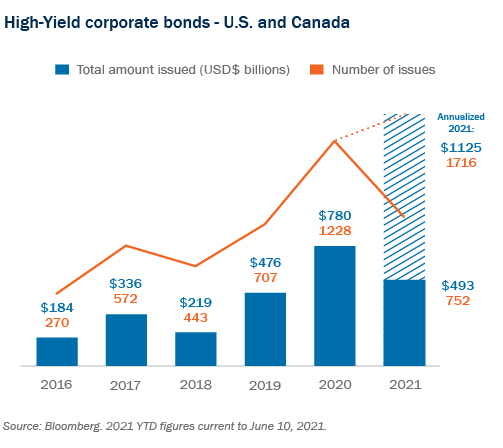

High-yield debt markets in Canada and the United States have seen very high levels of activity in the last year.

This activity has largely been driven by refinancings as strong investor demand is coupled with issuers seeking to lock in low rates for extended terms. While the strength of the high-yield market is a common theme in both Canada and the United States, leading to some convergence of the two markets, they remain very distinct in a number of ways.

The Canadian high-yield debt market

The story of the Canadian high-yield debt market has been one of a mismatch between supply and demand. Traditionally, Canadian non-investment grade companies seeking debt financing would look to their Canadian relationship banks or the large, well established U.S. high-yield market. While a Canadian high-yield market has existed for years, ready access to financing from these other sources has limited the number of Canadian offerings and the growth of the domestic market. Meanwhile, Canadian institutional investors have shown a strong appetite for high-yield paper—they have been active purchasers of high-yield notes in both Canadian and U.S. offerings, and could form the basis of a more robust and deeper high-yield market domestically should the supply of offerings increase.

The Canadian high-yield market offers a number of advantages to Canadian issuers in comparison to a U.S. issuance. The most obvious is the ability to borrow Canadian dollars, aligning the currency of an issuer’s liabilities with that of its revenue and reducing its FX exposure.

Recent Canadian offerings in the range of C$500-800 million indicate a broad spectrum of deal sizes are available in Canada.

In addition, the Canadian market generally has a smaller minimum deal size, allowing issuers to launch deals as small as C$100-$125 million (which would be unusual in the U.S. market and viewed as not liquid enough by U.S. bond investors). While this may also have led to the perception that the Canadian market may not be able to support large deal sizes, recent Canadian offerings in the range of C$500-$800 million indicate a broad spectrum of deal sizes are available.

It can also be simpler, less costly and more efficient for a Canadian issuer to access Canadian debt markets. For example, both public and private issuers can market high-yield offerings in Canada using a detailed term sheet describing the bonds, thereby eliminating the need for a lengthy offering memorandum (or other detailed disclosure document) describing the issuer’s business and affairs. By offering bonds through a detailed term sheet, issuers would not be subject to the various statutory liability regimes across Canada which impose statutory liability for misrepresentations contained in an offering memorandum.

U.S. high-yield market considerations

Despite the advantages of a Canadian offering, the U.S. high-yield market is also readily accessible to Canadian issuers and may provide advantages, depending on the nature of the issuer and proposed transaction. The largest high-yield offerings in the United States are still significantly larger than the largest Canadian high-yield offerings; an issuer requiring a larger deal size may be better off targeting the U.S. market or a cross-border offering. Similarly, a company that intends to issue notes on a regular basis may be well served by becoming a familiar name with U.S. investors, given the larger and deeper pool of those investors.

Lower-rated issuers may also find more welcoming investors in the U.S. debt market. While there are some indications that Canadian investors’ appetite for risk is increasing, most Canadian issuances have been at the higher end of the high-yield market (BBB credits), so lower rated issuers (C credits) will likely find more success issuing in the U.S. Similarly, issuers in industries viewed as being less attractive (such as oil and gas in the current climate) have generally issued in the U.S. The lower risk appetite in Canada helps explain why a relatively high percentage of recent Canadian offerings have been structured as secured issuances (including second-lien issuances, such as the recently completed offering for new issuer Cineplex Inc. for which Torys acted for the dealers1). Secured deals in the United States tend to be limited to challenging credits.

The strength of the market has been reflected in favourable covenants and pricing for issuers across both markets.

While the traditional perception has been that the U.S. market is also advantageous to issuers from pricing and covenant perspectives, there are no longer easy conclusions to be drawn in that regard. The pricing differential between Canadian and U.S. offerings is now generally perceived to be insubstantial. We have also seen a trend of convergence of covenant terms between U.S. and Canadian offerings. For example, Torys’ client Superior Plus issued notes in the U.S. market in March 2021, and followed with a Canadian issuance in April 2021 with virtually identical covenants and with lower pricing (albeit with a shorter term). This convergence is logical given that many Canadian investors are active in both the Canadian and U.S. markets, and are familiar with—and expecting their transactions to reflect—U.S. deal trends.

Conclusion

In summary, the combination of strong investor demand and the desire to lock in low rates has driven significant high-yield market activity in both Canada and the United States in the last year. The strength of the market has been reflected in favourable covenants and pricing for issuers across both markets. However, across size of the investor base, deal size, risk tolerance and disclosure and compliance requirements, the two markets remain very distinct, such that Canadian issuers need to weigh a number of considerations beyond currency in determining which market to access.

_________________________

1 Torys advised the dealers on this transaction.

Inscrivez-vous pour recevoir les dernières nouvelles

Restez à l’affût des nouvelles d’intérêt, des commentaires, des mises à jour et des publications de Torys.

Inscrivez-vous maintenant