Despite challenging macroeconomic headwinds at the onset of 2025, overall M&A activity in the Canadian market remains robust. We review the state of Canada’s deal landscape at the close of Q3, providing insights into the trends driving activity and an outlook for the remainder of the year.

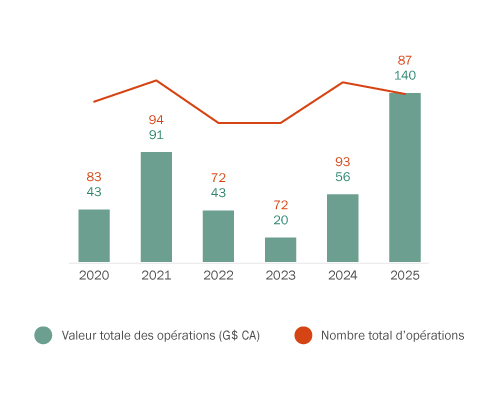

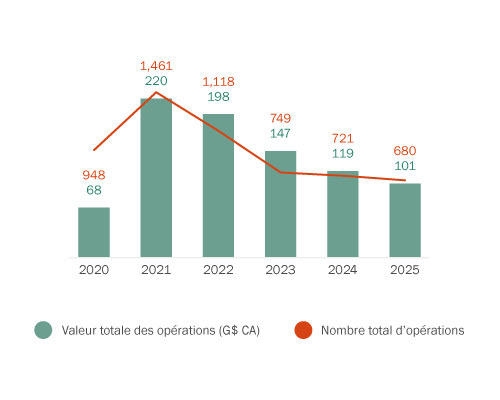

At the close of Q3, the Canadian M&A market presents a very different picture than what was anticipated earlier in the year. While U.S. tariffs and shifting trade policies have left their mark on the year, as discussed below, Canadian deals rebounded by the year’s midpoint and have surged sharply from the previous year, suggesting that the markets are absorbing some of the initial shock from the flurry of tariff announcements made by U.S. President Trump. So far in 2025, the value of all announced public acquisitions has increased 150% from the total M&A values for 2024 (see Figure 1). However, deal volumes have slowed with just 87 announced deals at the time of writing, indicating that boards and acquirors have greater confidence to pursue larger, high-confidence targets over smaller transactions.

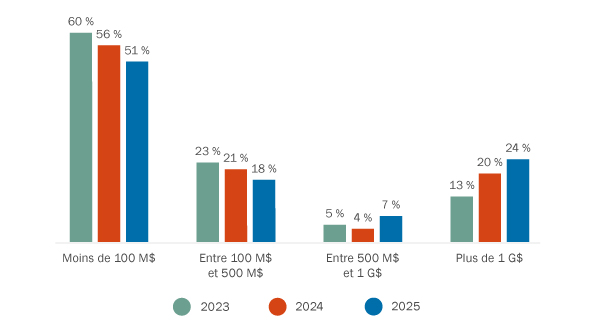

Deals less than $100 million and between $100-$500 million continue to dominate Canadian transactions; however, while this is typical for the Canadian market, year-over-year trends indicate that larger deals are becoming more prevalent (see Figure 2). For example, deals over $1 billion have increased 85% in the last two years, suggesting that Canadian buyers are no longer sitting on the sidelines waiting for global uncertainty to settle but are instead sourcing opportunities from the volatility. The rise in private lending may also be injecting much-needed liquidity during ongoing difficult fundraising conditions, allowing companies to scale and secure supply chains.

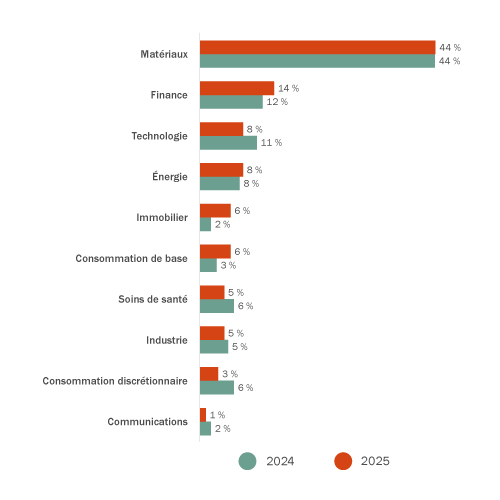

Basic materials, technology and financial services remain attractive sources of targets (see Figure 3), with federal investment policies and tailwinds from infrastructure and energy development further spurring activity. Globally, we are witnessing increased activity in the basic materials sector, and Canada’s endowment of natural resources and established supply chains continue to support the country’s role as a key global supplier of raw materials. Within Canada, deal activity in this sector has been affected by shifting trade relations and domestic policies that, in part, encourage protective measures within the supply chain as well as the development of key resources. As Canada and other countries continue to pursue a greener economy and expand digital and other critical infrastructure, companies may find further opportunities to make strategic acquisitions in the basic materials space.

Looking at the year’s top five deals announced further supports a strong outlook for Canada’s energy and natural resources industries, with deals covering critical minerals, oil and gas production, fuel distribution and renewable platform investments. The largest of these was the announced agreement by Anglo American plc and Teck Resources Limited to combine the two companies in a US$57 billion merger of equals1 to form the Anglo Teck group, a global critical minerals champion and top five global copper producer, headquartered in Canada. The emphasis on large transactions in the energy and natural resources space may be reflective of recent shifts in policy toward energy security and shoring up supply chains amid ongoing geopolitical uncertainty. It is also possible that incentives coming out of the Canadian government, such as the clean economy investment tax credits, may be further bolstering deals in this space.

Financial services acquisitions have also increased from last year, driven in part by ongoing digital innovation, strategic consolidation and vertical integrations, and megadeals from companies with strong cash reserves. Financial services dealmakers find themselves in a time of transformation. Many companies are feeling the pressure to adapt and may be shifting their focus to deals that allow them to scale up by acquiring quality assets, smaller players or complementary industries that further supplement their value chain. M&A transactions in the asset management and custody banking areas (as targets) accounted for over 50% of the deals. Some notable deals in this space include BMO’s announced acquisition of Burgundy Asset Management Ltd.2, the take-private of CI Financial by Mubadala Capital3, and Guardian Capital Group’s take-private acquisition by Desjardins4. Strategic reasons stated for the acquisitions include strengthening the position in the Canadian independent wealth management space and enhancing the ability to cater to high-net-worth and ultra-high-net-worth clients.

And, of course, AI and other tech innovations continue to significantly contribute to transactions, with data centres being a high area of focus for dealmakers. Notable investment activity in this space includes this year’s announcement that Pembina Pipeline Corp. is investing in a large natural gas power plant that could supply a massive data centre complex. However, the 3% decrease in tech acquisitions compared to last year may indicate waning excitement for AI assets, as some organizations wait to see more of a return on these investments.

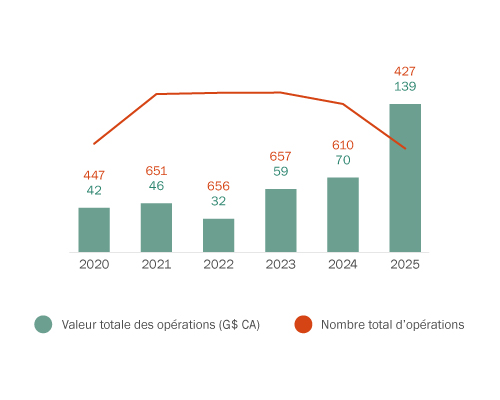

Cross-border deal activity remains mixed, with Canada’s strong fundamentals in industrials and basic materials attracting inbound deals while Canada’s outbound deals remain somewhat muted. Inbound deals are slightly skewed by the Anglo American plc and Teck Resources Limited merger of equals, but even accounting for this, deal value remains robust at the Q3 mark for the year (See Figure 4). Meanwhile, Canadian outbound deals have fallen slightly (see Figure 5), but financial services acquirors continue to pursue the majority of outbound transactions, putting their capital reserves to work in the U.S. and European markets.

Uncertainty surrounding tariffs and their knock-on effects in H1 2025 has softened cross-border flows generally; however, the U.S. remains one of Canada’s top acquirors by both deal volume and deal value, and likewise, the U.S. remains one of Canada’s top sources of targets. As the two countries continue to work towards a trade deal5, buyer confidence will likely continue to increase. Globally, as acquirors adapt to geopolitical uncertainty by addressing tariff risks in their deal structures, we expect increased levels of cross-border transactions.

Dealmakers will need to be mindful of enhanced regulatory scrutiny of their M&A transactions. In Canada, recent amendments to the Competition Act (the Act) strengthened the Competition Bureau’s enforcement tools and posture, especially toward serial acquisitions and roll-ups. Some of the changes make strategic mergers and acquisitions that trip statutory concentration levels presumptively anti-competitive, shifting the burden to merger parties. Merger reviews following the amendments have become longer and more complex, in part because the Bureau is now tending to invest considerable resources in defining markets and calculating market shares. This can include costly and complicated document production subpoenas.

Additionally, foreign investors in significant Canadian businesses—particularly in resources, energy and infrastructure projects—should expect enhanced national security scrutiny under the Investment Canada Act. At the same time, the government is conscious of the need to promote foreign investment in Canada, and therefore is trying to balance enhanced scrutiny in some areas with a more pragmatic approach in others. Investors should also expect more investments to be approved conditionally and a decrease in the number of blocked transactions. Further, the federal government has introduced several initiatives this year that signal its business-friendly intentions and support increased investment into Canada—from the Building Canada Act to tax and fiscal incentives aimed at encouraging greater domestic investment by pension plans and other institutional investors.

The data from Q3 suggests that fortune may favour the bold in 2025—companies executing on transformative deals or sourcing strategic options from sellers may be in a better position to ride the waves of geopolitical uncertainty. As the concerns from the start of the year have eased (e.g., tariffs, inflation rates and regulatory shifts), more buyers and sellers are eager to get dealmaking back on track, pointing to sustained momentum and a strong end to the year for Canadian M&A deals.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.

Tags

M&A

Transactions

Advisory and Regulatory

Capital Markets

Private Equity and Principal Investors

Buyout Transactions

Private Fund Transactions

Board Advisory and Governance

Financial Services

Mining and Metals

Technology

Competition and Foreign Investment Review

Emerging Companies and VC

Banking and Debt Finance

Private Credit

Hybrid Capital Solutions