Acquisition Financing in Canada Will Take Cues from the United States

Canadian banks spent 2013 bemoaning the competitive state of the market. A combination of sluggish M&A activity and an aggressive pursuit of Canadian deals by U.S. lenders has resulted in a number of significant trends that will shape Canadian acquisition financing activity in 2014.

The lion’s share of M&A activity in Canada in 2013 had a private equity component. In many cases, this involved U.S. sponsors bringing their U.S.-market experience and expectations to bear. Canadian banks financing these acquisitions have been pressured to incorporate U.S. terms that were once foreign to them. These banks are now accepting U.S. approaches far more than they have in the past. For example, U.S. SunGard provisions are now common in Canadian commitment letters. These provisions limit the representations which are a condition to the financing to those representations which are required for the acquisition closing (with some additional narrow representations regarding the legal status of the borrower and loan documents). Canadian banks have also become more amenable to material adverse change (MAC) conditions consistent with those in the underlying acquisition agreement itself. This means that an unforeseen event permitting a prospective buyer to terminate the potential acquisition could equally allow the lenders to withdraw from the related financing commitment.

Despite Canadian lenders warming to a U.S. approach in loan documentation, some U.S. terms are still met with resistance. For example, U.S. SunGard provisions also limit the collateral requirements on closing to financing statement filings, delivery of possessory collateral (such as share certificates) and sometimes intellectual property filings, with other requirements pushed to after closing. Generally, this approach has not been used much in the Canadian market. Canadian banks are also not receptive to equity cures for financial covenants (equity cures permit sponsors to treat new equity investments as EBITDA, curing a financial covenant breach). Although equity cures have made occasional appearances, they are still rarely seen in the Canadian syndicated market. Canadian banks are similarly resisting “covenant lite” deals, which impose no financial covenants on the part of the borrower and which are a staple of the U.S. acquisition finance market.

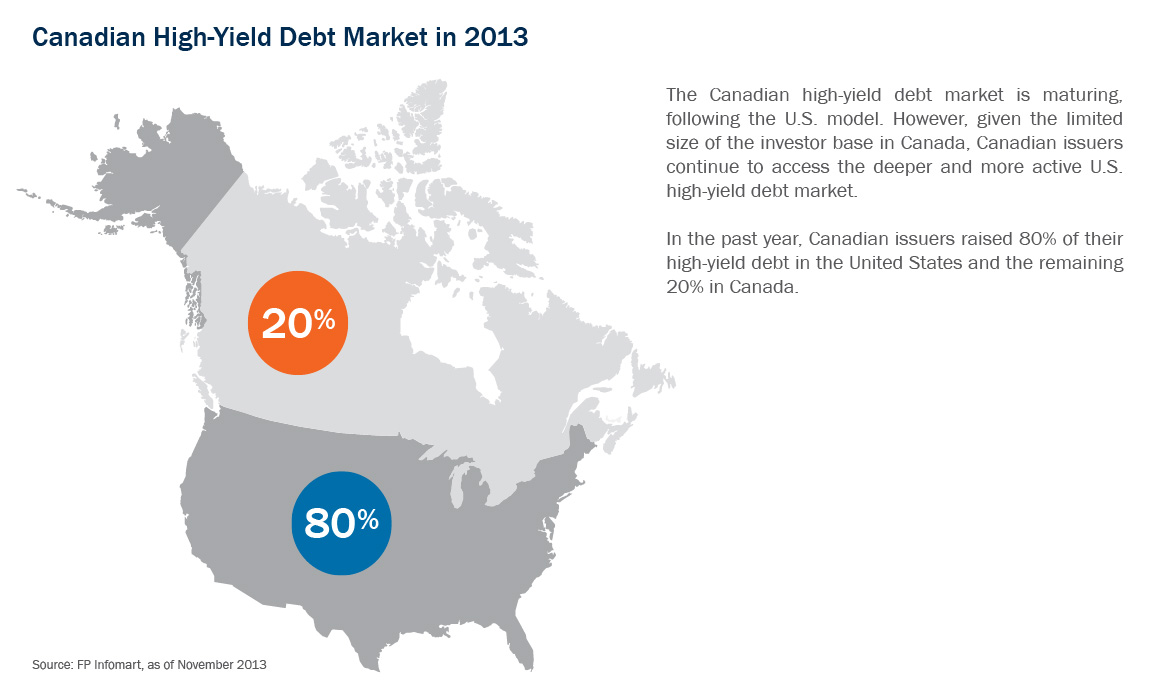

Separately, the Canadian high-yield market is maturing, following the U.S. model. While the Canadian equity markets have been soft, the Canadian high-yield market has been active, particularly in the oil and gas sector. High-yield bonds are now an established financing option in an M&A context. A recent example of a high-yield offering used to finance an acquisition was Canadian Energy Services & Technology’s issuance of senior unsecured bonds, which were primarily used to repay a bridge facility that was part of the acquisition. The limited size of the investor base in the Canadian high-yield market remains a consideration. Issuers may therefore need to be prepared to tap the deeper and more active U.S. high-yield market as an alternative if a high-yield offering is used to finance an acquisition in choppy markets or if the acquisition is of significant size.

The soft Canadian equity markets have also encouraged acquirors to become more creative, especially in the oil and gas industry, to bridge the large gap between the buy and sell prices of assets or companies put on the market. These innovative pricing mechanisms are part of a broader trend that we describe in article 2, Contingent Value Rights and Similar Tools Are Becoming More Commonplace. Many potential sellers have assets that require large amounts of capital spending and, with less equity available, companies are financing their capital programs by selling portions of their assets through joint ventures. The buyers are deep pocketed, but tend to be passive and usually foreign investors. For these deals, the financing is driving the sale rather than the other way around. There is no lack of creativity in how these deals are being structured in terms of reversion rights, minimum returns and governance, and their popularity is clearly growing.

This latest trend in innovative financings, together with the growing influence of U.S. private equity–backed transactions and the burgeoning Canadian high-yield market, will continue to affect the nature of M&A acquisition financing in Canada in the coming year.