Rising interest rates, record inflationary pressures and world events have converged to create uncertainty and volatility in equity markets. Some stocks have experienced steep declines in trading prices, in many cases, significantly at odds with views of fundamental values. This creates an environment conducive to unsolicited M&A transactions and activist investor campaigns. Because an unsolicited M&A proposal or activist campaign can be costly, time consuming and can divert attention from running the business, many public companies, with the assistance of legal and financial advisors, are developing an advance preparedness strategy and readiness plan.

Readiness for unexpected M&A proposals or activists is a board responsibility. A plan for responding to M&A proposals or activists positions the directors to protect the corporation and achieve better outcomes for affected stakeholders. The process of preparing a readiness plan also serves to focus the board on long-term business objectives, benefiting the corporation even if the plan never has to be implemented.

Current M&A and activism environment

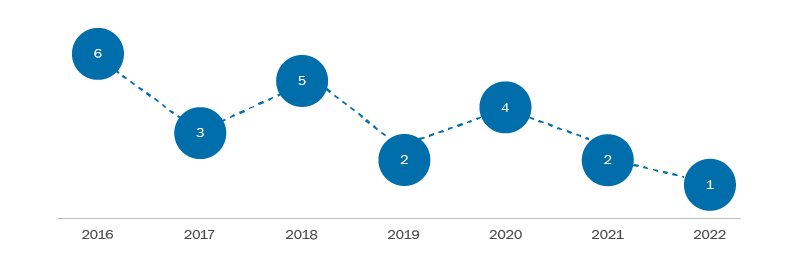

Since the 2016 takeover bid rule changes, the number of hostile takeover bids in Canada has declined. The bid rule changes tilt the balance in favour of the target and make successful completion of a hostile bid less certain than in the past. The chart below shows the number of hostile bids launched in Canada since 2016:

Number of hostile bids

Despite the decline in the number of hostile bids, we may see an uptick in unsolicited bid activity in 2023 by assertive bidders wishing to take advantage of trading price weakness in economic circumstances where target boards are unwilling to proceed with a negotiated transaction.

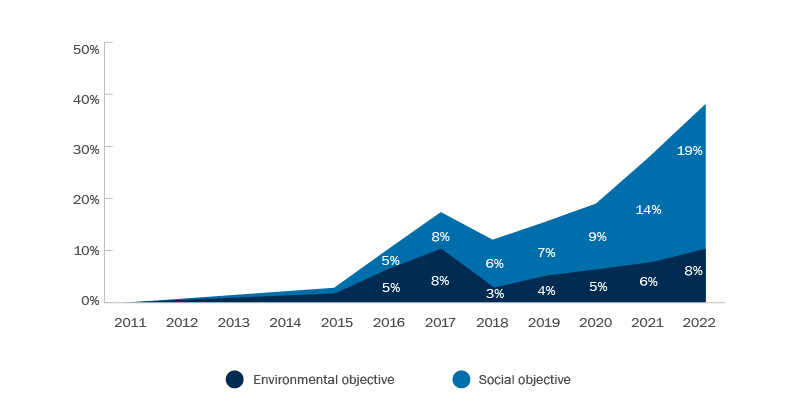

Shareholder activism on both sides of the Canada-U.S. border continues unabated. No public company is immune, regardless of how successful or large it may be or in which sector it operates. Activism has never been limited to targeting sector under-achievers; companies that are market leaders have also been the subject of activist campaigns. Even with controlled companies, activism to achieve change, if not a change in board leadership, is a risk. Activist campaigns have, in many cases, expanded from the usual transactional or shareholder return focus into issue-dominated campaigns designed to address ESG matters. Recent examples of ESG-based campaigns include Carl Icahn’s animal welfare campaigns involving McDonald’s and Kroger in the U.S., and Elliott Investment Management’s campaign involving Suncor in Canada which focused, in part, on employee safety issues. Recent activist campaigns have underscored that targets and their boards need to be ready to properly respond to, prevent or defend an attack by one or more activists, whether it be a traditional campaign or an ESG campaign. Below is a chart that shows the growing prevalence of ESG campaigns.

Shareholder activist campaigns with E&S objectives have soared in recent years

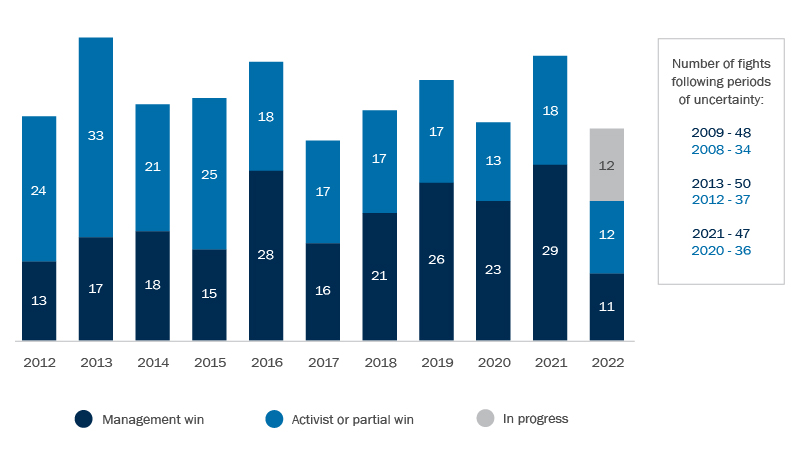

Activism tends also to increase following periods of market uncertainty, as exhibited in the following chart:

Proxy contests in Canada (2012 - 2022)

Readiness planning

There are a number of practical steps a board can take in preparation for unsolicited M&A transaction proposals or activist campaigns, discussed below, but the prospect of having to respond to the unexpected should start with the board’s consideration of substantive matters affecting long-term corporate objectives.

An important component of target defensive strategy, particularly as it relates to activism, is to anticipate and have responses to various “themes” that may be utilized in an attack. This will enable the target to quickly get in front of the situation with a prompt and persuasive response. Anticipating activist themes and target responses might involve the following:

- demonstrating how the company is performing well within its peer group;

- showing why the current strategy and business plan is being implemented and is or will be effective;

- explaining why the existing board and management is best-positioned to execute on the company’s strategy;

- showing why governance practices align with shareholder interests, from executive compensation to the make-up and committee organization of the board; and

- in the face of a demand for alternatives to the current strategy, describing the way the board has and routinely considers a range of alternatives, including asset sales and spin-offs, return of capital, governance changes, operational changes and/or a sale or break-up.

Focusing on these matters in readiness planning—thinking about potential areas of attack—requires evaluation and reflection, and may require action. This exercise will benefit the company irrespective of whether the readiness plan is ever needed.

In the current environment, a public company should, in particular, articulate and promote its corporate purpose and position on environmental and social issues material to its business. It should also develop a compelling long-term value creation plan and be ready to explain how its compensation and governance practices are aligned with that plan.

A board should constantly focus on the identity of its investors to understand their interests and prepare for steps they may take. Establishing a “stock watch” and procedures to analyze, communicate and react to any unusual share trading activity by potential suitors and activists, and adopting a proactive and consistent approach to shareholder engagement through periodic meetings between major shareholders and management and board members can also help to prepare for or defend against an unsolicited bid or an activist. The message is: don’t wait until a situation arises before taking these steps.

Some practical advance planning steps to consider include:

- prepare the board to respond efficiently to proposals by means of regular meetings in which the strategic direction of the company is discussed and refined, and consider in advance board and management conflicts that may require the creation of a special committee to respond to proposals;

- establish a well-defined response team consisting of key executives, outside counsel, investor relations, financial advisors and proxy solicitation advisors, establish “rules of engagement” if the company is approached by a suitor or activist, including detailed guidelines on how to handle the conversation and respond to it (that is, who does what), and develop a detailed step-by-step response plan that itemizes actions to be taken by designated internal and external personnel to respond to any proposal;

- develop a communications strategy designed to funnel all communications to a designated spokesperson (to be reviewed by counsel) along with a pre-formulated plan for communicating with key stakeholders (investors, customers, suppliers, lenders and employees) as well as stock exchanges and regulators; and

- create a virtual data room containing all material company documentation and refresh it on a regular basis.

In advance of, or in response to the unexpected occurring, directors may wish to consider “defensive measures” the board can take to enable it to exercise more control over unsolicited M&A proposals and activist campaigns. Unlike in the U.S., a “just say no” approach to takeover bids has not been effective in Canada given the treatment of shareholder rights plans by Canadian securities regulators and the role of securities law in regulating the conduct of takeover bids. A target board may properly conclude that a change of control proposal is ill-timed or otherwise not in the best interests of the company, and act on that conclusion, but securities regulators may nonetheless intervene, allowing a takeover bid to proceed. U.S.-style structural defences such as staggered boards, supermajority voting, prohibitions on shareholders calling meetings and removal of directors only for cause contained in charter and by-law provisions typically are not permitted or are ineffective under Canadian corporate statutes.

However, Canadian public company targets can adopt some defensive measures. A target board can implement an advance notice by-law preventing ambush activism at shareholder meetings. This type of measure is becoming increasingly commonplace. Other measures might include pursuing a “white knight” alternative transaction, private placements, option grants and asset sales, or launching litigation or regulatory complaints where the conduct of the other party is unlawful or contrary to the public interest. Any defensive measures adopted may be scrutinized by Canadian securities regulators with an eye to improper constraints on shareholder choice, and courts may also be asked to review and set them aside as oppressive. Shareholder rights plans were, until a few years ago in Canada, the most popular defensive measure to lengthen the bid process. They have been rendered largely redundant by the 2016 extension of the minimum bid deposit period from 35 days to 105 days. A poison pill to prevent a creeping acquisition of control may be allowed, but not one intended to frustrate a takeover bid that is compliant with securities law. The limited utility of this tool makes advance planning for the unexpected all the more important in Canada.

While it is impossible to anticipate every possible situation that may emerge in the current environment and equally difficult to implement a predetermined course of action, Canadian public company boards should develop an advance preparedness strategy with the assistance of their advisors. Advance planning is critical to properly position a public company to handle and respond quickly to an unsolicited M&A proposal or activist campaign.

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.