Authors

Tyson Dyck

Tyson Dyck

Henry Ren

Given the potential for climate change to drive transformation across entire economic sectors, the fact that it often dominates the environmental, social and governance (ESG) conversation is hardly surprising.

Here we examine the important role that climate change has assumed in ESG and discuss the related question—will regulation, incentives, or a combination of both drive future trends in this area?

Climate change as a central pillar of ESG

According to S&P Global Market Intelligence, “80% of the world’s largest companies are reporting exposure to physical or market transition risks associated with climate change”, while “increasing pressure from shareholders and activists has led to divestment from some carbon-intensive industries”1. Physical climate change risks include exposure to increasingly severe or unpredictable weather events, or broader climatic changes. For example, certain companies own or insure assets that may be at greater risk due to rising temperatures or sea levels. Transition risks result include exposure to the regulatory, economic or similar consequences resulting from the transition to a low carbon economy. For example, certain companies sell or require carbon-intensive fuels that may become more expensive as regulators increasingly seek to impose a price on carbon.

In response to these risks, many ESG efforts have been focused, at least in part, on the assessment of material climate change issues2. For example, the Sustainability Accounting Standards Board highlights a company’s greenhouse gas emissions as a sustainability issue that is likely to be material for more than 50% of industries in the transportation and extractives and minerals processing sectors, among others.

Given the far-reaching implications of climate change, an open question is whether climate action has outgrown the ESG mandate and needs its own.

Companies and investors are also looking to improve the availability and reliability of climate-related financial information to inform decision-making. One leading source of investor-led guidance is the Task Force on Climate-related Financial Disclosures (TCFD), which consists of more than 30 members from across the G20. The TCFD’s recommendations—structured around governance, strategy, risk management, and metrics—have been adopted by a growing list of regulators and companies around the world3.

In fact, given the far-reaching implications of climate change, an open question is whether climate action has outgrown the ESG mandate and needs its own4. Some argue for unbundling climate change from other ESG factors, citing the distinct nature of climate risks relative to other important social and governance issues. Climate events can directly and immediately impact safety and physical assets (e.g., due to more frequent severe storms and wildfires), such that long-term sustainability often takes a backseat to the urgency of immediate adaptation or recovery efforts. Some also argue that corporate sustainability goals based on a grouping of ESG criteria could inadvertently dilute awareness of specific climate risks. This concern is heightened by the macro nature of climate risk exposure, which affects nearly all market segments and businesses either directly or through their customers and supply chain5.

Risk and regulation

Not surprisingly, given the potential impact of physical and transitional climate-related risks on many businesses, certain climate change assessment and reporting standards are increasingly being codified as legal requirements. This is occurring through both regulation and contract. As a leading example, the UK Chancellor of the Exchequer recently announced that it will require certain companies to improve their climate-risk reporting for reporting periods that begin in January 2021, with even broader climate change disclosure rules expected to take effect by 2025. These rules are expected to be based on the TCFD’s recommendations (read more in “In pursuit of a climate change risk framework for Canada’s financial institutions”).

In Canada, the Ontario Security Commission (OSC) has also issued guidance on climate change-related disclosure, and participated in the Capital Markets Modernization Taskforce Report, which was released in January 2021 and which recommended mandating disclosure of material ESG information, “specifically climate change-related disclosure that is compliant with the TCFD recommendations for issuers through regulatory filing requirements of the OSC”6. The Office of the Superintendent of Financial Institutions (OSFI) is already actively consulting federally-regulated financial institutions and pension plans regarding potential supervisory approaches and prudential tools to address climate-related risks7.

While these regulatory developments continue, lenders and other parties are increasingly requiring their contract counterparties to make climate change-related disclosures. For example, the Government of Canada’s recent large employer loans program in response to COVID-19 required recipients to commit to publish annual climate disclosure consistent with the TCFD’s recommendations8.

Climate change and company performance

In addition to regulatory requirements, performance incentives for companies may also help address climate change risks. The link between corporate performance and commitment to ESG issues (especially climate change) is a hotly studied subject. While by no means free from debate given the relatively short track record of various ESG-focused strategies9, early evidence suggests there may be value for organizations that have strong ESG awareness and that invest in climate-related solutions.

Companies with high scores in ESG factors that are material to the industry, and with low scores in other factors, are the ones that tend to beat the market

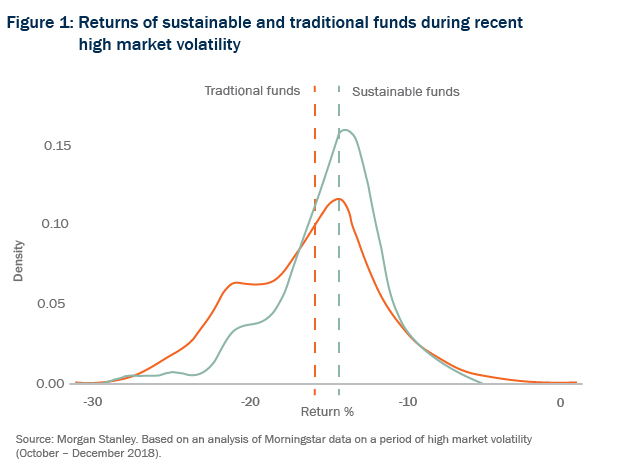

London-based CDP (formerly, the Carbon Disclosure Project)—which maintains an “A List” of global companies scored based on their climate disclosures—has said that these companies’ average annual returns outpaced their competitors’ by 5.3% in the last 7 years10. With respect to mutual funds, the Morgan Stanley Institute for Sustainable Investing found that the median performance for sustainable funds was in line with that of traditional counterparts from 2004 to 2018 (based on 11,000 funds included in the study). However, the Institute also found that sustainable funds provided more downside risk protection from volatility, as the graph below illustrates for a highly volatile period (Q4 2018) in the U.S. markets11.

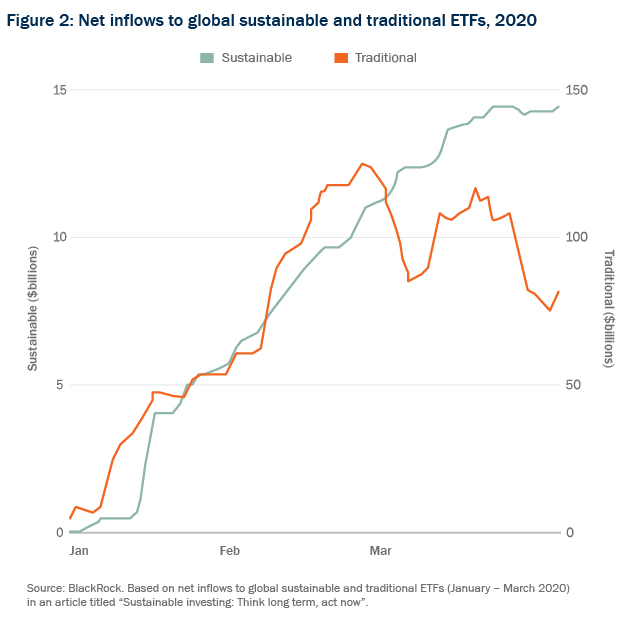

Market sell-off in the early phase of the COVID-19 crisis further highlighted the relative resilience of sustainable investments. Notably, a study of global public companies that generate at least 10% of revenues from climate solutions showed that their stocks outperformed the relevant regional indices by an average of 7.6% between December 2019 and March 2020 and by 3% between February and March 202012. Another study found that traditional ETFs saw heavy outflows during the sell-off, while net inflows into sustainable ETFs continued to grow (see figure below13). Although sustainable ETFs currently make up a small share of the global ETF market, their ability to weather the economic storm has been seen as potential sign of a sustainable investing wave over the coming decades14.

Leading research highlights an important caveat to these trends. This research concludes that wide-ranging investments in ESG factors do not necessarily lead to increased profitability. Rather, companies with high scores in ESG factors that are material to the industry, and with low scores in other factors, are the ones that tend to beat the market, particularly if they clearly implement and communicate a related corporate purpose. This is an important insight for those companies for which climate change risks are the most, or among the most, material to their business (read more in “Purpose and profit: ESG and the path forward”).

Climate change carrots, sticks—or a combination of both?

At this point, it is becoming increasingly clear that the combined drivers of regulatory requirements and financial incentives will likely shape future trends in climate change assessment and disclosure. There may be performance incentives that continue to compel companies to invest in climate change solutions, or to improve their internal processes for managing climate change risks, including through the adoption of voluntary standards. As regulatory agencies and contract counterparties increasingly impose climate-focused requirements, a concerted movement that is commensurate with the magnitude of climate change risk is gaining ground among financially motivated stakeholders15.

_________________________

1 S&P Global, Accounting for Climate: The Next Frontier in ESG, October 11, 2019. Available here.

2 E&Y, How ESG Creates Long-Term Value – Sustainability’s New Frontier, October 25, 2019. Available here.

3 Available here.

4 Standard Social Innovation Review, Climate Action is Too Big for ESG Mandates (September 29, 2020. Available here.

5 Ibid.

6 See page 70 here.

7 OSFI, Navigating Uncertainty in Climate Change (January 2021). Available here. In this discussion paper, the OSFI focused specifically on climate-related risks and indicated that a broader discussion on ESG factors may be considered in future discussion papers.

8 Available here.

9 For instance, of the 140 sustainable investment products available to Canadians, 51 are ETFs and a majority of these ETFs were launched just within the last 3 years (MorningStar, Canadian ESG Investing Soars in 2020, January 28, 2021. Available here.

10 CDP, Companies worth $15 trillion revealed on CDP 2020 ‘A List’ of environmental leaders, December 8, 2020. Available here.

11 Morgan Stanley Institute for Sustainable Investing, Sustainable Reality – Analyzing Risk and Returns of Sustainable Funds, 2019. Available here.

12 HSBC, Climate and sustainable investments outperformed as pandemic struck, March 27, 2020. Available here.

13 BlackRock, Sustainable Investing: Think Long Term, Act Now, March 31, 2020. Available here.

14 Ibid.

15 For further discussion, see Duke University School of Law – Global Financial Markets Center, ESG Carrots and Climate Sticks (July 14, 2020) [link].

Inscrivez-vous pour recevoir les dernières nouvelles

Restez à l’affût des nouvelles d’intérêt, des commentaires, des mises à jour et des publications de Torys.

Inscrivez-vous maintenant