New Investors, New Scope: Infrastructure Investing is Broadening

Authors

![]()

Significant capital expenditure will be required in the years ahead to improve infrastructure worldwide. As governments look to private capital to play a role in this push, competition among investors for infrastructure assets is growing rapidly. Private equity funds are increasingly looking to invest in infrastructure-like assets.

At the same time, traditional infrastructure investors are broadening the scope of their investment mandate: they are shifting their focus from direct investments in core infrastructure to related businesses and operations that support them. This is leading to an overlap of infrastructure investors and private equity investors in this space. We expect this trend will continue.

The Appeal of the Infrastructure Asset Class

Investors are increasingly allocating capital to infrastructure investing. The growing appeal of the asset class can be attributed to a number of factors: it offers some protection against economic cycles and inflation; it is less volatile than traditional private market investments; and it provides steady cash flow returns. Infrastructure investing also matches well with the investment profile of investors with longer-term liabilities, such as pension funds.

In the private equity space, investors are establishing investment funds with longer investment horizons to pursue infrastructure deals. They are also dedicating more capital to the sector. For example, KKR recently raised a US$3.1 billion global fund focused on infrastructure investments. Domestically, Canada Pension Plan Investment Board also recently announced the formation of an investment vehicle with allocated funds in excess of C$1 billion targeting investments in midstream energy infrastructure in the Western Canadian basin.

It follows that investor demand for core infrastructure assets is high and competition is driving up prices. As a result, infrastructure investors are now looking beyond core assets for opportunities to invest in businesses that support or manage infrastructure such as transportation assets, water utilities, power generation and social institutions. For infrastructure investors, these businesses share many of the attributes of the underlying assets—because they relate to essential services with steady, long-term consumer demand, they too present lower commercial risk and often benefit from long-term contracts guaranteeing stable revenue streams. However, these businesses can benefit from improved efficiencies and present opportunities to realize enhanced returns, thereby also appealing to private equity investors.

Private Equity in Infrastructure: What are the Challenges?

Alongside infrastructure investors, we are increasingly seeing private equity players pursue investments in infrastructure-related businesses where prospects to maximize value present a compelling business case. However, unlike conventional investing in the private markets, deals in infrastructure present unique challenges that private equity investors must face.

Regulation

These businesses are heavily regulated, either as a result of the regulatory framework that applies to the infrastructure asset and/or the longer-term contracts that govern it. Government-led sales processes are also highly regulated, making them more challenging than typical private company auctions. Investors will need to make important concessions about transparency, both in relation to the sales process and the business once it has changed hands.

Operations

Complex businesses may require deep industry knowledge and expertise. And while day-to-day control may reside with the investor, the investor will nevertheless face overarching operational restrictions under the relevant contractual framework or concession agreement.

Governance

Investments in these businesses may require partnering with the public sector. The government entity will have certain control rights over investment decisions and the exercise of those rights will not always be driven by business considerations; social, political and economic considerations may have equal, or even more important, weight in decision-making processes. These rights will ultimately constrain what the investor can do with the business, particularly on exit.

Transparency will need to be considered when making investments in highly regulated businesses in the infrastructure space.

Despite these challenges, we predict that the overlap between private equity and infrastructure investing will keep expanding. This is especially the case as governments and institutions turn their attention more and more to addressing infrastructure needs. In Canada, the platform of the newly elected federal government contemplates significant investment in infrastructure assets along with other strategies, including a federal infrastructure bank2 to help provincial and municipal governments finance projects.3

Time will tell how these plans unfold in Canada as governments around the world focus on projects to develop, refurbish and upgrade infrastructure. And as private investors venture into the infrastructure space, they may need to adjust their traditional perceptions about, and approach to, dealmaking in order to tap into this growing sector.

_________________________

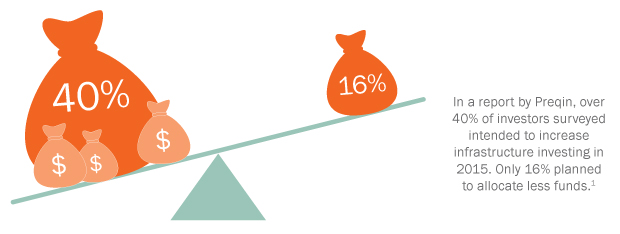

1 Source: 2015 Preqin Global Infrastructure Report. Available here.

2 Source: Liberal Party of Canada. Available here.

3 Source: Liberal Party of Canada. Available here.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.

.jpg?h=1000&iar=0&w=1000&hash=D8A146D41AC358CB32645E96B92BB7C7)