CSA reports continuing progress for representation of women on boards, but not for women in the C-suite

Authors

Rima Ramchandani

Rima Ramchandani

Janet Holmes

Glen R. Johnson

Glen R. Johnson David A. Seville

David A. Seville

The Canadian Securities Administrators (CSA) have published their Report on Sixth Staff Review of Disclosure Regarding Women on Boards and in Executive Officer Positions (Report), which tracks metrics between 2015 and 2020 for 610 TSX-listed companies whose fiscal years ended between December 31, 2019 and March 31, 2020.

What you need to know

- The trend line at the board level is generally positive: for example, 79% of issuers now have at least one woman on the board and 20% of issuers have three or more women on the board (up from 49% and 8%, respectively, in 2015). Rising expectations within the investor community for greater representation of women on boards, supported by CSA disclosure requirements that facilitate investors’ ability to monitor and compare issuer practices, are resulting in change.

- Progress in the C-suite, however, continues to be very slow: for example, 35% of issuers do not have any female executive officers (compared to 40% in 2015). Given that the rules only capture data on individuals who qualify as “executive officers”—generally the most senior members of the management team—standardized disclosure of positions one or two levels below the senior management team could provide a better indication of the degree of progress more broadly, including the representation of women in the pipeline for senior management.

- The adoption of board term limits and targets for the representation of women has not gained momentum. Despite proposals made earlier this year by Ontario’s Capital Markets Modernization Taskforce that all publicly listed issuers be required to adopt term limits and targets, the Ontario Government’s 2021 budget was notably silent on the topic. Absent the express endorsement from the Ministry of Finance, it is unclear whether and when the Ontario Securities Commission (OSC) will pursue these recommendations.

Progress at the board level

Progress continues to be made toward increasing the representation of women on TSX-listed company boards in most industry sectors.

- 79% of issuers, up from 49% in 2015 and 73% in 2019, now have at least one woman on their boards.

- 20% of issuers have three or more women on their boards, up from 8% in 2015 and 15% in 2019. Governance advocates have cited evidence that a minimum of three women on the board is necessary to achieve a board with a sufficient diversity of members that can exert influence in the boardroom.

- The manufacturing, retail and real estate industries continue to lead the way with 93%, 91% and 90% of issuers, respectively, having at least one woman on their boards.

- The technology industry has made significant improvements in the representation of women on boards in the past six years and also showed the greatest year-to-year improvement since 2019. 84% of issuers had at least one woman on their boards in 2020 (up from 39% in 2015 and 73% in 2019).

- The oil and gas and mining industries also continue to make improvements, with 73% of oil and gas issuers and 72% of mining issuers reporting that they had at least one female director in 2020 (up from 40% and 35%, respectively, in 2015).

- In the biotechnology industry, however, the trend has been negative, with 59% of issuers reporting that they had at least one female director in 2020 (down from 65% in 2015 and 67% in 2019).

- As in prior years, Canada’s largest banks were excluded from the study because they have October 31 fiscal year-ends. On average, women held 38.8% of the board seats at the six largest banks in 2020, compared to an average of only 20% of the board seats at the companies reviewed for the Report.

- Although issuers with a larger market capitalization generally have a higher representation of women on their boards, progress has also been made among smaller-cap issuers.

- Board seats held by women of issuers with over $10 billion in capitalization was 31% in 2020, compared with 15% for issuers with less than $1 billion in capitalization.

- The percentage of board seats held by women of issuers with less than $1 billion in market capitalization has almost doubled since 2015, from 8% to 15%. The progress has been even greater at issuers with market capitalizations between $1 and $2 billion, where the percentage of board seats held by women grew from 11% in 2015 to 24% in 2020.

- The percentage of issuers that have adopted a policy relating to the identification and nomination of women directors continues to grow, albeit at a slower rate than in previous years. 54% of issuers had such a policy in 2020, compared to 15% in 2015 and 50% in 2019. Issuers with such policies had an average of 23% of their board seats held by women, while at issuers without such policies, women held an average of 15% of the board seats.

Room for improvement

- 57% of issuers reported having either no women, or only one woman, on their board in 2020.

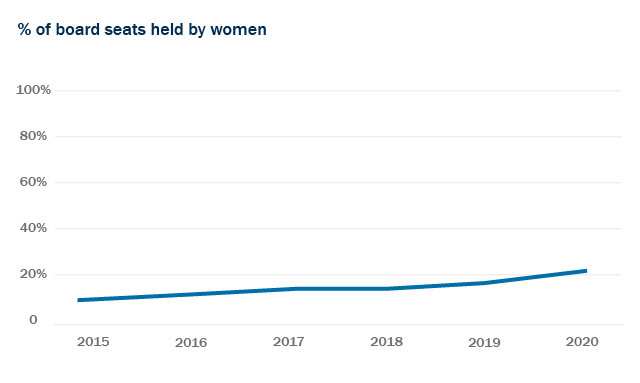

- Although the percentage of board seats held by women across all issuers has almost doubled in the past six years, rising from 11% of seats in 2015 to 20% of seats in 2020, the overall percentage remains low.

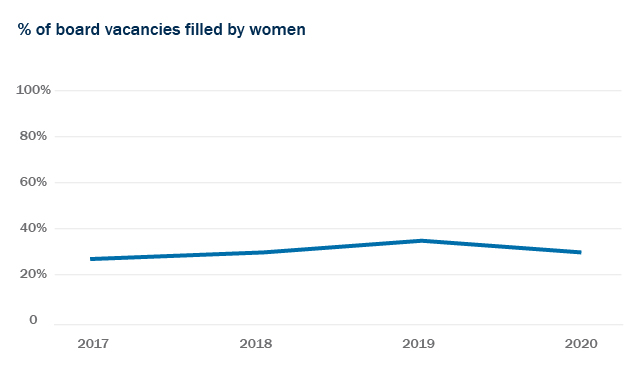

- When vacancies arose in 2020, 30% of the seats were filled by women (a slight decrease from 33% in 2019). The modest pace of change means that it could take many years to achieve one-third female representation on boards—the target often recommended by governance and diversity experts.

- Only 6% of boards have a female chair, up only slightly from 5% reported in 2019.

Targets and director term limits continue to be uncommon

Although the percentage of issuers with targets for the representation of women on boards has increased in each year of the study (from 7% in 2015 to 26% in 2021), the practice has not become widespread. Issuers with board-level targets for the inclusion of women had an average of 26% of their seats held by women, compared to issuers without targets, which had an average of 17% of their seats held by women.

Likewise, the percentage of issuers that have adopted director term limits (e.g., age limits and/or term limits) has increased only modestly in the past six years, from 19% in 2015 to 23% in 2020. An additional 34% of issuers reported that they have adopted other board renewal mechanisms, such as assessments of the board and individual directors. The Report does not indicate whether there is any correlation between: a) the adoption of term limits or other board renewal mechanisms and b) the percentage of board seats held by women and/or board vacancies filled by women. The inclusion of such data in the future could help issuers and investors evaluate the usefulness of such mechanisms.

Progress in the representation of women in the C-suite is lagging

The Report Indicates that only small gains have been made since 2015 in the representation of women in the C-suite.

- 35% of issuers do not have any female executive officers, compared to 40% in 2015 and 36% in 2019.

- 31% of issuers have one female executive officer (a slight increase compared to 30% in 2015).

- 19% of issuers have two female executive officers (compared to 15% in 2015).

- 15% of issuers have three female executive officers (no change since 2015).

- 5% of issuers have a female CEO (a slight increase compared to 4% in 2019) and 15% of issuers have a female CFO (no change from 2019).

- Targets for the representation of women in executive officer positions remain rare. Only 4% of issuers have such a target (up from 3% in 2019 and 2% in 2015). By contrast, all six of Canada’s largest banks have a target either for executive officers or senior executives (e.g., VP or higher-level executives) and, on average, approximately 24.7% of these positions are held by women.

What could drive more rapid change?

The CSA’s disclosure-based framework has facilitated monitoring of issuers’ gender diversity practices. The rate of progress on certain metrics, however, may not be sufficient for some stakeholders and policymakers. Outside Canada, some governments have introduced quotas for the representation of women on boards and/or in executive officer positions1. Earlier this year, the Capital Markets Modernization Taskforce established by the Ontario government recommended that Ontario securities legislation be amended to require all publicly listed issuers to set board and executive management diversity targets, implementation timelines for achievement of those targets, and tenure limits for directors2. Although requirements like these fall outside the traditional scope of securities regulation in Canada, they are consistent with initiatives being driven by proxy advisory firms and institutional investors3.

However, in its recently released 2021 budget, the Ontario Government was notably silent on the Taskforce’s diversity target and term limit recommendations. Absent the express endorsement from the Ministry of Finance, it is unclear whether and when the OSC will pursue these proposals.

_________________________

1 California is the first jurisdiction in North America to introduce such a requirement. In September 2018, it passed a law requiring all publicly held companies headquartered in the state to have: (i) by the end of 2019, at least one female director; and (ii) by the end of 2021, at least three female directors (for companies with six or more board members) or two female directors (for companies with five or fewer directors). The legislation has been challenged in several lawsuits by shareholders and taxpayers (but, to date, no companies or directors).

2 For more information on these and other governance-related recommendations by the Taskforce, see our recent bulletin “Ontario’s Capital Markets Modernization Taskforce issues final recommendations”.

3 For more information on proxy advisory firms’ voting guidelines applicable to Canadian companies, see our bulletins “Glass Lewis releases its 2021 proxy voting guidelines” and “ISS releases new diversity proxy guidelines: S&P/TSX Composite Index companies expected to adopt a 30% target for women on boards”.