What do AI’s massive data needs mean for the future of power development?

As data centre capacity expands to meet the exponential growth of AI, the rising demand for electricity presents a significant challenge to balancing AI’s expansion with the climate commitments taken on by governments and companies. We examine the brewing energy demand crisis and the efforts being made towards sustainably powering AI.

Exponential growth in AI

Given its potential to transform the global economy by increasing productivity across various industries, significant resources are being invested by both the private and public sectors to develop AI, resulting in exponential growth. In 2023, the global AI market was estimated at US$196.63 billion and is projected to reach almost a tenfold increase (US$1,811.8 billion) by 20301. Canada released a national AI strategy in 2017 and has invested over $2 billion in the sector since then, with an additional $2.4 billion investment package announced as part of the 2024 federal budget, aimed at building and expanding access to AI-computing capabilities, technological infrastructure and boosting the adoption of AI in critical sectors, such as agriculture, clean technology, healthcare, and manufacturing. In the Ontario AI sector alone, there are nearly 400 AI firms, venture capital investment has reached approximately $1.16 billion dollars, and over 20,000 jobs have been created2 (for more on AI transactions, read “Are AI transactions different than traditional tech deals?”).

Data centre boom and demand for electricity

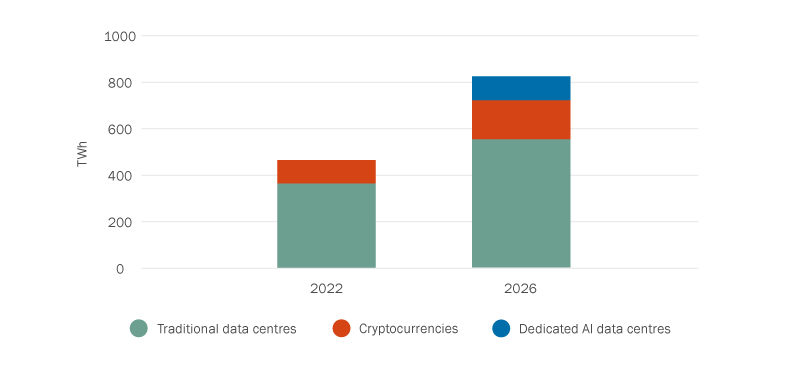

AI relies on mass quantities of digital data and infrastructure housed in data centres around the world. As AI adoption grows, so does the demand for data centre capacity and the electricity to power that capacity. Data centres, cryptocurrencies and AI consumed approximately 460 TWh of electricity globally in 2022 (nearly 2% of total global electricity), and that demand could double by 20263. AI companies are also continually releasing new generations of AI servers that are more powerful but also consume energy at a higher rate. In 2022, data centres consumed approximately 1% of the total electricity used in Canada; this figure is expected to increase rapidly in the coming years4. Efforts are being made to reduce the electricity demand of data centres, including by making each new generation of AI server more power-efficient than the last (computing processes account for approximately 40% of the electricity demand of a data centre) and by adopting high-efficiency cooling systems (cooling systems account for another 40% of the electricity demand of a data centre); however, there will be an increasing need for additional electricity generation capacity to meet the high power demands of AI, in addition to an expansion in storage, distribution and transmission capacity.

Estimated electricity demand from traditional data centres, dedicated AI data centres and cryptocurrencies, 2022 and 2026, base case

Finding a new balance

Technology firms are seeking to balance the energy requirements to deploy data centres worldwide to power their AI needs while meeting their carbon reduction commitments in upcoming years. To meet these commitments, companies are looking to reduce their Scope 2 emissions (i.e., those indirect emissions that result from their electricity use), which can be done by reducing electricity use and improving energy efficiency. While improvements are being made with respect to efficiency, the adoption of AI is resulting in an increase in electricity use rather than a decrease. In response, companies are looking to market-based approaches to reduce these Scope 2 emissions. Carbon accounting standards such as the GHG Protocol allow organizations to offset emissions associated with their electricity use from the grid by purchasing renewable power or the environmental attributes associated with renewable power (with products such as renewable energy certificates or clean energy certificates), often through power purchase agreements or similar transactions.

A new era for data centre operators

Data centre operators and other organizations in the AI space are seeking significant and reliable electricity capacity while also being able to meet emissions targets. For example, in 2023 Google reported a 37% increase from 2022 in Scope 2 emissions, primarily resulting from their data centre electricity consumption, which they noted was, among other things, “due to data centre electricity consumption outpacing [their] ability to bring more CFE projects online”; at the same time, Google has also pledged to meet net-zero 20305.

We have already seen substantial investment in the development of renewable projects, including wind and battery storage through corporate power purchase agreements with renewable developers, and we only expect this demand to increase. Data centre operators are also looking to new approaches to power these facilities, including by partnering with power developers to implement behind-the-meter generation, in particular for data centres located outside large metropolitan centers where reliable power sources are more limited6. Energy generation and storage facilities can be co-located with data centres to provide reliable long-term sustainable power while also lessening the need to expand transmission capacity on the grid.

Conclusion

While the rapid expansion of AI and the resulting demand for power presents significant challenges for the energy sector in Canada and globally, it also brings tremendous opportunities for the development of new electricity generation projects, transmission and distribution capacity and energy storage systems.

- Invest Ontario, Artificial Intelligence and Connectivity: Where Innovation Unleashes in Ontario’s AI and Connectivity Hub, (June 2024).

- International Energy Agency, “Electricity 2024: Analysis and forecast to 2026”, (January 2024).

- Google, “Environmental Report 2024”, (July 2024).

This article was published as part of the Q4 2024 Torys Quarterly, “Machine capital: mapping AI risk”.