“The public expectations of your company have never been greater. Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.” –Larry Fink, CEO, Blackrock

Socially responsible investment (SRI) is firmly on the agenda of institutional investors and money managers in Canada, the United States and globally.

Broadly, SRI involves investing with a view to profit while taking into account a diverse range of concerns affecting corporate stakeholders and ordinary citizens—climate change and environmental degradation, human rights, income inequality, ethics in government and politics, and diversity of gender, race, ethnic origin, religion and sexual orientation. Institutional investors and money managers exercise their own judgments in defining and assigning weight to these and other SRI concerns when making investment decisions.

SRI and the Financial Markets

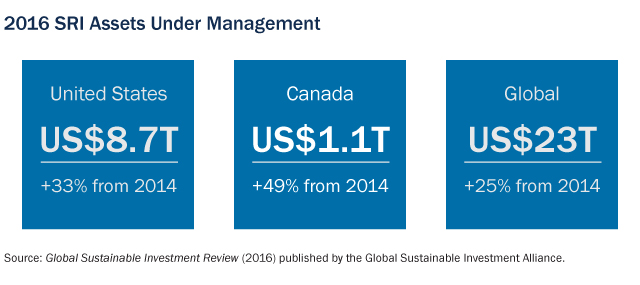

According to the Global Sustainable Investment Alliance (GSIA), based on assets under management and shareholder proposal activity, SRI is now a major force in financial markets, with about US$23 trillion of assets globally being professionally managed using responsible investment strategies as of the end of 2016—a 25% increase from 2014.

GSIA’s report also indicates that

- SRI accounts for about one-fifth of all assets under professional management in the United States and about one-third in Canada; and

- together, climate change, carbon-based energy, pollution and toxics were the leading drivers of SRI activity, with other top drivers being global conflict risk, human rights and corporate governance matters.

Shareholder Proposals

Shareholders proposals are an important tool in the push toward social responsibility. ProxyPreview reported 429 shareholder proposals on environmental, social and sustainability matters had been submitted to U.S. companies leading up to the 2018 proxy season.1 Climate change was the leading proposal topic, comprising 20% of the total proposals submitted. A subset of the climate-related proposals requested companies to report on the impact on their business of the Paris Agreement’s goal of limiting global warming to below 2-degrees Celsius.

In 2017, shareholder proposals relating to the 2-degree scenario received majority support at Exxon Mobil, Occidental Petroleum and PPL Corp., with major institutional investors voting “yes” for the first time. The non-profit sustainability organization Ceres reported that 20 of these 2-degree scenario proposals had been submitted to U.S. companies as of May 2018, 12 of which were withdrawn by their proponents because the companies agreed to conduct the requested climate risk analysis.

Fiduciary Duties, Governance and Reporting

A recent guidebook from the Canadian Coalition for Good Governance (CCGG) indicates that engaging with companies on environmental and social (E&S) matters is part of institutional investors’ fiduciary duties.2 These investors use their leverage with companies to mitigate adverse impacts to their portfolios by seeking fuller E&S disclosures, engaging investee companies on areas of concern, and taking further steps when companies do not make the desired changes. Two key insights in the guidebook are, first, that corporate culture and strategy go hand-in-hand and depend on the tone at the top and, second, that companies’ transparency creates trust and goodwill among stakeholders.

Consistent and reliable reporting of climate-related financial information is one of three pillars of a G7-related project announced in June 2018 by a group of leading global institutional investors in collaboration with the Government of Canada. The group—led by Caisse de dépôt et placement du Québec and Ontario Teachers' Pension Plan with partner institutions AIMCo, Allianz, Aviva, CalPERS, CPPIB, Generali, Natixis Investment Managers, OMERS, OPTrust and PGGM—aims to promote comprehensive and comparable climate-related disclosures using the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD recommendations encompass disclosures related to risk management, corporate strategy, targets and metrics, and corporate governance. Approximately 250 organizations worldwide have expressed support for the TCFD recommendations. Canadian supporters include AIMCo, Barrick Gold, BMO Financial Group, BCIMC, Caisse de depot et placement du Québec, Canadian Imperial Bank of Commerce, CPPIB, Desjardins Group, Manulife Financial Corporation, National Bank of Canada OTPP, OPTrust, Royal Bank of Canada, Scotiabank, Suncor Energy, TD Bank Group and Telus.

More stakeholders can be expected to reward companies that make progress on both profit and social responsibility measures.

The sustainability reports 551 U.S. and Canadian companies were recently reviewed by the Centre for Sustainability and Excellence.3 The three leading industries in the United States, in terms of the number of companies publishing sustainability reports, are energy and energy utilities, financial services, and food and beverages. In Canada, the leading industry is mining, followed by energy and energy utilities, and financial services, in alignment with the leading industries in the U.S. Sixty-five percent of these companies used or at least referenced the sustainability reporting standards published by the Global Reporting Initiative (GRI), which provides some measure of reliability and comparability among reports, albeit only approximately one-third of the reports included third-party assurance akin to an audit. The CSE study included a list of the top-scoring companies from CSRHub, a global sustainability ratings agency listing more than 17,000 companies. The top six Canadian companies based on their CSRHub scores were TD Bank Financial Group, BMO Financial Group, Telus Corporation, Desjardins, Royal Bank of Canada and Bombardier.

Canadian Securities Regulators’ Insights

In April 2018, Canada's securities regulators published a report on climate disclosure requirements in various countries; sustainability reports of large-cap S&P/TSX issuers; and global voluntary frameworks on climate change disclosure. Notable findings and guidance include:

- Board committees vs. disclosure. About half of the 78 companies in the study disclosed the existence of a board committee charged with environmental or sustainability-related matters; however, few companies disclosed related governance and risk management practices.

- Regulatory risk. This was the most commonly cited climate change-related risk. Companies generally consider regulatory risk to be the most immediate and quantifiable, whereas other climate change-related risks are sometimes considered so uncertain or remote that their ultimate materiality and financial impact is difficult to assess or quantify.

- Disclosure woes. Some large institutional investors interviewed for the report expressed reluctance to seek climate change-related risk management information from companies through one-on-one engagement meetings because of a perceived risk of violating selective disclosure prohibitions.

- Take the long view. The report cautions companies that they are responsible for making materiality assessments and disclosure about climate change-related risks and financial impacts. Moreover, the materiality assessment should not be limited to short-term risks: if a company concludes that a medium- or long-term risk would likely influence a reasonable investor's decision to buy, sell or hold the company’s securities, the risk should be disclosed.

The End of the Profit Motive?

McKinsey’s 2017 article “From Why to Why Not: Sustainable Investing as the New Normal” indicates that while SRI strategies are designed to achieve the conventional aim of maximizing risk-adjusted returns, some investors still hold back because they believe these strategies will result in lower returns. But times may be changing—numerous initiatives around the world are challenging the traditional notion there is an intractable conflict between the profit motive and social and environmental concerns. More and more stakeholders, through investment decisions, consumer purchasing decisions, publicity and other means, can be expected to reward companies that make progress on both profit and social responsibility measures.

_________________________

1 ProxyPreview was published jointly in February 2018 by Proxy Impact, the Sustainable Investments Institute and As You Sow.

2 The Directors’ E&S Guidebook, Canadian Coalition for Good Governance. Available here.

3 Sustainability Reporting Trends in North America 2017, Centre for Sustainability and Excellence. Available here.

Inscrivez-vous pour recevoir les dernières nouvelles

Restez à l’affût des nouvelles d’intérêt, des commentaires, des mises à jour et des publications de Torys.

Inscrivez-vous maintenant