U.S. and Canada Tax Developments

Change has been in the air this spring for tax regimes on both sides of the Canada-U.S. border. And in both countries, some of the changes carry with them potential unintended consequences that transcend the scope of what the rules were intended to target.

Discussed in detail below, in the U.S., newly released regulations attacking U.S. tax inversions also affect some debt instruments; and in Canada, the new federal government’s budget includes proposed rules that have significant implications for linked notes and tax switches in mutual fund corporations.

U.S. Update

Proposed Regulations Target Inversions—But Hit Intercompany Debt

On April 4, 2016, the U.S. Department of the Treasury released comprehensive regulations attacking U.S. tax inversions (for a definition of inversions, see below), taking a two-pronged approach. One set of regulations strengthens the existing tax inversion rules by causing more transactions to be treated as meeting the 80% threshold (for example by ignoring certain shareholders). These strengthened regulations generally had immediate effect. For example, they were widely reported to have halted the proposed combination of Pfizer and Allergan.

A second set of regulations focuses on earnings stripping. In a successful inversion earnings stripping involves the payment of deductible interest by a U.S. corporation to its new foreign parent. Many taxpayers had expected earnings stripping to be attacked by applying existing interest disallowance rules more strongly in the inversion context. Surprisingly, Treasury adopted an unusual approach based on a long-dormant provision of the U.S. Internal Revenue Code—section 385, which addresses whether an instrument issued by a corporation should be treated as debt or equity. The new debt-equity regulations under section 385 are issued only in proposed form, but if finalized, could apply retroactively to certain debt instruments issued on or after April 4, 2016, and would apply in a broad array of contexts that have little to do with inversions.

This set of proposed rules under section 385 would generally apply to any cross-border loan involving a U.S. subsidiary or partnership, as long as the non-U.S. parent owns at least 80% (or 50% in some cases) of the vote or value of the U.S. borrower. The draft rules have three main components, which we expand on: (i) treatment as part debt and part equity; (ii) documentation required to sustain debt treatment; and (iii) debt distributions treated as equity.

The Treasury’s unusual approach to thwarting inversions would apply in an array of contexts that have little to do with inversions.

Treatment as Part Debt and Part Equity

Under current law, an instrument is generally treated either entirely as debt or entirely as equity. The new rules will allow the IRS to characterize a single instrument issued by related parties with 50% overlapping ownership as part debt and part equity. For example, if there is a $50 million loan, but only $30 million is likely to be repaid, then $20 million can be reclassified as equity.

Documentation Required to Sustain Debt Treatment

Debt between 80% related parties will be required to satisfy four record-keeping requirements. A failure to satisfy any of these requirements will cause the debt to be treated as equity and include documentation:

- as debt;

- of typical creditor’s rights;

- of a reasonable expectation of repayment; and

- of a genuine debtor-creditor relationship.

A reasonable expectation of repayment would be documented with cash flow projections, financial statements, debt-equity and other financial ratios, and the like. A genuine debtor-creditor relationship would be documented by showing compliance with the terms of the debt, such as regular repayment.

In the event of a default, the documentation must demonstrate the creditor’s reasonable diligence and judgment, including attempts to enforce or cure a default, as well as any deliberations surrounding a decision not to exercise default rights.

Debt Distributions Treated as Equity

Under the new rules, distribution of a debt instrument to a related shareholder will generally be treated as equity rather than debt. This rule targets the issuance of new debt for no new capital, but potentially sweeps in many other transactions. To backstop this main distribution rule, certain other transactions within a corporate group can be recharacterized. For example, purported debt generally would be recharacterized as equity where (1) the debt is issued to a related person for cash, (2) the issuing corporation distributes cash in excess of its “earnings and profits” to a related person (which could include a distribution to the creditor or another related entity), and (3) the debt was acquired during the period from 3 years before to 3 years after the distribution. As a result, a foreign parent that capitalizes a subsidiary with debt generally will need to do so by contributing cash and ensuring that the subsidiary does not make any distributions exceeding earnings and profits during the 6-year period spanning the creation of the debt.

If finalized in their current form, the new rules will require rigorous documentation of internal debt between a U.S. subsidiary and its non-U.S. parent. The rules will also require close attention to how the indebtedness is created, and close monitoring of cash distributions made by the subsidiary for several years before and after the creation of the internal debt. If enacted in their current form, the new rules will make it very difficult to change the leverage ratio of a subsidiary, other than at the time the subsidiary is established or is funded to make a new investment. These new rules will only be effective if finalized, and, based on the U.S. presidential election cycle, it appears that Treasury hopes to accomplish this before Labor Day 2016.

An open question is whether Treasury, in its zeal to thwart inversions, has exceeded its authority under section 385. On one hand, Section 385 expressly permits bifurcation of a single instrument as part debt and part equity. On the other hand, section 385 generally authorizes Treasury only to prescribe “factors” for characterizing an instrument as debt or equity. The new rules regarding debt distributions do not clearly qualify as “factors.” Depending on the resolution of this open question, as well as the general reaction to Treasury’s proposals, the scope of the rules may be significantly expanded or narrowed.

Canada Update

I. Changes to Linked Notes

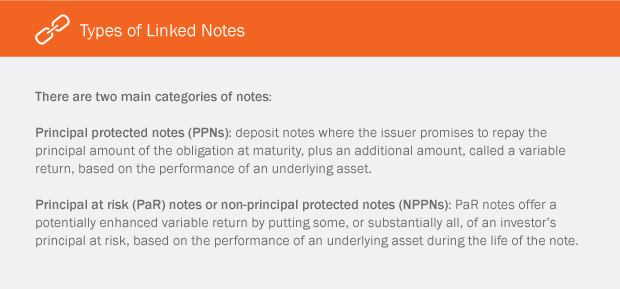

The 2016 federal budget (the Budget) proposes to change the tax treatment to an investor on a transfer of a linked note. As the name implies, a linked note is a debt obligation usually issued by a financial institution with a return that is linked to an index, a basket of securities or a fund. A holder of a linked note would generally not have any income inclusion prior to the maturity of the note. At maturity, the holder is required treat any return on the note as ordinary income (taxed at regular rates). Prior to maturity, a holder who transfers a note with an appreciated value would typically realize a capital gain (taxed at half regular rates) instead of ordinary income. The Budget proposes to tax the accrued gain on transfer as ordinary income instead of as a capital gain.

Within the above two types of notes, many variations exist. For example:

- The reference assets can include equities, equity indices, interest rates, commodities, currencies or mutual funds.

- The variable return can be based on a multiple (accelerator notes) (say 120%) or a portion (say, 80%) of the performance of the reference fund or asset.

- The variable return can be capped or reduced after achieving a specified return.

- Issuers can have a redemption right either at various valuation dates prior to maturity (e.g., autocallables) or on a single date during the term.

- Notes, called “barrier” or “buffer” notes, can offer no loss of principal until the index falls below a specified level. However, if the index falls below that level, with barrier notes, the principal loss is the full reduction of the index, and, with buffer notes, the principal loss is only to the extent the index has fallen below the buffer level.

Held to Maturity

Linked notes are general “prescribed debt obligations” under the relevant regulations on the basis that the return on the notes for a year depends on a future contingency (i.e., the performance of the reference index or asset). A holder of a prescribed debt obligation is required to accrue each year the maximum amount that could be payable for the year.

No interest is deemed to accrue on a typical linked note while the maximum amount of interest that could be payable under the note is indeterminable. Instead, the variable return is included in the holder’s income at maturity when the variable return is determined. Canada Revenue Agency (CRA) has accepted this treatment in several advance income tax rulings. The Budget does not propose any changes to this treatment.

Secondary Market

An affiliate of the financial institution that issues the notes will generally agree that it will use reasonable efforts under normal market conditions to provide for a daily secondary market for the sale of the notes. For each series of notes, an affiliate of the issuer publishes a daily bid price at which the notes could be sold.

Notes are not typically listed on any exchange or marketplace and are therefore otherwise illiquid investments. As stated above, under existing rules, an investor who sells an appreciated note pursuant to the secondary market facility would generally realize a capital gain.

Budget Changes

Subject to certain exceptions, the Budget proposes to treat a gain realized on a sale of a linked note as interest that accrued on the note for a period prior to the transfer. The explanatory notes indicate that the measure is intended to provide symmetry between the treatment of the return on maturity and its treatment on transfer. The rule is proposed to apply to all linked notes that are sold by a holder after September 2016.

Conclusion

Linked notes are widespread and there are thousands of investors who obtain access to the markets through these products. In many cases, notes provide access to investment strategies that ordinary investors could not otherwise readily obtain. Investors can now obtain exposure to such strategies (which are tantamount to equity investments) only at the cost of ordinary income. This is particularly harsh given that any loss on a note by reason of a decline in the value of the underlying asset is recognized only as a capital loss. Investors may also require additional transitional measures to preserve capital treatment for their existing accrued gains, since they might not be able to effect cost-effective secondary sales before the end of September 2016.

II. When a Butterfly Flaps its Wings: Proposals to Tax Switches Within Mutual Fund Corporations

The Budget also introduces a proposal (the Proposal) to eliminate the perceived tax advantage available to investors of multi-class mutual fund corporations (MFCs) to switch between classes of an MFC with one investment mandate (like an equity class)for shares of another class with a different investment mandate (like a balanced class) without immediate taxation at the time of the switch. Under the Proposal, investors switching between such classes after September 2016 will face a taxable disposition of their shares. The mutual fund industry is grappling with the impact of this change on their business model. What appears as a simple tax policy change to eliminate a potential tax deferral marketed as a “tax advantage” will have many unintended consequences.

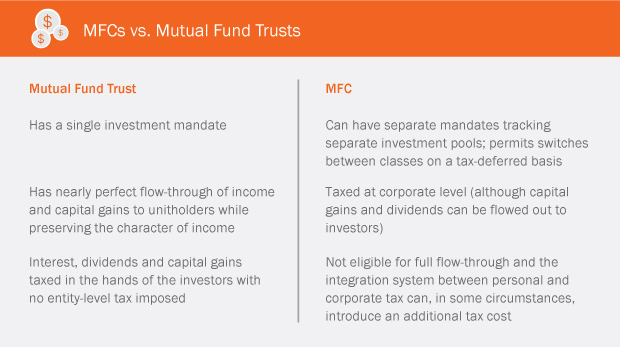

Mutual funds are commonly structured as “mutual fund trusts” or classes of shares of a multi-class MFC. The tax treatment of mutual fund trusts and MFCs is different (see below)—and therein lies the issue.

Market Distortion

There are many billions of dollars invested in MFCs. The change will create a one-time market distortion for investors who believe they would have had one opportunity to make a final switch before becoming “locked in” to a particular strategy mix. Due to this legislative change, we expect investors may switch en masse this year—a dramatic market turn that would, if not for the new rules, not have otherwise occurred.

Less Flexibility for Long-Term Investors

The existing switch rules allowed flexibility for investors to re-allocate their portfolio among different strategies (i.e., different classes within the MFC) to react to the market. Investors with significant accrued gains face large tax burdens if they temporarily change strategies to reduce market risk in times of volatility. Investors will be faced with the choice of riding out the risk or paying tax even though they remain invested in a MFC.

Reduced Appeal

Fund companies (Managers) are concerned that investment advisers will have less incentive to put clients into an MFC and that the market share of MFCs will decline, eventually making the product uneconomic. There has been significant growth in MFC offerings in the past few years because investors liked could the flexibility to switch between Classes to re-balance their portfolio on a tax-deferred basis (even though we understand few actually did and that many holders were tax-deferred investors like RRSPs). Managers often offered MFC classes to defend against competitive pressures where other fund families had similar structures.

Although the proposed changes appear simple, the industry will need at least until year-end 2016 to make a range of necessary administrative and systems changes.

Under the proposed new rules, the inability to switch will render MFCs generally less attractive than their mutual fund trust counterparts—and some Managers will want to migrate to avoid duplication. Since many Managers already offer separate mutual fund trusts with investment mandates similar to those of particular classes of their MFCs, those Managers will want to migrate their MFCs to mutual fund trusts—and currently, there is no ability to do this. Transitional relief will be needed to ease the transition some or all MFC classes to one or more mutual fund trusts.

Technical and Administrative Issues

Where switching occurs, there are often taxable dispositions by the MFC to re-balance its investments to the new investment strategy. In a switch, the total assets of the MFC remain the same. Accordingly, there are additional changes necessary to the capital gains refund mechanism to accommodate the income realized within MFCs that would be realized when an investor switches (and is subject to personal tax). There are also technical concerns that gains or losses that are realized as part of taxable switch will not give rise to an appropriate recognition of the underlying capital gains.

Although the Proposal appears simple, the administrative and systems changes necessary to re-code the affected MFC switches will not be ready by October 2016. The industry will need at least until year-end to reliably provide investor tax information. This timing will also allow for the change to coincide with tax year reporting, which should avoid mid-year differences in tax reporting and the potential for errors and the very messy re-filings that can ensue. We understand that the Department of Finance (Finance) is willing to work with the industry to address its concerns, and discussions are already underway with Finance to explain these implementation issues and to seek an extension of the change-over date and other relief. Ideally, Finance will permit changes to the mutual fund exchange rules to permit one or more classes of a MFC to be transferred to a mutual fund trust on a tax deferred basis.

This small change is likely to make a large impact on the industry. Investors will need to consider their long-term strategies, including if they should switch now. In the long term, investors will likely be migrated out of MFC structures by having one or more of their existing classes migrated to mutual fund trusts. This process will need to be accommodated in a seamless and simple fashion with the least amount of friction costs. The cost associated with switching reduces the efficiency of savings for investors. Given the size and complexity of the industry, will the change be worth the effort?