Financing in the Mining Sector: Creative Solutions Go Mainstream

![]()

As challenging financing markets persist in the mining sector, miners are increasingly looking to creative combinations of financing options to fund project development and acquisitions. It is now common for transactions to feature multiple financing sources, with both equity (public and/or private) and debt (senior secured, high-yield, convertible and/or cost-overrun facilities) being raised in conjunction with streaming, off-take and/or royalty financing.

No longer confined to junior and mid-tier transactions, stream and royalty financing is playing a key role in high-profile transactions. With their sustained use, streams and royalties are evolving to suit the needs of mining companies and their financiers.

Evolution of Stream and Royalty Financing

Streams and royalties can be highly flexible instruments. Although used for some time in the mining sector, more recently they have been used in conjunction with traditional debt and equity to bridge the funding gap for both project development and M&A transactions. Streams are also used by miners as an alternative to noncore assets sales, whereby the miner completes a forward-sale of by-products from a mine (usually precious metals) while retaining control over its mining operations.

As the use of stream and royalty financing becomes more frequent, these instruments are being tailored to align with the needs of transaction parties. Recent transactions have included some of the following features:

- a combination of fixed and floating delivery schedules;

- the linkage of streamed precious metal deliveries to underlying base metal production;

- multiple buyers and third-party information/paying agents and security trustees involved in syndicated stream arrangements;

- coverage of new products and minerals, such as diamonds and chromite; new variations on traditional royalty calculations to extract downstream value; and

- the use of “early deposit” stream structures to fund pre-development stage projects.

Royalties have also featured in prominent spin-off transactions as an important means of ongoing financing for the “spinco” entity.

Inter-creditor issues are a key part of negotiating transactions involving multiple financing sources. Royalties and streams give rise to unique inter-creditor considerations as the interests of royalty holders and stream financiers often conflict with those of traditional creditors in an enforcement scenario. These and related issues are fundamental to the various financing parties and should be addressed as early as possible in the transaction process, whether the stream or royalty is implemented in conjunction with existing or new credit facilities, or in advance of other project financing that will be required.

Entry of New Participants

Major royalty and stream companies, such as Franco-Nevada, Silver Wheaton and Royal Gold, continue to be the primary players in this area. New participants, such as major pension funds, other institutional investors and mining-focused private equity firms, are becoming increasingly active. For example, La Caisse de dépôt et placement du Québec (La Caisse) agreed to provide C$275 million stream financing in connection with the proposed partnership between Osisko Mining and Yamana Gold as an alternative to Goldcorp’s original hostile bid for Osisko. La Caisse also partnered with the Orion Mine Finance Group, a mining-focused private-equity investment business, to provide C$250 million stream financing to Stornoway Diamond Corporation in connection with the construction of the Renard diamond project. The Renard stream was recently further syndicated through the secondary sale of a minority interest in the stream to a Blackstone affiliate. As access to traditional equity and debt financing remains constrained, we expect to see a growing number of new players enter this space and continue to focus more attention to these opportunities.

Streams and royalties can be highly flexible instruments; more recently they have been used in conjunction with traditional debt and equity.

Recent Transactions

Several recent high-profile examples showcase the sector’s new wave of multifaceted financing packages for project development and M&A transactions.

In July 2014, Stornoway completed a C$944 million comprehensive financing package for the construction of its Renard diamond project in northern Québec. The various financing transactions, which involved a marketed offering of common share subscription receipts in conjunction with the negotiation of five different financing facilities with four different financing parties, taken together, constituted the single largest project financing transaction for a publicly listed diamond company. The financing package consisted of a combination of public and private equity financing, separate senior secured debt, convertible debt, cost overrun and equipment financing facilities and a US$250 million diamond stream financing. Orion and La Caisse provided a first-of-its-kind stream financing based on diamond production, designed to allow further syndication of the stream. The application of the stream vehicle to diamonds, a non-fungible product, required innovative structuring to achieve the parties’ commercial, legal and tax goals.

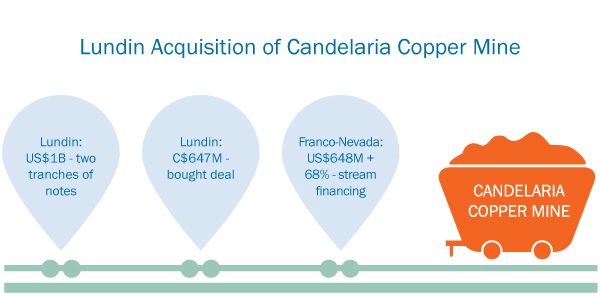

Stream financing played a key role in Lundin Mining’s US$1.8 billion acquisition of Freeport-McMoRan’s 80% ownership stake in the Candelaria copper mine in Chile. The acquisition was funded with a combination of equity financing, senior secured debt and stream financing. Lundin raised US$1 billion through the sale of senior secured notes in two tranches, US$550 million of 7.5% Senior Secured Notes due 2020 and US$450 million of 7.875% Senior Secured Notes due 2022, and completed a C$674 million bought deal offering of common share subscription receipts. The stream financing was provided by Franco-Nevada and consisted of the sale of a stream on 68% (reducing to 40% after certain thresholds are met) of Candelaria’s gold and silver production for an upfront payment of US$648 million. Franco-Nevada also participated in the equity financing for C$50 million.

Significant royalty financing was part of the recent acquisition by Noront Resources of Cliffs Natural Resources’ chromite mining claims in Ontario’s Ring of Fire mining district. To finance the acquisition, Noront entered into a loan agreement with Franco-Nevada through which Franco-Nevada loaned US$25 million to Noront for a five-year period at a 7% interest rate with interest to be accrued and paid at the end of the loan term. In return, Franco-Nevada received a 3% royalty over the Black Thor chromite deposit and a 2% royalty over most of Noront’s remaining property in the region. In addition, Noront received US$3.5 million in cash consideration from Franco-Nevada as part of the granting of the royalty arrangements.

Conclusion

As conditions remain challenging in the mining sector, creative financing solutions will play an ongoing and key role in transactions in the mining sector. Streams and royalties will continue to evolve to meet the particular needs of mining companies and their financiers and attract new participants in the alternative financing space.