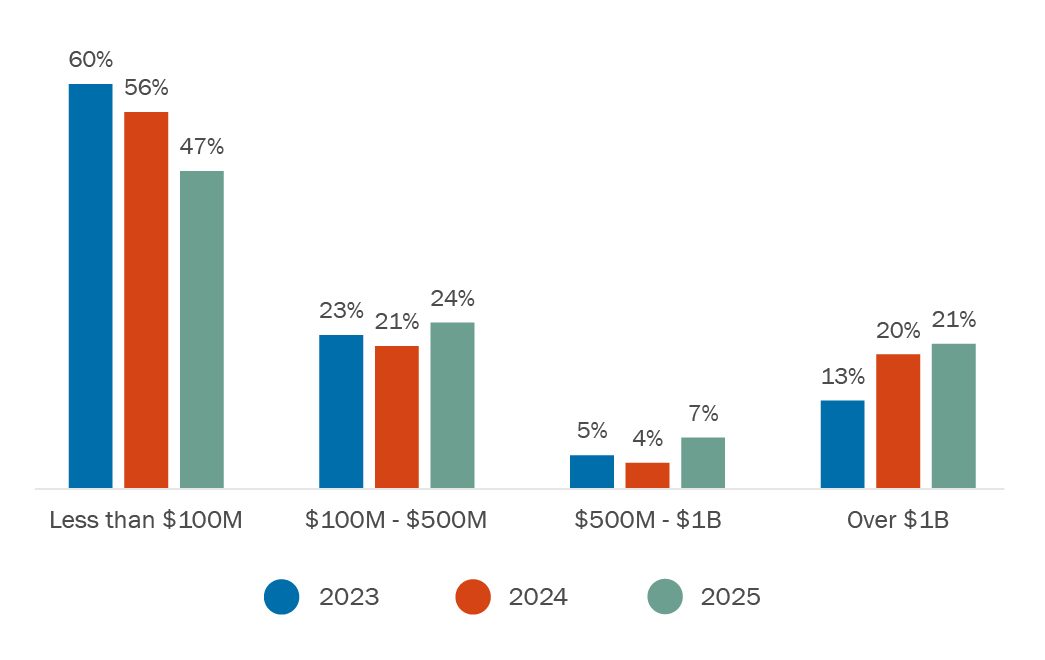

While roughly half of the deal volume in the public M&A market remains in smaller transactions valued at less than $100 million (see Figure 2), Canadian deals over $1 billion have grown by 8% since 2023, consistent with the global trend towards more megadeals. In 2025, the top 10 deals in Canada’s public M&A market accounted for over 74% of total deal value for the year. Highlights include: the US$57 billion merger of equals to form Anglo Teck1 and Sunoco LP’s US$9.1 billion acquisition of Parkland Corporation2.

Figure 2: Canadian public M&A deal value range

Private M&A

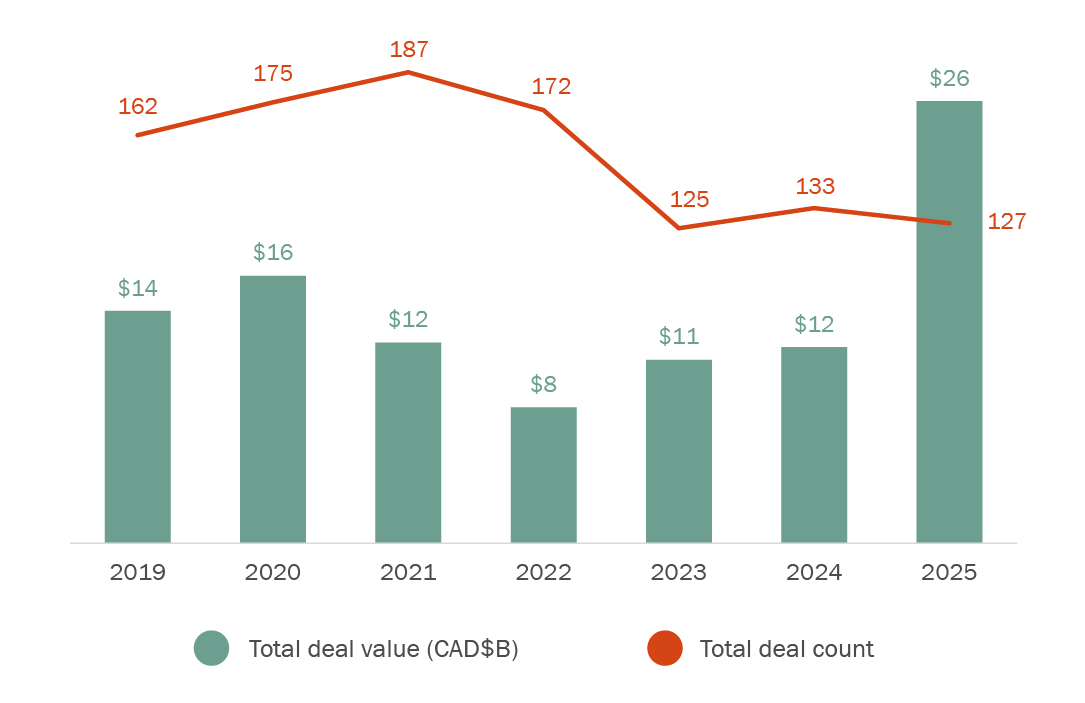

Canada’s private deal activity (M&A transactions involving private company targets) also surpassed 2024 levels but only in respect of deal value, as deal volume remained muted (see Figure 3). Deal volume, while down from the previous year, saw an increase in the proportion of mid-market deals valued at $100 to $500 million (See Figure 4), as market participants continue to look to the mid-market for deployment on value creation opportunities. Further, more private equity fund exits could bolster private M&A activity for 2026, provided that macroeconomic factors continue to be supportive of dealmaking.

Figure 3: Canadian private M&A by value and volume

Figure 4: Canadian private M&A deal value range

Sectors in focus

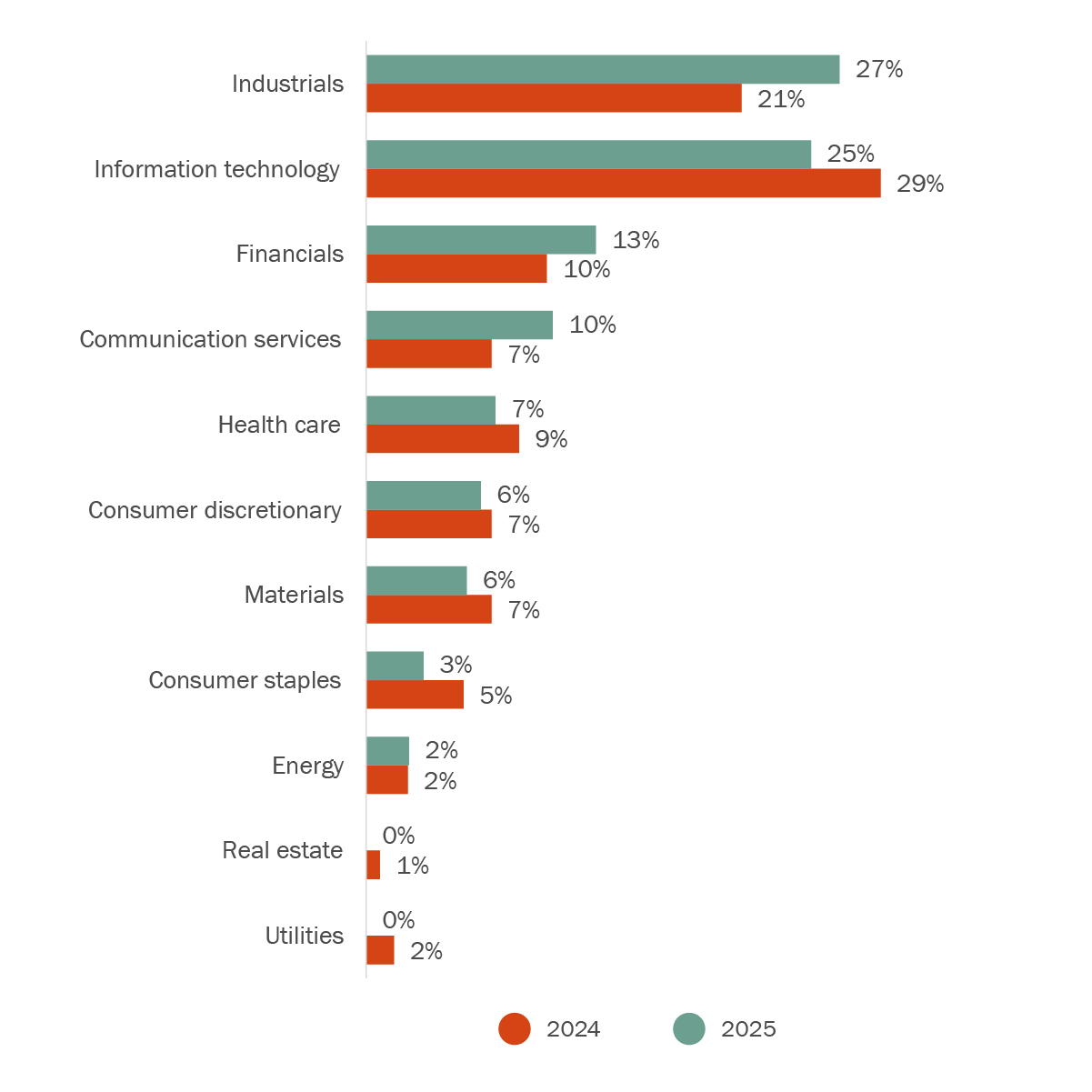

Industrials and materials continue to be the fundamental blocks of Canada’s nation-building initiatives

Canada’s strong fundamentals in the materials and industrial sectors continued to attract M&A activity throughout 2025, which, when combined, represent 49% of all deals for the year for public transactions (see Figure 5) and 33% of deals in the private sector (See Figure 6). Deals involving mining and metals accounted for some of the largest transactions of the year, such as the above-mentioned Anglo Teck merger. For 2026, we expect materials to hold strong as metals prices continue to rise, geopolitical tensions persist, and securing precious and critical mineral supply becomes an increasing priority

Investors will be further encouraged to make moves in the industrials and materials sectors as the “Canada Strong” 2025 federal budget reinforces the government’s intention to help build out infrastructure, defence and security, and energy projects, among others. Relatedly, the defence subsector has benefitted from a wave of investment activity in 2025, and we expect this area will likely see increased deal volume and value in 2026, with support from the 2025 Budget and growing investor interest in dual-use technologies. In the coming months, we anticipate a high volume of private sector investment and M&A transactions within the industrials and materials sectors.

Large transactions bolster resilience within the financial services sector

The financials sector remains fixed within the Canadian M&A landscape as a top target industry. As we noted in a previous M&A report, deal activity in this sector has been resilient, driven by strategic consolidation and digital innovation, among other trends, which we expect to continue throughout 2026. Big deals within the banking and wealth management space included a number of high-value transactions, such as Fairstone Bank’s announced C$1.9 billion acquisition of Laurentian Bank of Canada3 and the First National Financial Corporation’s agreement to be acquired by Birch Hill Equity Partners and Brookfield4 in a deal valued at nearly $2.9 billion. Other noteworthy transactions within asset management and custody banking include EQB’s $800 million agreement to acquire PC Financial from Loblaw5, the acquisition of Burgundy Asset Management Ltd. by BMO Financial Group for approximately $625 million6, the take-private of CI Financial by Mubadala Capital7, and Guardian Capital Group’s go-private acquisition by Desjardins8.

Canada’s tech innovation continues to entice private investors

For private sector M&A, the most active sector by deal volume in 2025 was information technology (IT) (see Figure 6). IT activity is poised for a robust 2026, as AI, cybersecurity and tech-enabled services continue to fuel opportunities in this space. Government policies to promote digital sovereignty will also be a prominent part of the dealmaking landscape, with private capital and pension funds further incentivized by the “Canadian Sovereign AI Compute Strategy”, which allocates $1.7 billon to developing AI, data centres and digital infrastructure, and computing initiatives.

REITs: a rising star for 2026?

While real estate activity levels have remained subdued amid high inflation rates, the Bank of Canada’s easing of inflation rates in 2025 prompted renewed interest in real estate, especially in the Canadian REIT market. Canadian REITs provided 11.8% in total returns in 20259, raising C$6.23 billion through capital offerings in 2025 (a 23% increase year-over-year)10. 2026 has already built on this momentum, as demonstrated by the announced going private transaction with Crestpoint and Minto Apartment REIT, valued at approximately C$2.3 billion11.

Figure 5: Target industry sector for public M&A

Figure 6: Target industry sector for private M&A

Cross-border transactions

Canadian inbound M&A

Total Canadian inbound deal value for 2025 has surpassed the total deal value for each of the previous six years (See Figure 7), mainly driven by the high-value deals. Despite this increase in deal value, the deal count for 2025 softened compared to the previous four years, following a trend observed globally as megadeals continue to grow while deal counts remain challenged. Consistent with last year’s top sectors, Canada’s natural endowment of resources and materials continues to attract inbound activity towards the industrial and materials sectors.

Despite changing trade policies and relations, the United States continues to be the top acquirer of Canadian targets both by deal count and deal value at $85 billion and covering 393 deals. Other top acquirer countries by deal count include Australia, followed by the UK and France.

Figure 7: Foreign buyers of Canadian targets

Canadian outbound M&A

Canadian outbound M&A activity is recovering after a declining trend that began in 2021, with both deal value and deal count showing improved growth compared to last year. The top target sectors for Canadian outbound M&A activity were industrials, materials and technology. In particular, the industrials sector deal volume has increased year-over-year, representing 21% of all deals and up from 16% in 2024. The U.S. continues to be the top destination for Canadian buyers in terms of both deal count and deal value, followed by the UK and Australia.

Figure 8: Canadian outbound M&A

Regulatory implications of dealmaking in 2026

Dealmakers will be mindful of the potential effects of the evolving macroeconomic and geopolitical environment on their transactions heading into 2026. Foreign investments will bring additional complexity to transactions, with the Government of Canada looking to strike the right balance between 1) enhanced reviews for foreign investors in certain Canadian businesses (particularly in resources, energy and infrastructure projects); and 2) bolstering Canada’s standing on the global stage as a place to attract capital and do business. As such, enhanced scrutiny under the Investment Canada Act may contribute to longer deal timelines; however, these timelines could be truncated where the government feels that certain deals are aligned with national interest (as was the case in Anglo Teck). As such, having strategic clarity at the outset of a deal (i.e., a compelling rationale as to why a deal is in the public interest) may help foreign transactions across the finish line in the current environment of shifting trade relations and geopolitical uncertainty.

- See “Mubadala Capital to Take CI Financial Private via Premium, All-Cash Offer” (CI Financial, November 25, 2024). Torys acted as Canadian counsel to Bain Capital as a holder of preferred equity in Corient Holdings Inc., the U.S. subsidiary of CI Financial Corp.

- Torys is acting as counsel to the special committee of Guardian Capital.

- Coldwell Banker Horizon Realty, “Conquering Canada's REIT Landscape” (January 23, 2026).

- S&P Global, “Canadian REIT capital offerings up over 23% in 2025” (January 22, 2026).

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.

Tags

M&A

Private Equity and Principal Investors

Transactions

Advisory and Regulatory

Capital Markets

Buyout Transactions

Private Fund Transactions

Board Advisory and Governance

Financial Services

Mining and Metals

Technology

Competition and Foreign Investment Review

Emerging Companies and VC

Banking and Debt Finance

Private Credit

Hybrid Capital Solutions