Mining: Mining sector unleashed

As 2021 draws to a close, the mining sector is emerging from the pandemic from a position of strength buoyed by strong commodity prices and new drivers of investment and transaction activity. Meanwhile, the momentum to make and deliver on ESG commitments and the global energy transition are influencing operations, investment and strategic decision-making in the sector. Altogether, these developments underscore the transformation that is underway in Canada’s vibrant mining sector.

The current environment

Since 2020, commodity prices, including precious and base metals, have gone from strength to strength during the pandemic. As of November 2021, the copper price is above US$4.00/lb showing an increase of 66% over the same period in 20191. Gold, while retreating through the 3rd quarter, has rebounded and remains significantly above pre-pandemic levels at a price of over US$1800 per oz2. The drivers of strong commodity prices are varied: supply constraints, inflation, and the unexpected strength of the global economic recovery—but point to continued strong commodity prices through the balance of 2021 and into 2022. Commodity prices, coupled with a combination of external catalysts, new and old, are supporting activity in the sector, including M&A activity, a stronger financing market, and facilitating the continued necessity of investment in exploration and innovation.

Buoyant commodity prices are driving increasing capital markets and M&A activity

Commodity prices and the healthy outlook for the sector has spurred improved investor sentiment in the capital markets as the world emerges from the pandemic. In 2021, equity financings by mining companies have returned at levels higher in both volume and transaction value in over five years. Of further note is the broader support for exploration and junior miners who have been able to access capital, and by extension increase exploration and development budgets through 20213. As at the end of Q3, 2021 the number of new issues on the TSX Venture Exchange has more than doubled compared to 2020 with 52 new issuers4.

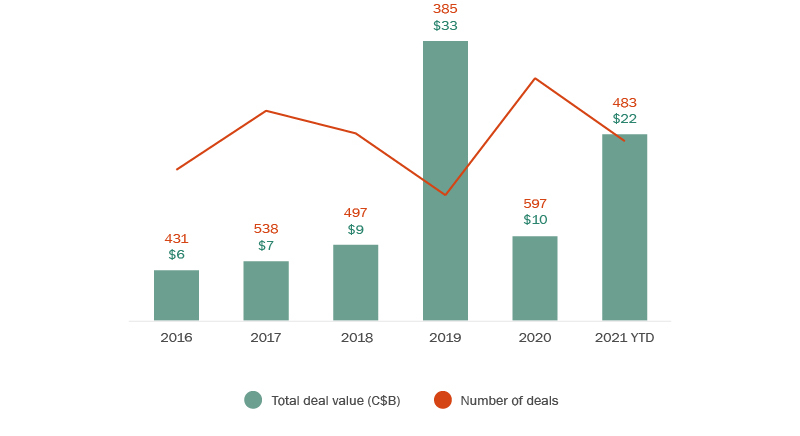

In turn, strong commodity prices and the fundamentals behind them, positive outlook, and improving capital markets have led to a return of M&A activity of size. During the first 3 quarters of 2021, while the number of transactions is roughly on par with the same period in 2020, deal value increased significantly, from approximately C$10 billion in 2020 to $22 billion led by Agnico-Eagle’s acquisition of Kirkland Lake. At the time of publication, the pace of significant M&A has only increased in Q4, highlighted by ASX and TSX listed Newcrest Mining’s proposed C$3.5 billion acquisition of Pretium Resources, and Zijin Mining’s proposed C$960 million acquisition of Neo Lithium.

M&A deals with Canadian mining targets

ESG, net-zero and the energy transition

EESG remains a key focus of mining companies and their investors and other stakeholders. It will continue to drive operations, investment and strategic decision-making in the industry. Public attention has turned again to net-zero commitments in the wake of the recent COP 26, the UN Climate Change Conference recently held in Glasgow. However, investor and stakeholder pressure has led key participants in the private sector to make their own net-zero commitments. According to one recent review, 1,858 of the world’s 2,000 largest public companies have announced net-zero commitments. UN Special Envoy Mark Carney has also enlisted over 450 financial institutions, controlling US$130 trillion in private capital, in the Glasgow Financial Alliance for Net Zero. We see this growing commitment to the global energy transition to impact the mining sector in three ways.

First, the mining sector has been and will continue to be a leader in the global energy transition. We expect the net zero commitments, and the ESG focus of investors and stakeholders more generally, to continue to drive operational decision-making and capital investment. At the operational level, the ongoing electrification of mining fleets, and the use of hydrogen and alternative fuels for vehicles and other equipment, will only accelerate as these technologies become more cost competitive. We also expect miners to increasingly explore opportunities to install on-site solar, wind or energy storage facilities, both at remote sites to supplement or replace diesel generators and at sites that would otherwise be connected to a carbon intensive grid. Where those opportunities are not available, operators may also consider novel forms of alternatives to meet targets such as virtual power purchase arrangements, where environmental attributes associated with renewable power production are acquired to help offset miners’ emissions associated with their operations (read more in “Virtual power purchase agreements: A net zero strategy”).

Second, the growing global trend toward electrification, whether electric vehicle (EVs) or more generally, is supporting increased demand and investment in the minerals necessary for the energy transition. So called ‘Battery Metals’ such as copper, nickel, cobalt, graphite and lithium have seen significant increases in price and investment. In addition to driving M&A, such as Zijin’s acquisition of Neo Lithium described above, smaller miners in the lithium and cobalt sector are now in demand and found much easier access to capital.

Finally, with the importance of the mining and metals industry to the energy transition, we expect governments and regulators to play an increased role in support of mining of, and supply chains for, these critical minerals and the oversight of transactions in the sector. As we noted last quarter in “Critical minerals: a new focus for foreign investment review”, battery metals and other metals deemed strategic or critical, will be the subject of ongoing foreign investment scrutiny from regulators. In Ontario, Canada, the Ford government recently made the most recent pledge of support to develop to the Ring of Fire area of Northern Ontario by announcing certain changes to legislation designed to facilitate the development of roads to open up mining development5. The announcements were supported as being part of a strategy to improve Ontario’s position as a EV producer. Of note, as of this writing, a miner with significant mineral rights in the Ring of Fire, Noront Resources, is the subject of a contested take-over between BHP and Andrew Forrest-backed Wyloo Resources.

- Capital IQ.

- Capital IQ.

- TSX MIG report, September 30.

- Read our recent analysis on the latest Ring of Fire update here.