In what has been a remarkable year, Canadian M&A activity demonstrated resiliency, opportunism and adaptability.

Although many businesses put their M&A plans on hold at the beginning of the pandemic, deal activity significantly rebounded in the second half of the year. Companies quickly returned to M&A to advance their strategic and growth plans, while others sought to capitalize on market dislocations. Parties successfully overcame many challenges in navigating an environment of heightened risk and uncertainty to get deals done. The outlook for M&A in 2021 is optimistic: equity markets have shown strength and significant capital raising capacity, debt capital is readily available at low interest rates, and well-funded buyers are increasingly active. Altogether, these indicators suggest a positive M&A environment for the year ahead.

Canadian public M&A markets

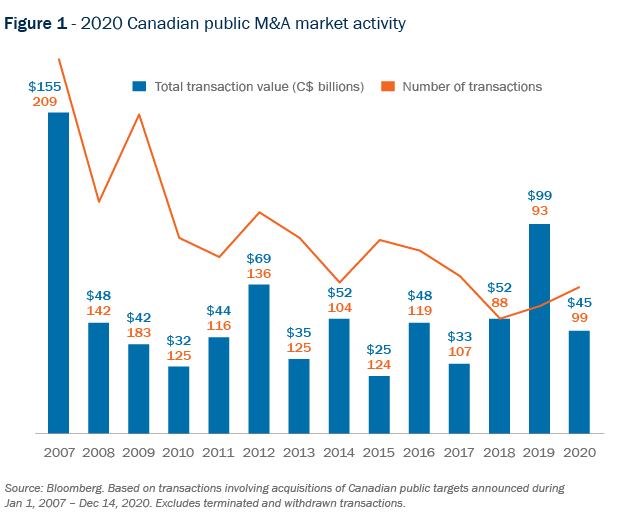

Canadian public M&A activity in 2020 was remarkably robust, surpassing 2019’s level by number of deals. While aggregate transaction values were considerably lower relative to 2019, aggregate deal value made an impressive recovery from start-of-year record low values to reach an aggregate of $45 billion in 2020 (Figure 1).

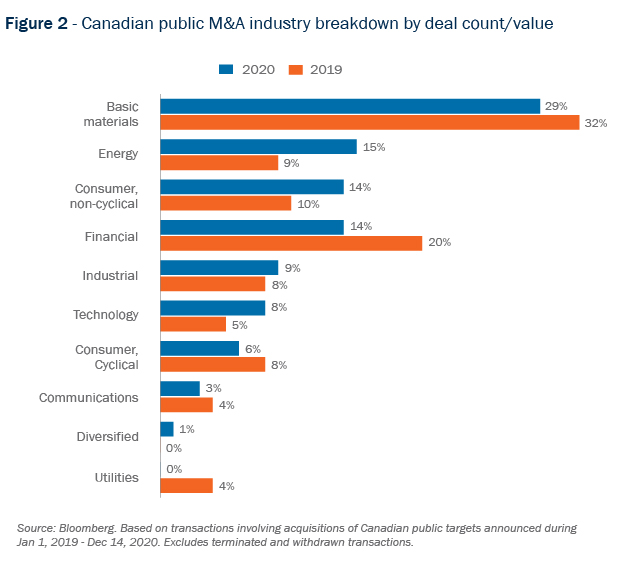

Transactions in the basic materials and energy sectors generated over 40% of overall Canadian public M&A deal activity in 2020 (Figure 2). One of the largest basic materials transactions in 2020 was the $4 billion proposed all-Canadian combination of West Fraser Timber and Norbord1, creating a global and diversified leader in the wood products sector.

Basic materials transactions involving gold mining companies were particularly noteworthy as they were characterized by low-premium merger of equal deals rather than the high premium cash transactions witnessed in previous cycles. We expect transactions in the precious metals space to continue to be led by disciplined low-premium merger of equals transactions as supportive precious metal prices persist and as larger players look to grow their reserves and smaller single asset players look to bulk up and diversify to a multi-asset platform.

The Canadian oil and gas industry notably underwent a flurry of consolidation activity, headlined by the Cenovus-Husky all-stock merger valued at $3.8 billion based on the value of Cenovus stock to be issued to Husky shareholders. A combination of factors are expected to drive deal activity in 2021 (for details, see “What’s next for Canadian oil and gas in 2021”).

Financial buyers adaptive to changing conditions

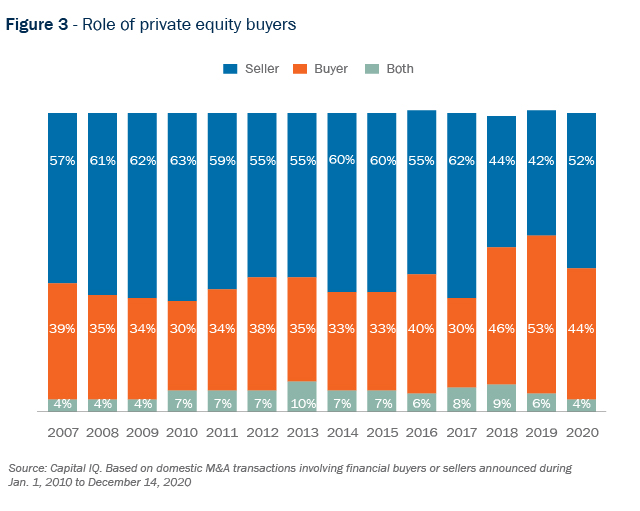

Private equity and pension funds were particularly active and resilient in 2020, going into the pandemic with an unprecedented amount of dry powder. These investors were well positioned to take advantage of the post-pandemic market dislocations to pursue opportunistic buyouts and deploy excess capital. Acquisitions accounted for 44% of overall financial investor deal activity in 2020 (Figure 3). In addition, financial buyers were active not only in acquisitions but also in PIPE transactions, supporting M&A undertaken by strategic public company buyers. A notable example was CPPIB’s PIPE in Premium Brands to partially fund the C$1 billion acquisition of Clearwater Seafoods.

Cross-border deal activity at historically high levels

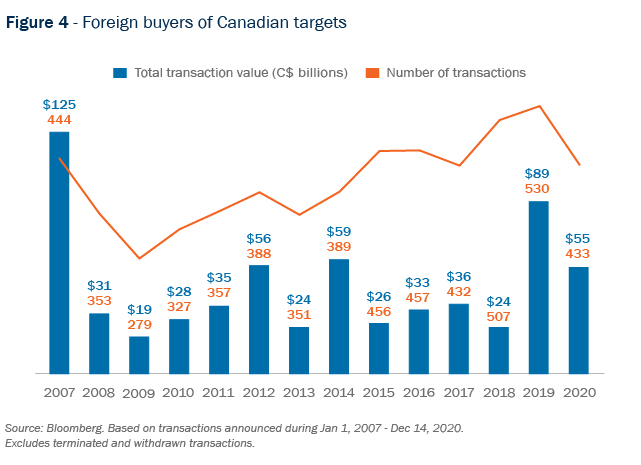

While the aggregate value of foreign investment in Canada declined in 2020, foreign acquisitions of Canadian targets remain at historically high levels (Figure 4). Canada continues to be a favourable destination for foreign buyers, with the United States representing the largest inbound source of foreign acquirors of Canadian targets (see “Will a “Canada First” sentiment curb M&A?”).

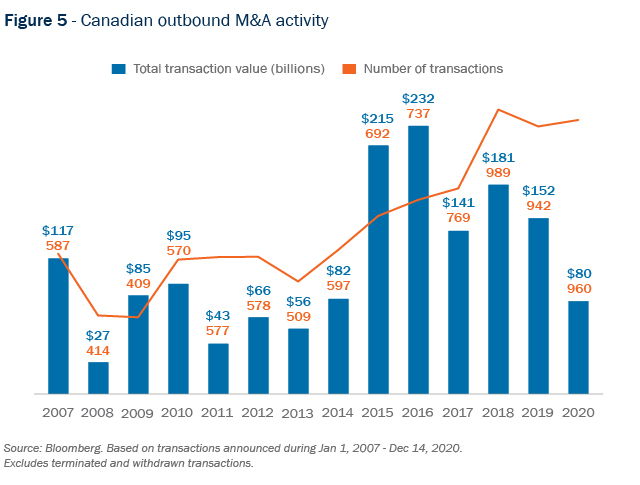

Canadian buyers continue to look abroad for transactions with Canadian outbound investments. However, they were more cautious in 2020, with total outbound aggregate capital invested representing just over half of the overall value recorded for 2019 (Figure 5).

Increased regulatory scrutiny here to stay?

Consistent with actions taken by governments around the world, the Canadian government announced last year that investments in Canadian businesses that are related to public health or involved in the supply of critical goods and services to Canadians or to the Government would be scrutinized. It also reiterated that particular attention will be paid to state-owned or state-influenced investors.

The regulatory risk associated with foreign acquisitions by state-owned or influenced enterprises was highlighted by the Canadian government’s recent rejection of Shandong Gold’s proposed acquisition of TMAC Resources and its arctic gold mining project on national security grounds. This was the first time that an investment in the Canadian mining sector by a Chinese company has been blocked under the Investment Canada Act. Chinese investments in Canada have suffered a significant decline in recent years for a number of reasons, including due to concerns over foreign investment regulatory scrutiny (Figure 6). For details, see “Canada blocks Chinese acquisition of Arctic gold mine”.

In the near term, foreign state-owned investors from China and certain other countries should expect longer and more difficult reviews and should consider engaging counsel early in the transaction planning process to appropriately assess the risks and seek to manage them effectively in a proactive manner.

As the pandemic continues to batter certain industries whose path to recovery may be long and uncertain—in particular, retail, travel, hospitality and entertainment—some businesses in these segments have become distressed. They may become subject to increasing commercial pressure leading, in some cases, to insolvency. As a result, M&A opportunities may be available for prospective strategic purchasers, even in concentrated markets, which would not have been otherwise possible.

Strategic buyers looking to acquire competitors’ assets in these ailing industries may find they are able to advance these deals and/or withstand regulatory challenge from Canada’s Competition Bureau under the ‘failing firm defence’ (for details, see “The Competition Bureau and failing firm acquisitions under COVID-19”). Under this defence, competition regulators may conclude that a merger transaction would not substantially lessen competition because the target firm would have otherwise exited the market in the absence of the merger. After undertaking a detailed review and applying a strict analysis, the Competition Bureau accepted this approach in an important case last year and is likely to be similarly receptive to the use of the defence in 2021.

The long-term market impact of the pandemic is likely to affect companies across the spectrum as businesses restructure and refocus their operations to best position themselves in their respective markets for the recovery to come. This should create many opportunities for distressed investment in businesses that continue to have solid fundamentals, but require operational and financial restructuring to operate in a post-COVID environment (read more on “Market conditions generate distressed M&A opportunities”).

Deal terms in focus

The current environment has resulted in heightened deal risk in the period after a deal has been signed and before completion, giving rise to a greater focus by all parties involved on material adverse effect (MAE) termination provisions, interim operating covenants, closing conditions and the manner of progressing and obtaining regulatory approvals.

As we had seen during the 2008 financial crisis, the pandemic resulted in a number of repriced or broken transactions with MAE clauses and other merger agreement provisions being tested. While the standard for proving an MAE is high, these clauses as well as interim convenants and efforts standards provisions in merger agreements need to be carefully reviewed and negotiated so that risks are approporiately allocated between buyers and sellers.

In a recent leading case2, an Ontario court concluded that when assessing whether a business has reacted in the “ordinary course” to an external shock, consideration should be given to the reasonableness of its actions in light of how it has reacted to similar economic circumstances in the past and the steps taken by the business in comparison to those taken by other businesses in similar circumstances. This is in contrast to recent law out of Delaware, holding that an ordinary course covenant required seller to conduct its business in the “normal and ordinary routine of the business”, and that conduct which might be “ordinary” for the pandemic would still be inconsistent with its obligations under the contract.

Conclusion

As 2021 progresses, the roll-out of widely available vaccines along with extensive monetary and fiscal stimulus by governments in Canada and around the world are expected to set the stage for the recovery and rebuilding effort to come. Reduced pandemic-related market volatility and access to robust equity and credit markets should provide the confidence and fuel to ensure that well-funded buyers will be able to advance their strategic agendas and pursue opportunities involving distressed businesses. All of this points to an optimistic outlook for dealmakers in the year ahead.

_________________________

1 Torys advised Norbord on this transaction.

2 Fairstone Financial Holdings Inc. v Duo Bank of Canada, 2020 ONSC 7397 (December 2, 2020)

Inscrivez-vous pour recevoir les dernières nouvelles

Restez à l’affût des nouvelles d’intérêt, des commentaires, des mises à jour et des publications de Torys.

Inscrivez-vous maintenant