This article is part of our M&A outlook for 2024.

The transactional environment is becoming increasingly challenging as the high-interest-rate environment and other macroeconomic factors are testing dealmakers.

In this article, we reflect on recent Canadian deal activity and consider what may be in store for 2024 as acquirers and investors continue to adapt to a new deal environment.

Canadian domestic M&A

This year, recessionary concerns shaped the global markets—and the Canadian domestic M&A market was no exception. Against the backdrop of a possible economic downturn, a range of factors influenced dealmaking, such as higher interest rates, inflation, economic uncertainty and geopolitical changes and conflicts.

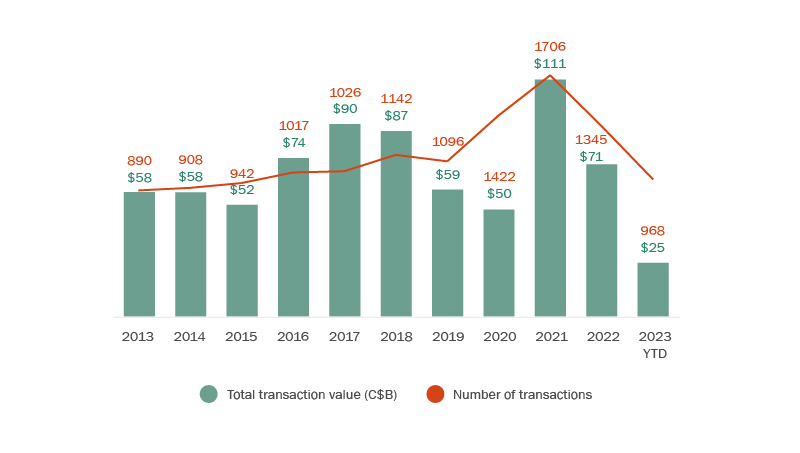

Within this environment, we are seeing a softening of purely domestic deals (involving Canadian acquirers of Canadian targets). Total domestic M&A deal value is sitting at around $25 billion to date, which represents a significant decline over the levels recorded in 2022 (see Figure 1).

Figure 1 – Canadian acquirers of Canadian targets

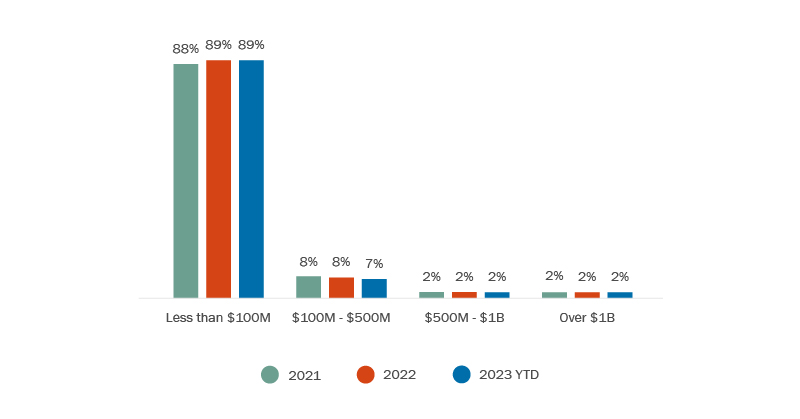

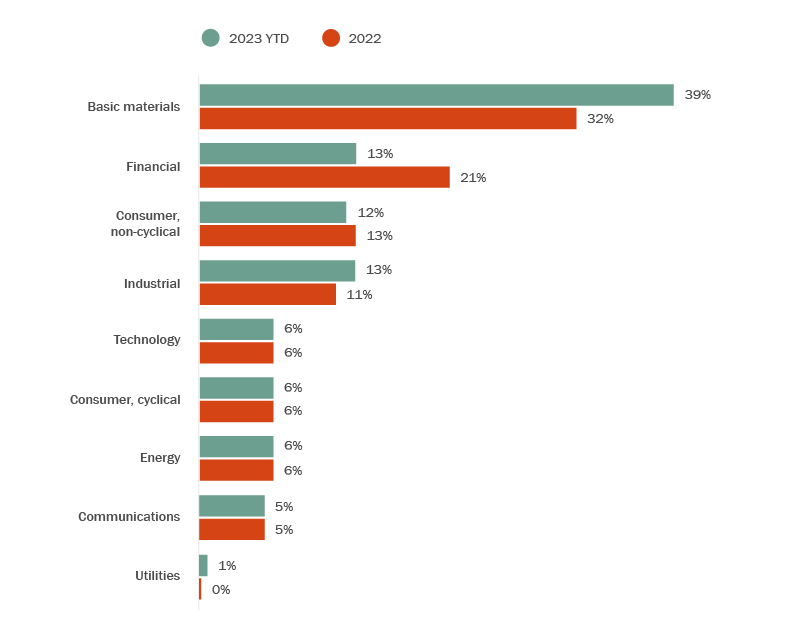

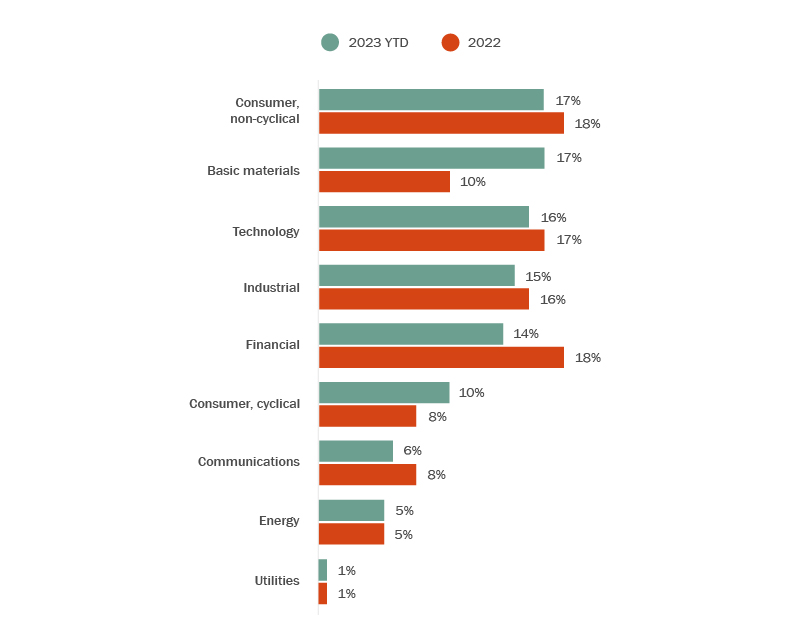

As is typical of the Canadian market, most of these deals were in the small- to mid-value deal range, under $100M (see Figure 2). Interestingly, we saw almost a 7% rise in deal activity in the basic materials sector (see Figure 3)—part of a global trend we elaborate on below.

Figure 2 – Deal value categories for domestic deals

Figure 3 – Target industry sector

Rising demand for basic materials

Globally, we are witnessing increased activity in the basic materials sector. Many governments, including the Canadian government, are in the process of establishing incentive programs to encourage the development of critical mineral assets, which also includes foreign investment from friendly nations.

Within Canada, deal activity in this sector has been affected by shifting global and domestic regulations that, in part, encourage protective measures within the supply chain. Canadian strategics are feeling the pressure to invest in critical minerals and fortify their supply chains because of growing regulatory restrictions around the world, especially Foreign Direct Investment (FDI) rules that reinforce “friend-shoring” of critical minerals. Dealmakers have also had to consider increased scrutiny from Canadian federal regulators, such as in the case of last year’s ordering of three Chinese companies to divest their recently acquired interests in critical mineral assets. We will see this continue in 2024, in particular with changes to the Investment Canada Act that will introduce a comprehensive scheme of mandatory pre-closing screening for a wide range of cross-border deals.

As with the activity in many other sectors, much of the M&A activity in the critical minerals sector has a cross-border component, and, in the current environment, those transactions are getting more complex—a broader trend we discuss below.

Cross-border transactions

Inbound M&A

Despite the added complexities of cross-border dealmaking, including in the current environment, Canada continues to represent a valuable market for investors, with a weaker Canadian dollar playing in its favour.

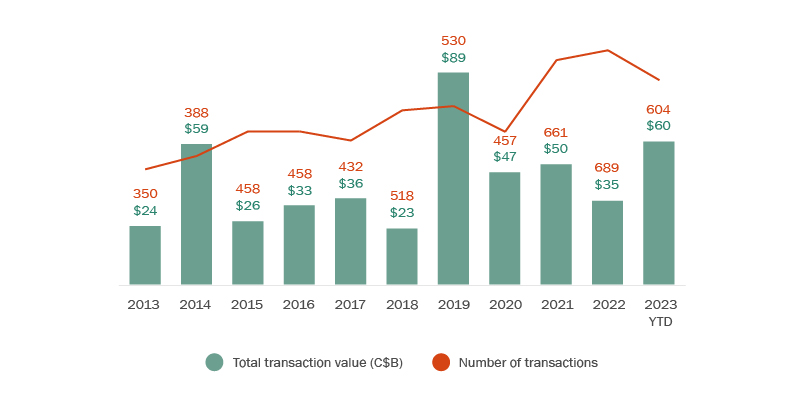

In an interesting departure from recent years, there has been a rise in the total value of foreign investment in announced deals in Canada. Year-to-date (YTD), aggregate deal value has already surpassed 2022 levels (see Figure 4). And although deal volumes are lower, they are not lower by much. Australia and the United States have been some of the largest sources of foreign capital investment in Canada.

Figure 4 – Foreign buyers of Canadian targets

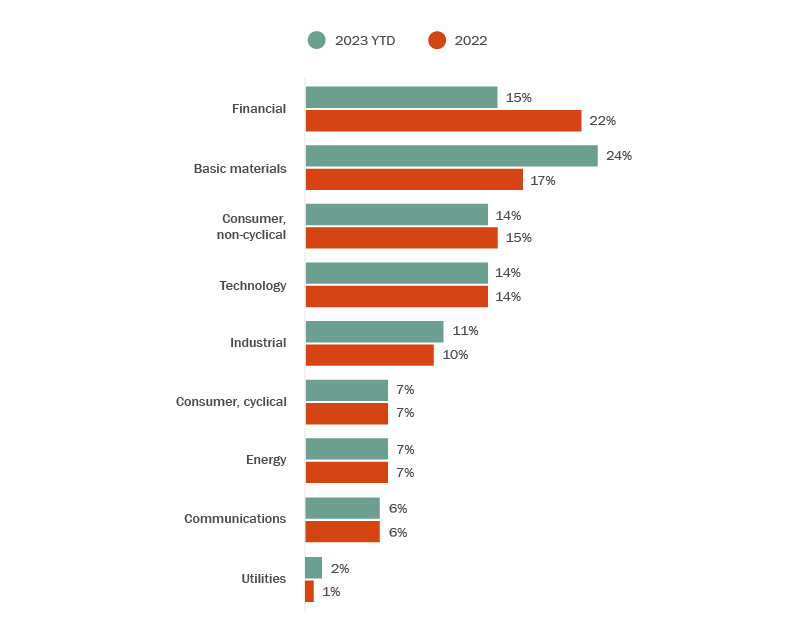

From a sector perspective, the top sectors of choice for foreign investors so far this year have been the consumer (non-cyclical), basic materials and technology sectors (see Figure 5).

Figure 5 – Target industry classification

Outbound M&A

Canadian outbound investments have softened this year, reaching $174 billion to date—a pace which, if continued, would represent a decline over 2022 levels.

The U.S. continues to be the preferred destination both in terms of deal count and value for Canadian outbound investments. Apart from the U.S., Canadian dealmakers are also exploring growth opportunities in Australia and the United Kingdom, among other countries.

Consistent with what we are observing in the domestic market, the basic materials sector is the top sector of choice for Canadian outbound investment (see Figure 6).

Figure 6 – Canadian outbound investment: target industry sector

Competition enforcement

There has been a significant increase in Canadian antitrust enforcement that is translating into longer and more burdensome reviews and increasingly uncertain outcomes. These reviews involve expansive document production orders and sometimes novel enforcement tools. In the recent RBC/HSBC merger, for example, the Competition Bureau took the unusual step of seeking public feedback on the transaction and received over 1500 replies. The practical utility of such efforts is unclear, but they add a layer of complexity to be managed. The Competition Bureau is also increasingly willing to try to stop mergers in court. Spectacular defeats in the Rogers v. Shaw merger and P&H v. Louis Dreyfuss have left the agency bloodied but unbowed. The mere willingness to challenge deals is a powerful weapon as few deals can withstand the prospect of time-consuming litigation. Amid all this the Canadian government has announced plans to amend the Competition Act to broaden the scope of transactions subject to review and to make enforcement easier. Changes announced in late November would de facto lower mandatory merger notification thresholds; allow non-reportable deals to be challenged up to three years after closing; introduce a scheme of automatic temporary injunctions to stop mergers from closing; allow challenges based solely on market share data; and expressly permit the Bureau to consider impacts on labour markets.

Navigating regulatory approvals in M&A planning and agreements

Where substantive competition (or FDI) issues can be identified upfront, parties can take steps to maximise the likelihood of approval. Sellers can be selective in choosing counterparties. Strategic buyers or those from states creating national security issues often offer attractive purchase prices but may be viewed less favourably than others if their practical ability to close is limited. Parties can also agree to remove potentially problematic assets or business lines from the transaction perimeter. The recent Pembina/KKR transaction, for example, involved the up-front sale of an overlapping pipeline that streamlined and accelerated the merger review and approval process. Transaction agreements can also of course provide a structure for managing processes. Efforts covenants can identify specific steps to be taken to attempt to secure approval. This could include for example listing the assets or business lines that a buyer would have to agree to sell or other regulatory conditions that may have to be accepted. Similarly, parties may also wish to consider how to manage the cost and duration of complex reviews. They could allocate responsibility for payment of fees and other expenses or include a “ticking fee” that would require the buyer to pay an increased amount to the vendor in the event of an extended review.

Getting deals through

Despite the challenges, both buyers and sellers are adapting to this changing regulatory climate. Here are some notable trends emerging in dealmaking that will shape acquiror and investor activity in 2024:

- Pricing. Seller expectations remain high, and seller-buyer valuation gaps are persisting. Parties are using earn-outs to address these pricing gaps, but equity rollovers and spinouts are being utilized for businesses that are difficult to value. Financing terms are also getting tighter, though (as always) these terms continue to depend on the credit risk of the buyer.

- Deal planning. With dramatic increases in interest rates, more upfront deal planning (including on the funding side) is being undertaken. Additionally, the dealmaking playbook has been adjusted in various ways to accommodate increased regulatory oversight. Advisors are guiding dealmakers through more rigorous upfront planning and assessment of regulatory risk. Therefore, it is critical to understand areas of concern before committing to a process. Parties will also need to consider multiple stakeholder interests and develop key messages for all identifiable constituencies, as regulators are considering broader stakeholder interests when forming their decisions.

- Board oversight. As boards work through the challenges of getting deals done, we are seeing more conversations around whether to walk away from less attractive risk profiles and timelines of certain deals. Some deals may not be doable, or at least not without an unacceptable timetable or cost. For most businesses or buyers, a two-year time frame to get to a closing may not be a sensible undertaking. And, unlike in the past, it may not be wise to consider closing before a regulatory review is complete.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.