Authors

The Canadian life sciences industry experienced substantial growth in 2021, reflected in robust investment, headline-making deals and a record-breaking level of M&A. Despite the market corrections in general, and the life sciences industry in particular, the substantial amounts of capital injected by both Canadian and U.S. venture capital funds bodes well for further increased investment in Canadian life science companies.

The year of big VC deals

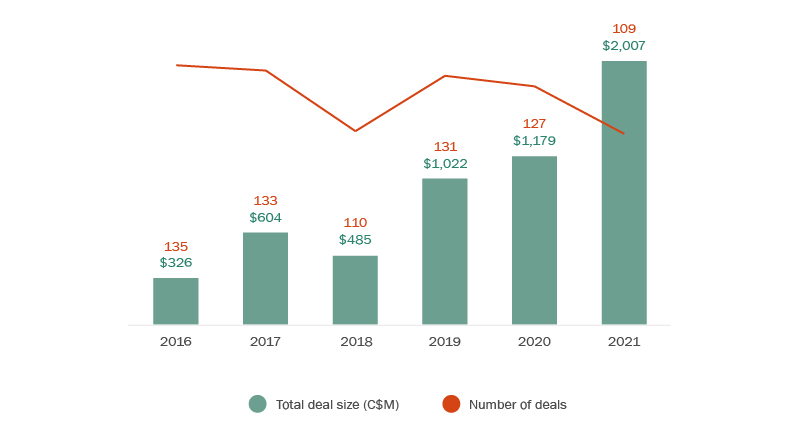

Venture capital investment in Canadian life science companies reached a record level in 2021, with a 70% increase year over year (Figure 1). Notable is that the overall investment total of just over C$2 billion was driven by two major July deals—Deep Genomics’ C$225 million Series C and Noblegen’s targeted C$500 million Series C. Noblegen’s Series C round, if completed as planned, will be the largest VC funding for a Canadian life science company in five years.

There was also an increase in activity in mid-market deals, but a slight decline in deals valued at less than $50 million1, signifying venture capitalists’ appetite for larger funding rounds at higher valuations across fewer deals.

Figure 1: Y-o-Y analysis on venture capital investment in Canadian companies

A third quarter peak

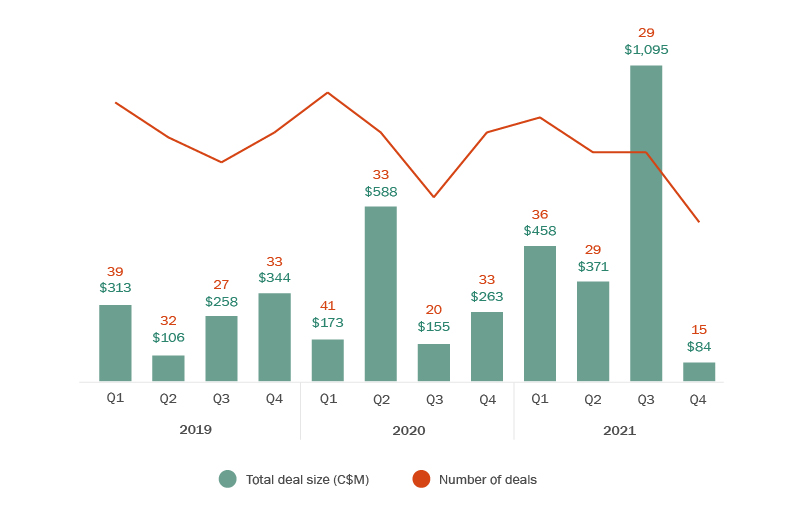

Deal volume across the first three quarters of 2021 kept pace with the previous year, while deal sizes in that same period doubled. However, Q4 of 2021 did not end on the same bullish note as 2020, with both total dollars invested and total deal count dropping (Figure 2). This was the lowest level of end-of-year investment activity in recent years, likely due to financial markets cooling off after the significant peak recorded in Q3 2021.

Figure 2: Quarterly analysis of venture capital investment in Canadian companies

Steady focus on preventative care

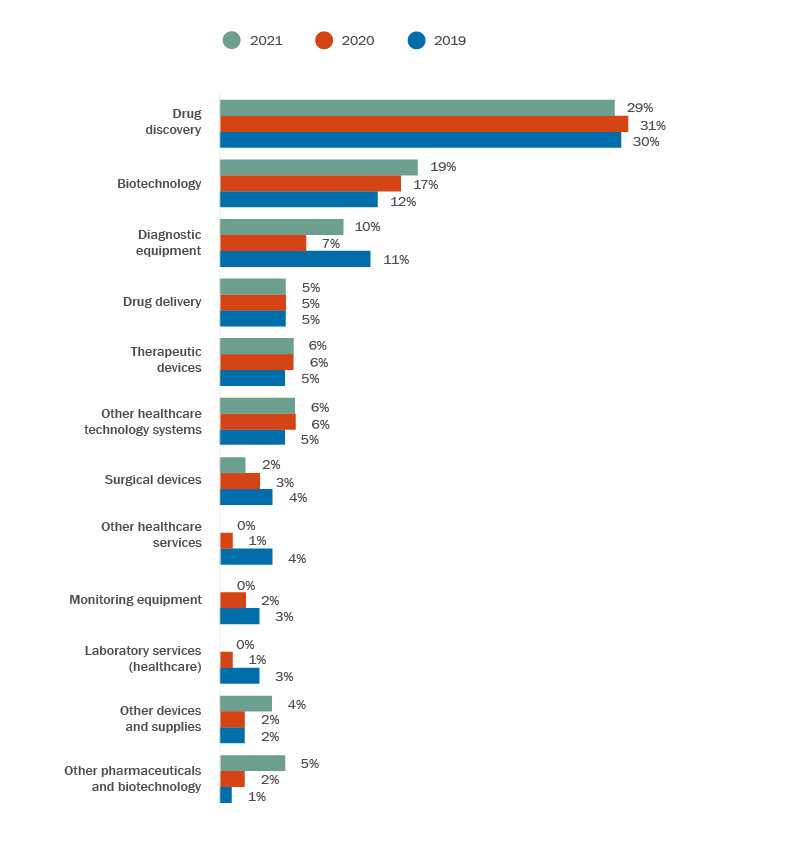

The standout sectors in 2021 were drug discovery, biotechnology and diagnostic equipment, collectively receiving approximately 60% of total VC investment in life sciences (Figure 3). The tailwind behind these sectors is expected, as the effects of the pandemic and a focus on preventative treatments continue to dominate the market’s behaviours.

Figure 3: Venture capital investment in Canadian companies: sector breakdown

Steady pace of foreign investment

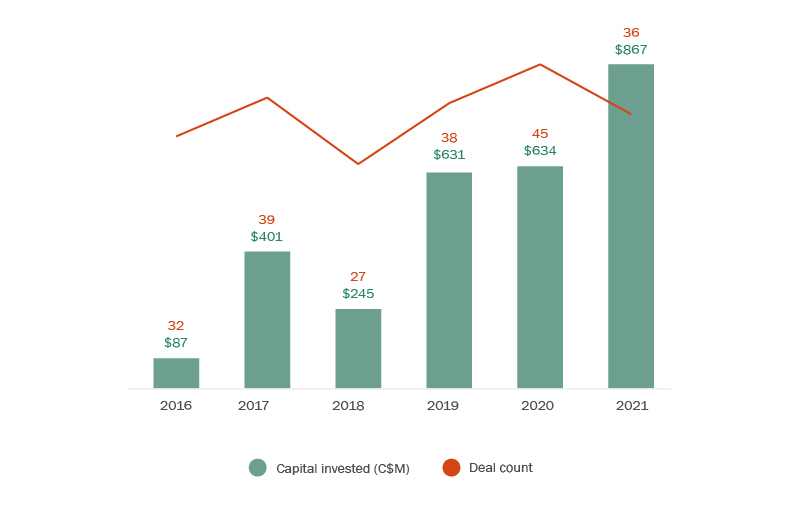

Canada maintained its position as a popular destination for foreign investors throughout 2021, with a 40% increase year-over-year. The United States remained the largest source of funding into the Canadian life sciences industry, with total capital investment amounting to more than $800 million across 36 deals. The U.K. and China held the second and third spots, respectively, for the top foreign investors in Canadian life science companies in 20212.

The impressive exits of several Canadian life science companies caught the attention of U.S. VCs, represented in the fact that virtually all major U.S. life sciences funds are now investing in Canadian companies.

While there was a record level of U.S. venture capital dollars invested into Canadian life science companies, the number of deals dropped to lower than pre-pandemic levels (Figure 4). This, of course, follows the same pattern we are seeing across the industry, where investors are writing bigger cheques across a smaller number of deals.

In addition, as the industry was producing impressive returns, generalist investors (i.e., those investors whose focus is not solely on the life sciences industry) were investing large amounts into the industry, resulting in spikes in both the size of financings and the valuations at which the financings were completed. While the life sciences specialist VCs will continue to invest in the industry, generalist funds will likely retreat into the background. This may be a positive for the industry in terms of producing long term gains for investors.

Figure 4: U.S. venture capital investments in Canadian life science companies

Provincial breakdown of investment

Ontario remained the top Canadian destination for life sciences investment in 2021, receiving over $1 billion in VC capital despite a 6% year-over-year decline in deal numbers. It appears that this continued investment in Ontario is producing tangible results—in Toronto alone, life sciences contributes more than $2 billion to the local economy3. British Columbia also saw a decline in the number of deals year-over-year, but maintained a healthy flow of investment (Figure 5). Deal activity levels increased in Alberta and Québec, a sign of the steady level of interest and growth that each region across Canada is seeing in their life sciences ecosystems.

Figure 5: Venture capital investment in Canada: breakdown by province

|

By province |

Capital invested 2021 |

Deal count 2021 |

|---|---|---|

|

Ontario |

$1,123 |

42 |

|

British Columbia |

$471 |

23 |

|

Québec |

$314 |

23 |

|

Alberta |

$65 |

17 |

|

Nova Scotia |

$12 |

2 |

|

New Brunswick |

$0.4 |

1 |

|

Saskatchewan |

$22 |

1 |

|

Grand total |

$2,007 |

109 |

Concluding thoughts

Canada is continuing its journey to becoming a life sciences industry leader. The steady flow of financing into the ecosystem is likely to continue throughout 2022, spurred on by high-profile successes, new domestic venture capital funds and increased U.S. and foreign interest in Canadian life science companies.

The Canadian public sector has also made substantial funding commitments to the industry. In July 2021, the Federal Government announced its new Biomanufacturing and Life Sciences Strategy aimed at growing a strong, competitive biomanufacturing and life sciences sector. The strategy entails an aggregate allocation of more than $2.2 billion toward Canadian life sciences investment initiatives4.

The increased capital being injected into Canadian life sciences by both investors and the government should result in a year of substantial growth for the sector, irrespective of volatility in the public markets.

- Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to Dec 31, 2021. Excludes failed/cancelled deals. Data has not been reviewed by PitchBook analysts.

- Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to Dec 31, 2021. Excludes failed/cancelled deals. Data has not been reviewed by PitchBook analysts.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.