BEPS Will Increase Transfer Price Scrutiny

Authors

Tax authorities around the globe remain focussed on profit allocation issues. Under the political banner that each corporation should pay “its fair share” of corporate tax, the final reports from the OECD Base Erosion and Profit Shifting (BEPS) working groups that were released in October1 call for “bold moves by policy makers to restore confidence in the system and ensure that profits are taxed where economic activities take place and value is created.”2 The G20 leaders recently endorsed the BEPS Reports and urged timely implementation in all jurisdictions.

The BEPS TP Reports call for changes to domestic law and to treaty provisions and for the negotiation of a multilateral instrument to be finalized in 2016. More immediately, the BEPS TP Reports introduce changes to the OECD Transfer Pricing Guidelines. Canada generally follows the OECD Transfer Pricing Guidelines, and since Canada has been a leading participant in the BEPS project, we anticipate that the CRA will adopt the new guidelines.

Change has arrived, and taxpayers will now need to evaluate their current compliance, adapt to new rules and be ready for additional implementation issues.

Effects of BEPS

Despite the apparent consensus in the BEPS Reports, each country’s view of “fair share” will be different Paying a “fair share” is a difficult concept in a “rule of law” tax system like Canada whose courts have eschewed “substance over form” in their decisions. Yet transfer pricing is inherently about assessing the relative contributions of local legal entities in a global value chain where increasingly global branding and intellectual property substantially contribute. The BEPS TP Reports call for a portion of an organization’s global profit to be taxed in jurisdictions in which profit arises (i.e., within the market in which the sale is made) or where contributions are made (i.e., the location of labour, intellectual property or capital) as manifested in risk and the ability to control risk. The BEPS Reports have been criticized for their emphasis on “people” contributions over “capital” contributions and for potentially inappropriately skewing residual returns to “people” functions. While the starting place for review remains the contractual relations between the parties, the BEPS TP Reports call for both greater scrutiny of the conduct of the parties and an analysis of risk and control over risk in determining contribution. Taxpayers will be required to maintain an analysis of the “economically relevant characteristics” of the actual transactions in their local transfer pricing file.

Transfer pricing scrutiny will intensify. Global tax authorities, including, in particular, the CRA, have invested considerable resources in audit infrastructure over the past 10 years and these organizations will continue to audit and propose adjustments. There is a political will to be seen to be assessing tax against multinationals. Adjustments are seen as easy pickings. Almost every audit is going to lead to some adjustment–the rules are too imprecise to be able to predict outcomes with certainty. There are a significant number of ongoing Canadian transfer pricing audits that are slowly grinding through the Competent Authority process and others that are making their way into the courts. Appropriate, timely and fair dispute resolution will continue to be a challenge.

Disputes will be inevitable. Despite the clear statements from the Supreme Court of Canada in Canada v. GlaxoSmithKline3 that as long as pricing is within the range of observed comparables, the pricing will be considered to meet the arm’s length standard, in practice, disputes will arise over the selection of methods, the identification of the comparables, the adjustments to be made to comparables and whether (and to what extent) the surrounding facts and circumstances need to be taken into account to derive appropriate pricing. All of this will be analyzed by a government auditor usually with little industry experience and in reliance upon position papers crafted by CRA economists. The BEPS TP Reports will further increase reliance on economic analysis.

The recent BEPS TP Reports will add additional complexity and confusion and which has a negative implication for multinationals through additional exposure upon audit. The BEPS Reports promulgate a risk approach to pricing largely to combat transfer pricing for global products where brand name is important, where multiple teams contribute and where failures are part of the development process. Under that approach, pricing is based on what risks exist and which entity is in the best position to address the risk (i.e., mitigate it, avoid it or absorb it). Data supporting this approach likely do not exist currently, and that rubric will allow multiple approaches from the CRA, leading to increased risk of adjustment. As this risk approach militates toward people functions, it is likely to result in significant interviews of functional staff, and will require greater tracking of people data.

The result will be an increased workload on tax managers in multinational organizations first in compliance and second in defense of the inevitable audits and tax assessments from tax authorities both at home and abroad who seek to collect additional tax. A transfer pricing audit from the CRA will be one of the most expensive and most arduous processes a multinational in Canada will face.

Experience in Canada suggests that resolving transfer pricing issues will be long and difficult. Companies that have outstanding assessments will need to be able to address the implications of a long process. Once an assessment is issued, a large corporation must pay 50% of the tax assessed and file a notice of objection to continue to dispute the assessment regardless of whether dispute follows the Competent Authority or court process. This has an immediate effect on cash flow. It also creates disclosure issues for public companies. We increasingly see transfer pricing as a significant issue in due diligence in corporate finance and M&A transactions. Finally, the pace of change within organizations will affect the ability to contest an assessment. People change, memories fade, and business units are restructured. By the time staff are interviewed they are more focussed on what they do now than able to remember long ago strategies.

Transfer pricing remains at its heart an allocation methodology. Its goal, from a government perspective, is to deliver on corporate tax revenues. This inherently raises double taxation issues and so the domestic audit in many cases quickly leads to Competent Authority processes bilaterally and increasingly to multilateral dispute resolution. This allocation aspect and the use of Competent Authority process takes the audit away from the domestic court process and away from the potential for a principles-based resolution. The nature of negotiation between government tax authorities is more likely to result in compromise than principled outcomes leading to less predictable outcomes.

Be Prepared: Audit Planning

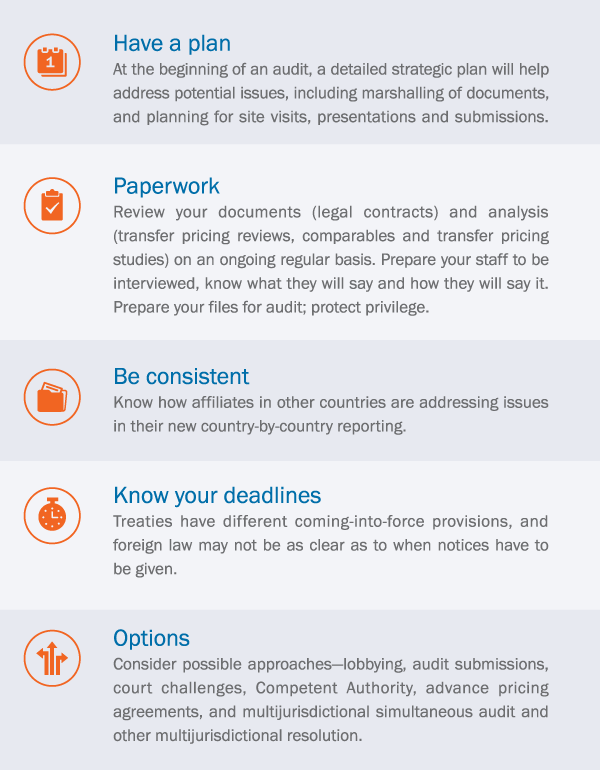

Good advocacy is key to achieving optimal transfer pricing outcomes. Like any dispute resolution method, “prepare, prepare, prepare.”

Below are considerations to keep in mind both in advance of and in response to an audit.

We expect the scope of influence of transfer pricing on corporate decision-making will continue to broaden. Amid the current dynamics of the international landscape, businesses should establish and maintain plans and processes that allow for nimble response to change.

_________________________

1 Final Reports of the Organisation for Economic Co-operation and Development (OECD) Base Erosion and Profit Shifting (BEPS) Action Plans 1 to 15 released October 5, 2015.

2 OECD/G20 BEPS Project; “Aligning Transfer Pricing Outcomes with Value Creation,” Actions 8-10 Final Reports (BEPS TP Reports).

3 2012 SCC 3.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.

Tags