Authors

Anne Merminod

Anne Merminod Karl Boulanger

Karl Boulanger Sarah E. Whitmore

Sarah E. Whitmore Alexandra Lawrence

Alexandra Lawrence

Roxanne Beaucage

Marisa Benjamin

Class actions continue to shape the Canadian legal landscape, and 2024 was an active year for litigation in this space. We reflect on key statistics from Canada’s leading class action jurisdictions (Québec, British Columbia and Ontario, as well as the Federal Court), and provide an analysis of the year’s major trends and most targeted areas1.

Key findings and trends to watch

Last year, striking trends emerged:

- Québec remains Canada’s leading class action jurisdiction. Québec accounted for 35% of new class action cases, closely followed by British Columbia and Ontario.

- The new face of digital class actions. Claims against online services began to rise sharply, and the frequency of data privacy claims is also increasing. Additionally, AI class actions are surfacing in Canada, with the first authorized AI class action in Québec and a groundbreaking class action filed in British Columbia (we examine this growing area of class actions more in our article, The growing intersection of AI and class action litigation).

- Low certification/authorization thresholds. The certification/authorization threshold proved to be low again this year. 75% of certification decisions were granted, and Québec and the Federal Court had authorization (or certification) rates approaching 80%.

- PFAS class actions are emerging. PFAS, so-called “forever chemicals”, have entered the Canadian class action landscape after sweeping through the United States.

Proposed class action filings and authorization applications

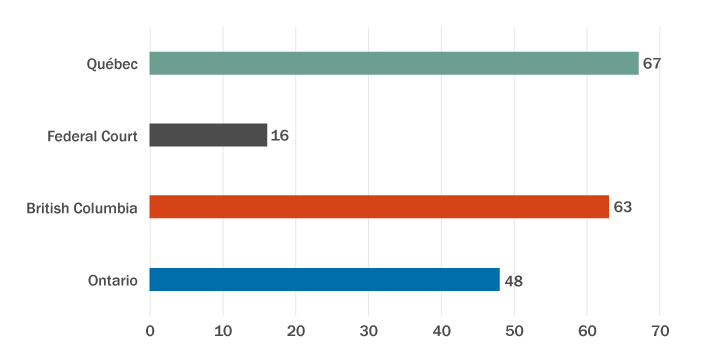

Figure 1: Applications for authorization or proposed class actions filed, broken down by jurisdiction

Activity was steady throughout the year, with around 17 new proposed class action filings each month. June and November were particularly active, with 23 filings (including 12 in Québec) and 28 filings (including 13 in British Columbia), respectively.

No fewer than 194 proposed class action filings (and authorization applications in Québec) were filed in the leading jurisdictions: Québec led the way with 67 filings, closely followed by British Columbia (63), Ontario (48) and the Federal Court (16).

Key class action areas

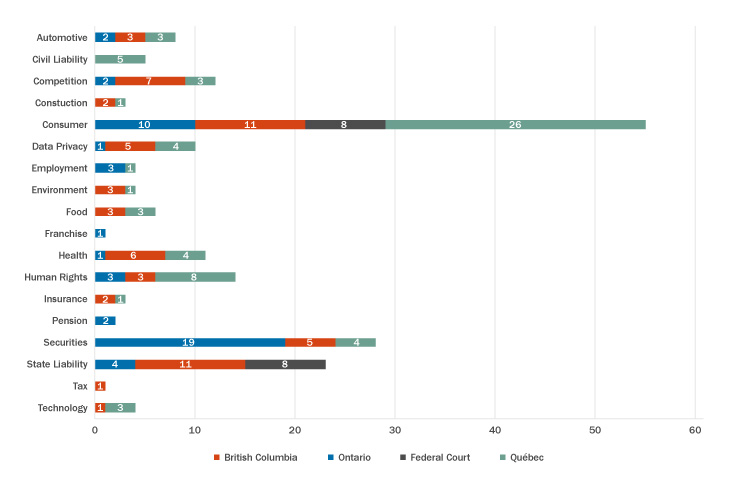

Figure 2: Applications for authorization or proposed class actions filed, broken down by area and jurisdiction

Several areas stood out in the proposed class actions filed in 2024:

- Consumer protection: Consumer protection class actions continue to dominate, representing nearly 33% of all claims. Québec remains a hotspot for such claims, accounting for nearly half of all cases in this category within the relevant jurisdictions. Consumer protection claims account for half the motions filed at the Federal Court.

- Securities: Securities remains one of the few areas where legislation is harmonized across Canada and have actively been the subject of class actions. Nearly 15% of all filings in 2024 were securities class actions. Of those, Ontario is by far the most active jurisdiction, accounting for close to 70% of cases.

- Data privacy: While accounting for 10 applications filed in 2024, the growing frequency of cases alleging data breaches or unauthorized use of personal information is notable.

In addition to proposed class actions filed by area (see Figure 2), we’ve identified several notable areas of class action filings in 2024:

- Product liability: The automotive and pharmaceutical industries were particularly active, mainly in Québec and British Columbia, specifically in the consumer and health areas.

- Online services: Online sale and delivery platforms continued to be the target of class actions, accounting for almost 10% of new filings in 2024, half of them in Québec.

- PFAS: An American trend is taking hold in Canada. The first Canadian claims were filed against manufacturers for alleged contamination by perfluoroalkyl and polyfluoroalkyl substances (PFAS), described as “forever chemicals”.

- COVID-19: Although the height of the pandemic has long passed, it is still the subject of new class actions filed in Ontario and the Federal Court.

Class certification and authorization decisions

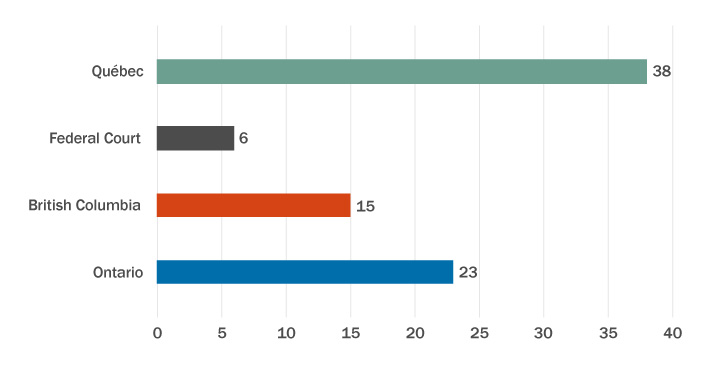

Figure 3: Class certification and authorization decisions, broken down by jurisdiction

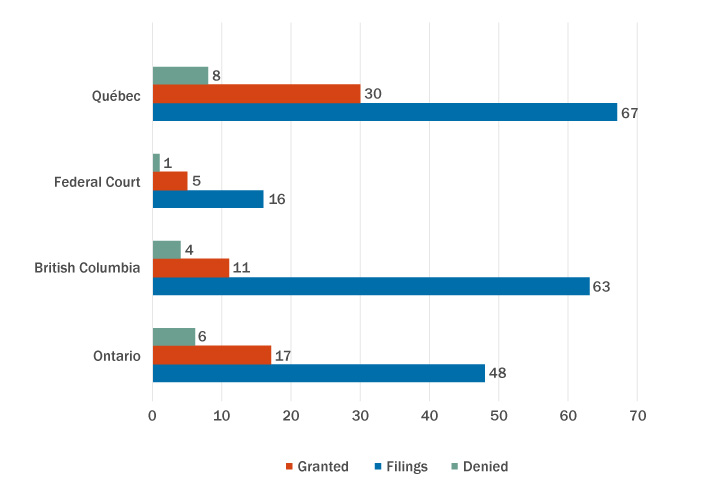

Courts were fairly active in 2024, with a total of 82 certification and authorization decisions rendered, averaging seven judgments per month. Québec was in the lead with 38 decisions, followed by Ontario (23), British Columbia (15) and the Federal Court (6) (see Figure 3). Furthermore, the low certification/authorization thresholds continue to favour plaintiffs. Of the authorization and certification decisions rendered, 75% were granted, representing 63 newly certified/authorized class actions across the 4 jurisdictions (see Figure 4). However, the certification/authorization rate varies between jurisdictions (e.g., 73% in British Columbia and 83% in the Federal Court).

Figure 4: Total proposed class action filings, with certification/authorization granted vs. denied

- The statistics were compiled as of February 18, 2025, using publicly available databases. In Québec, the Class Action Registry, CanLii and the dockets were consulted, while in Ontario, British Columbia and Federal Court, the National Class Action Database, Ontario Justice Services, Online Court Portal, Ontario Class Action Database, CanLii, Lexis+ Canada and Westlaw Canada were consulted. The statistics presented for Ontario, British Columbia and Federal Court are subject to the inherent limitations in the National Class Action Database, which cannot guarantee comprehensive search results because the database depends on voluntary submissions from lawyers across Canada.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.