Key priorities for boards in 2022

The role of directors is more interesting and challenging than ever—the dynamic nature of the pandemic and shifting global markets mean continued uncertainty and persistent evolution in the way corporations do business. Below are six priorities for directors as they navigate companies through this disruptive time.

This year, we collaborated with Hugessen Consulting to provide perspective and commentary on their annual Director Pulse Survey. The survey analyzes the responses of 75 Canadian director participants collected in the final two weeks of November 2021. The directors sit on a wide range of company boards, including with respect to ownership, industry, geography, and company size. The goal was to capture directors’ sentiments regarding the ongoing impacts of the pandemic on their organizations, their compensation programs (read our commentary on the survey’s executive compensation results here) and related governance topics.

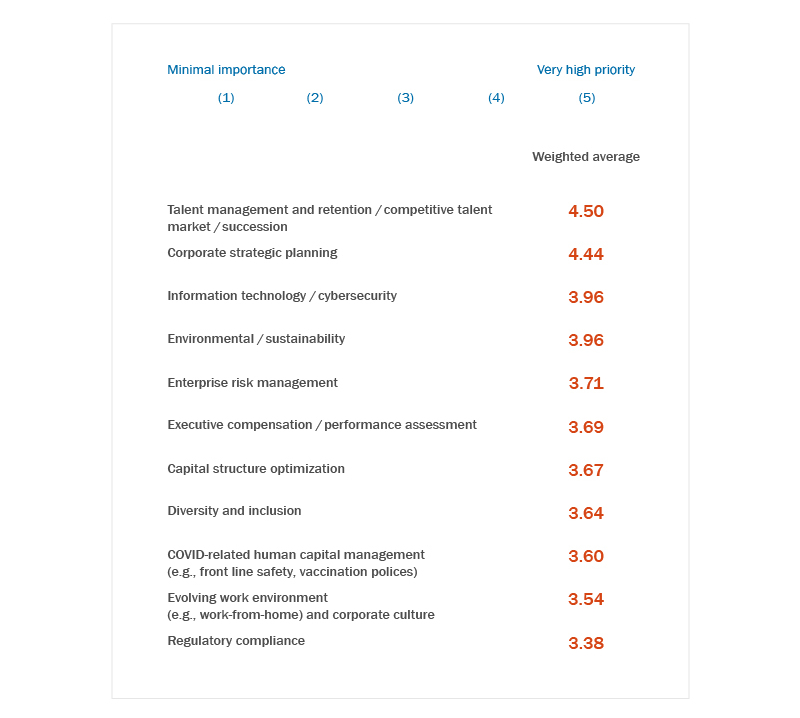

The directors surveyed identified the following as the top board priorities in 2022:

1) Talent management and board composition

Having the right board and management team is crucial, especially in the face of disruption, and talent management, retention and succession are key priorities for boards in 2022. The pandemic caused abrupt change in the workforce. Along with the transformation to remote working, the evolution of new technologies and an increased focus on health and wellness, there has been a dramatic swing from massive layoffs in 2020 to today’s environment of labour shortages and aggressive recruiting for talent, with weakening corporate loyalty. Boards must ensure that they have the right team with the right expertise to address evolving risks and opportunities, which requires that key executives are properly attracted, incentivized and retained. Boards are focused on human capital management and taking a hard look at management competencies, compensation systems and performance metrics, diversity and workplace culture, retention tools, and employee health and wellness. In light of the dynamic work environment and the war for talent, it is imperative that management and boards regularly assess the possibility of departures and their emergency and longer-term succession plans. Boards need to have confidence that management is developing a robust pipeline of potential successors and is creating and cultivating an inclusive workplace of choice.

Board composition is also a top priority, and directors with specialized expertise and from historically under-represented groups are in high demand. Board chairs and governance committees are spending more time examining board performance and competencies and navigating the tricky issue of board refreshment and succession. The best boards are adopting more robust and tailored evaluation and assessment tools, including the use of director interviews and independent evaluations, to gather honest and meaningful feedback to optimize board performance. Where there are gaps in desired expertise and attributes, boards are developing plans to address those gaps in the near and long term.

2) Strategic planning

Engagement by boards has never been so important, and boards are spending more time, on a more frequent basis, assessing and responding to strategic priorities. Many companies seized opportunities to make bold strategic M&A plays in 2021, and we expect this active deal cycle to continue. Companies continue to face a variety of changing circumstances with operational and financial impacts that demand swift decision-making in unchartered territory. Many companies are currently responding to considerable challenges with inflation, labour shortages, supply chain disruptions and the latest Covid variant. In this disruptive environment, directors must ensure that management is engaged in robust scenario planning and is prepared for possible risks and opportunities on the horizon, that capital and resources are being allocated appropriately, that performance metrics and disclosure are being properly aligned, and that the organization and its governance structure are adapting and responding to shifting business needs. A strong relationship between the board and management, with open and regular lines of communication and trust, will facilitate better planning and responsiveness as different outcomes unfold.

3) Stakeholder engagement and ESG

Boards and management must regularly engage with investors and stakeholders and be responsive to their evolving and sometimes divergent concerns. ESG has become a strategic imperative from a capital management perspective as investors are factoring ESG criteria and ratings into their investment decisions. Within the broad sphere of ESG considerations, boards must set their ESG strategy and priorities and expect to be held accountable. Activists are increasingly focused on climate action, diversity and inclusion and other ESG objectives, expressing their views through shareholder proposals, proxy battles, litigation and in the media. Boards can differentiate themselves, create value and fulfill broader social purpose through strong ESG performance, including by having clearly articulated, credible and broadly integrated short-term and long-term objectives and by reporting measurable progress over time. Boards should assess their particular vulnerabilities, refresh their stakeholder engagement strategies and have a plan to respond to various forms of activism.

4) Climate action and disclosure

While falling under the ESG umbrella, climate action and disclosure warrant their own spot on the list of board priorities. Securities regulators in Canada and internationally are taking action. In October 2021, the Canadian Securities Regulators proposed rules that will require public companies to report in line with the recommendations of the Taskforce on Climate-related Financial Disclosures1. While these rules are not proposed to come into force until 2024, issuers should start planning now, as compliance with these rules may require significant near-term investments of time and resources, and investors are already demanding more consistent and complete climate-related disclosure. To tackle this important and technically complex subject, boards need to assess the depth of the organization’s expertise and available data and identify gaps, and the circumstances will vary widely across industries, jurisdictions and companies. When guiding climate strategy and disclosure, boards should regularly revisit their priorities, action plan and disclosure as better technologies, information and practices emerge. Climate action requires long-term thinking and broad collaboration with governments, investors, supply chains and consumers, and boards need to take an active role to understand the complicated dynamics at play and the company’s plan for achieving a combination of short-term, mid-term and long-term targets and objectives. Proper oversight will require a custom-fit governance model with clearly articulated roles and responsibilities for the organization’s management, board and committees.

5) Digital business and cybersecurity

Digital transformation accelerated during the pandemic. Cybersecurity, data protection and the deployment of technology are now critical enterprise issues that require dedicated attention, expertise, capital and resources. These items need to be on the board agenda regularly and part of the director education program so the board can understand how digital technology is transforming the organization and its broader industry, and be confident the organization has the expertise to adapt and respond. The risk management framework should be updated regularly to identify and manage emerging cyber and data protection risks, with a reliable compliance program and protocol for reporting and escalating incidents so that the board can properly execute its oversight responsibility.

6) Evolving workplace

While the pandemic unexpectedly forced organizations to adopt and facilitate remote work environments for much of their workforce, many of the resultant organizational changes and flexible work arrangements are here to stay. Organizations are grappling to strike the right balance with their return-to-work/remote-work policies and facing divergent views about whether and how often employees must be physically present to conduct business optimally. While ensuring corporate objectives are met, companies need to be forward-thinking and receptive to new business models or they will have difficulty attracting and retaining the best talent. Boards need to be confident that management is steering this workplace evolution and monitoring emerging best practices in human capital management to ensure proper training and development, measurement of productivity and performance, effective collaboration and teamwork, employee health and wellness, and creation of corporate culture and loyalty, all of which are critical for the organization’s long-term success.

- See our bulletin “Climate change disclosure coming soon for Canadian reporting issuers” for more.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.