Heightened investor expectations and influence: key governance matters in Canada and the U.S. for 2024

The 2024 proxy season highlights the ongoing shift in the influence of proxy advisors, advocacy groups and shareholders on the governance practices of issuers in Canada and the United States, with increasingly prescriptive investor expectations applying significant pressure on companies to adopt governance practices that extend beyond legal requirements and regulatory guidance. Companies may be feeling the influence of these heightened investor expectations and their impact on the boardroom agenda, together with the accompanying uncertainty about the driving forces behind voting outcomes. In this article, we review several recent developments that provide a snapshot of these trends.

The future of virtual shareholder meetings

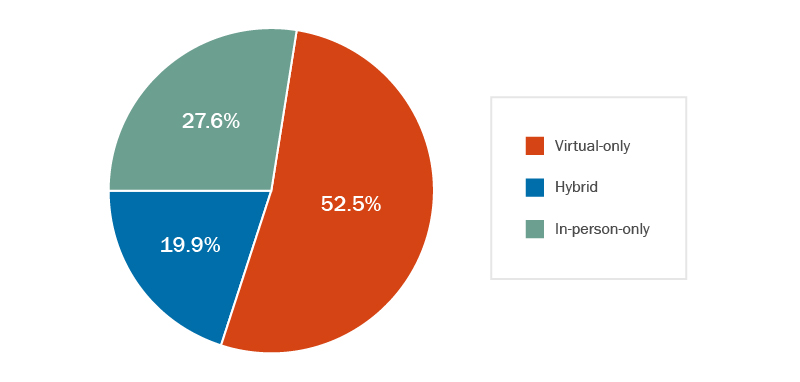

Majority of TSX Composite Index users held virtual-only meetings in 2023

In the wake of shifting in-office and hybrid work arrangements, proxy advisors, governance experts and market participants have raised concerns about the continued prominence of virtual-only shareholder meetings. Notwithstanding that a majority of TSX Composite Index issuers held virtual-only meetings in 2023, there has been a strong push to adopt a hybrid meeting format that provides for both in-person and virtual shareholder participation.

Glass Lewis (GL), for example, will generally recommend voting against the chair of the governance committee where the board is planning to hold a virtual-only shareholder meeting that does not adequately afford the same rights and options that shareholders would receive at an in-person meeting.

Earlier this year, the Canadian Coalition for Good Governance published its Virtual Shareholder Meeting Policy, which raises concerns that the increased use of virtual-only shareholder meetings increases the risk of shareholder voices being silenced and shareholder participation being diminished, advocating instead for hybrid meetings that preserve the right for shareholders to attend meetings in person. More recently, the Canadian Securities Administrators issued a press release providing issuers with updated guidance on virtual shareholder meetings, including that issuers should provide for an ease, level and quality of shareholder participation at a virtual meeting that is comparable to that which a shareholder could reasonably expect at an in-person meeting.

Several influential shareholder groups have joined in the chorus, advocating at a minimum for shareholder protections and procedures that mimic an in-person meeting and, in some cases, insisting that virtual meetings are not a suitable replacement for in-person meetings. B.C. General Employees’ Union rallied a number of other institutional investors to sign onto a letter subsequently delivered to many large Canadian issuers outlining concerns raised by investors since 2020 in respect of virtual meeting conduct, including problems with shareholder registration, participation in discussion and debate, or not having questions answered. The letter outlined a number of specific procedural expectations on issuers that hold virtual meetings and urged them to publicly disclose, both well in advance of their shareholder meetings and in their proxy materials, their plans to uphold shareholder rights at virtual-only or hybrid meetings of shareholders.

In addition, Mouvement d’éducation et de défense des actionnaires (MÉDAC) submitted shareholder proposals to several companies this proxy season, calling upon them to hold their annual general meetings in-person, with virtual meetings being complementary and not replacing in-person meetings. MÉDAC’s proposal received greater than 50% support from the shareholders of five companies (ranging from 50.66% to 82.22%) and over 47% support from the shareholders of two additional companies, a strong indication that there is significant support amongst shareholders for the hybrid meeting format.

Pass-through voting

Pass-through voting allows investors in pooled funds to direct how their shares are voted (typically in accordance with pre-defined voting policies established by the asset manager).

BlackRock recently announced that its pass-through voting program (known as “Voting Choice” and previously used exclusively by institutional investors) will be expanded to more than three million U.S. retail investors. Eligible shareholders in this U.S. pilot program will continue to have the option for their proportionate shares to be voted according to the BlackRock Investment Stewardship Voting Policy, but will now also be able to direct that their votes be cast based on proxy advisor policies that align with their policy preferences. Eligible shareholders will be able to select from six proxy voting policies from Institutional Shareholder Services (ISS) and GL covering a range of voting preferences and organized by theme, including, for instance, a socially responsible investment policy, a Catholic faith-based policy and a climate policy.

While pass-through voting is intended to democratize shareholder voting, giving shareholders a greater opportunity to vote their conscience and potentially sway voting outcomes, the ultimate impact of pass-through voting will depend on the extent of shareholder engagement. And as with the current system, those shareholders who choose to exercise their vote in alignment with these policies may have potentially outsized influence. Pass-through voting may also contribute to the increasing politicization of the shareholder vote—on shareholder proposals relating to environmental, social and governance matters, for instance, issuers may start to see more divided voting results. If pass-through voting becomes more commonplace, the voting system is likely to become increasingly opaque and difficult to navigate for issuers and their advisors. While disclosed positions by large institutions are visible, knowing how much of the shareholder vote may be based on the institution’s policies (ISS and GL jurisdiction-specific voting guidelines or pass-through proxy advisory thematic policies) is likely to become a significant challenge. As a result, consistent shareholder engagement will become more important than ever for issuers to monitor the pulse of their investor base and ultimately generate desired voting outcomes.

Climate-related reporting

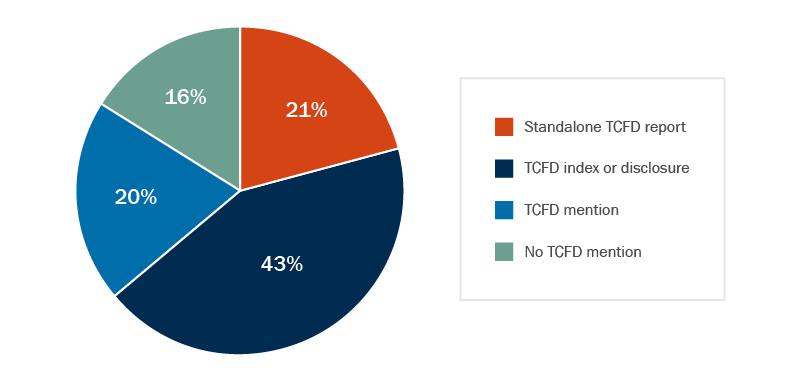

64% of ESG reports align to the TCFD

With the proliferation of climate-related regulatory proposals announced in North America and abroad, preparedness for climate-related disclosure remains top of mind for issuers. Over 90% of Canadian institutional investors identify climate change as a top ESG issue1, and over 60% of S&P/TSX Composite Index constituents voluntarily align their ESG reporting frameworks with the recommendations of the Task Force on Climate-related Financial Disclosures (representing a 113% increase in the adoption of such recommendations since their release in 2019)2.

The Canadian climate-related disclosure outlook

The Canadian Sustainability Standards Board (CSSB) published its proposed climate-related disclosure standards, largely based on international standards, and launched a comment period closing on June 10, 2024. The Canadian Securities Administrators (CSA) has announced its intention to publish revised Canadian climate-related disclosure rules for comment following the finalization of, and reflection on, the CSSB standards.

While the CSSB standards and related CSA disclosure rules are expected to establish the foundation for climate disclosures in Canada, investors and environmental advocacy groups are independently pushing forward in the interim and advocating for enhanced environmental policies and practices that, in many cases, extend beyond the requirements contemplated in the proposed regulatory framework. A recent report noted that investors are looking for more “granularity in disclosures related to climate and are highlighting their expectations—no longer desires—for transition plans, targets, risk analysis and demonstration of how organizations will adapt and mitigate the effects of climate change”3.

Environmental advocacy groups are increasingly scrutinizing the voluntary sustainability disclosures of issuers and using all available levers, including complaints to Canada’s Competition Bureau and securities regulators, and putting forward increasingly prescriptive shareholder proposals, to exert pressure on companies to provide enhanced climate-related disclosure. For example, the New York City Comptroller, responsible for the City’s five public pension funds, was recently successful in its efforts to push for three large North American banks to annually disclose a “clean energy supply financing ratio”, a metric designed to show each bank’s investment in green energy compared to fossil fuel energy.

Balancing climate-related disclosures against anti-ESG sentiment

In the U.S., the Securities and Exchange Commission (SEC) announced the approval of its long-awaited climate-related disclosure rules for U.S. public companies. Despite representing a significant milestone in the move towards climate reporting, in response to the overwhelming market feedback, the finalized rules scaled back the requirements of the SEC’s initial proposal. Most notably, the final rules dropped the requirement to report on Scope 3 emissions (those originating in their supply chains) and limited the requirement to disclose Scope 1 and Scope 2 emissions to larger issuers and only when material.

The final SEC rules come at a time of increasing anti-ESG sentiment and political pressure across the U.S. In 2023, over 150 anti-ESG bills and resolutions were introduced in 37 U.S. states, with at least 40 anti-ESG laws having been enacted in 18 states, including prohibitions on fund managers considering ESG factors in their investments and state entities investing with asset managers deemed to be discriminating against, or boycotting, the fossil fuel industry4. Shareholder proposals from anti-ESG groups continue to challenge U.S. companies on their governance and sustainability policies, the influence of which has already surfaced in Canada, with several large Canadian banks receiving proposals demanding clarification on their commitment to the oil and gas industry.

Notwithstanding the rise of anti-ESG shareholder proposals in the U.S., having more than doubled in the last three years to 79 proposals in 2023, shareholder support levels remain very low, averaging only 2.4% last year5. This increasing politicization, however, has resulted in a shift away from the use of the term “ESG”, with Larry Fink noting that the term has been “weaponized”, with many issuers now opting to file “sustainability” reports. Meanwhile, the regulatory regime in the U.S. remains in limbo with multiple petitions filed in opposition to the final SEC rules, including by a group of attorneys general representing ten states asking the Court to vacate the final rules. In April, the SEC determined to exercise its discretion to stay the final rules pending the outcome of these court challenges, noting its intention to continue to vigorously defend the rules.

Board diversity and overboarding

In Canada, amendments proposed by the CSA to broaden the current diversity disclosure requirements beyond gender remain under consideration, and it is unclear where regulators will land. In the U.S., the Nasdaq board diversity rule, which requires issuers to publish diversity characteristics and have (or explain why they do not have) at least one director who self-identifies as female and at least one director who self-identifies as LGBTQ+ or as an underrepresented minority, is once again subject to challenge.

Despite this uncertainty, investors and proxy advisors continue to drive forward and evolve their own expectations of companies. For S&P/TSX Composite Index companies, ISS now generally recommends voting against the nominating committee chair (or its equivalent) where the board has no apparent racially or ethnically diverse members, and the company has not provided a formal, publicly disclosed written commitment to add at least one racially or ethnically diverse director at or prior to the next annual meeting. We have already observed diversity expectations taking hold, with ISS and GL both issuing “vote against” recommendations where female board representation does not meet their guidelines—generally, at least 30% female board representation for S&P/TSX Composite Index companies and at least one woman on the board in all other cases.

ISS is also beginning to apply its broader diversity policy in Canada and has recommended voting against at a number of companies during the 2024 proxy season. While Canadian proxy advisory diversity guidelines are being broadened, anti-ESG shareholder proposals in the U.S. pull in the opposite direction. Two-thirds of the 2023 anti-ESG proposals in the U.S. advocated against the consideration of racial and ethnic diversity on boards and in the workplace and against corporate diversity, equity and inclusion programs6. As with anti-ESG proposals focused on climate, these proposals have so far garnered meagre support.

As corporate governance expectations become increasingly complex around the globe, the thresholds for overboarded directors are also shifting. Despite North American guidance from ISS and GL that non-CEO directors should not serve on more than five public boards, some institutional investors are adopting more stringent expectations aligned with other jurisdictions, including the United Kingdom and the European Union. Vanguard, BlackRock, J.P. Morgan and Northern Trust, for example, will now generally vote against a director who serves on more than four public company boards.

- Sustainable Investments Institute, “Assessing Anti-ESG Efforts in the 2023 Proxy Season” (PDF).

- Ibid.