In the Markets: Canadian Private Equity in 2015

Authors

Michael F.E. Akkawi

Guy Berman

Guy Berman Sophia Tolias

Sophia Tolias

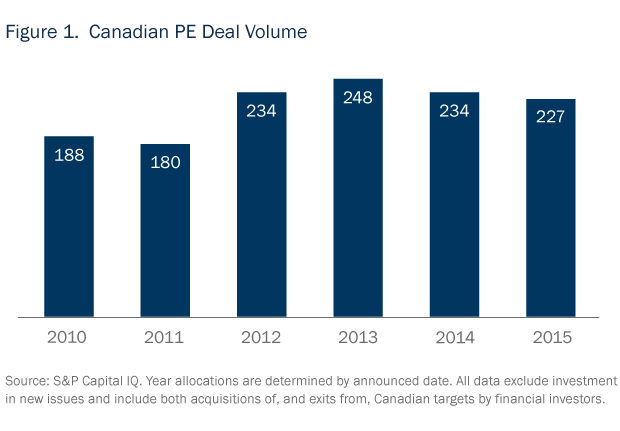

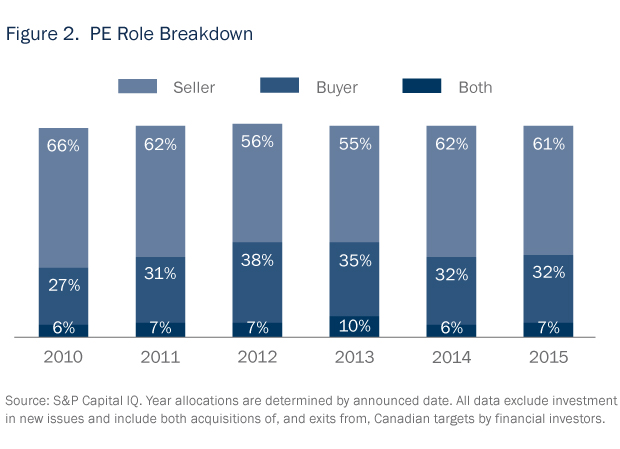

Sell-side activity dominated Canadian private equity dealmaking in Canada in 2015. Despite the slight decline in domestic M&A deal volume involving a financial buyer or seller (Figure 1), private equity investors continued to seize on favourable market conditions to exit their investments. Over 60% of private equity transactions in 2015 involved sell-side activity, in line with the prior year’s reported levels (Figure 2).

Sales to strategics

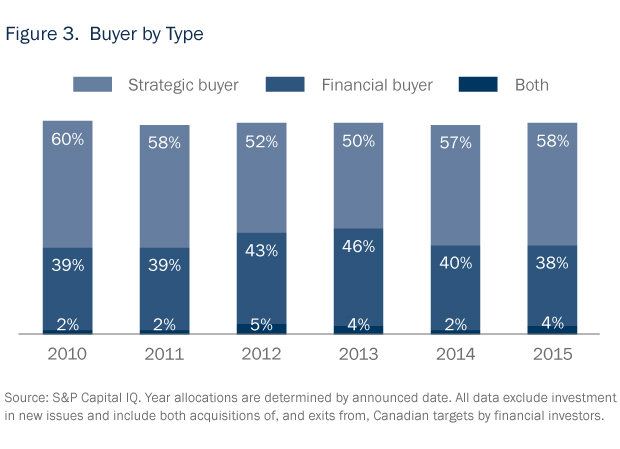

Many Canadian businesses are being sold to strategic buyers. In 2015, strategic sales accounted for the majority of private equity exits, representing 58% of domestic M&A transactions involving financial players (Figure 3). On the rise since 2013, acquisitions continue to appeal to strategics as a way to pursue business growth.

Capital investments decline

Despite global private equity dry powder having hit US$752 billion at the end of last year,1 Canadian domestic buy-side activity by private equity investors declined in 2015, following a downward trend since a recent high in 2013 (Figure 3). The decline in domestic private equity investments tracked a broader domestic M&A downturn as the aggregate deal value of Canadian domestic M&A fell in contrast to significant growth in outbound investments in 2015 (for more detail, see “Go With the (Capital) Flow in Cross-Border M&A”).

A competitive deal environment

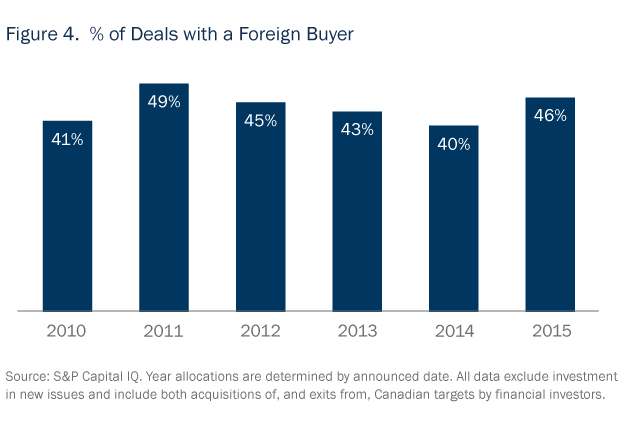

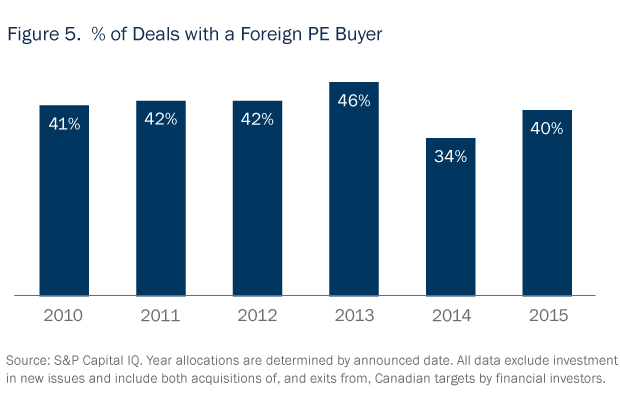

Private equity investors are facing ongoing competition from pension funds, strategic buyers and international investors who are increasingly seeking investment opportunities in Canada. In the last year, foreign investment in the Canadian private equity M&A market has grown, reversing a three-year decline since a peak in 2011 (Figure 4). Some 40% of foreign investment activity involved a foreign financial buyer, up from 34% in 2014 (Figure 5). The relative pricing of Canadian assets, accessible leverage markets (for details on debt terms, see “In the Terms—Canadian Private Equity Financings and U.S. Debt Terms: What’s Market?”) and weak Canadian dollar are all positive factors drawing international investor interest.

Enhancing sourcing strategies

In this competitive deal environment—and in the face of persisting economic uncertainties—private equity investors are adopting differentiated strategies to source deals. These include increasing the focus on developing deeper vertical expertise and building networks of potential vendors and partners. Investors are continuing to look for opportunities to bypass competitive auction processes and source proprietary deals from these vendors, and unlock value post-acquisition by leveraging industry expertise of operating partners in their portfolio companies.

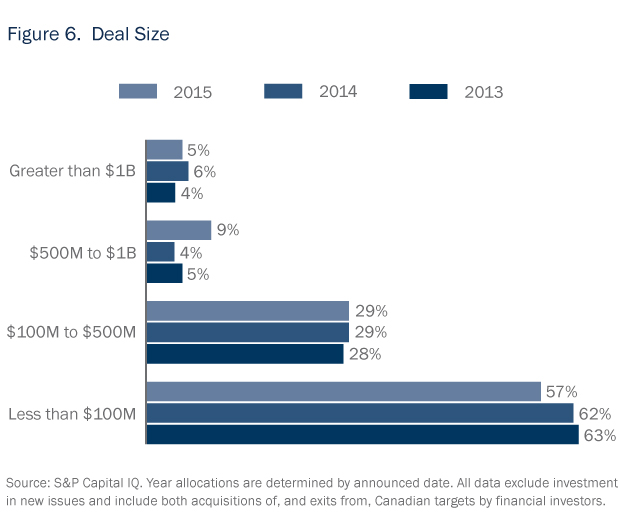

Over the last three years, we have seen sustained deal activity in Canadian small to mid-sized transactions, with deals valued under $500 million accounting for nearly 90% of investment activity (Figure 6). In targeting specific sectors, investors are cautious and focusing on industrial cycles, evaluating past industry performance in a recessionary environment as a potential indicator of future successes (for more on sector focus, see “Oil and Gas Sector Insights”).

In Canada, more private businesses are expected to come to market as baby boomers retire. This is likely to continue to draw private equity interest in those smaller and mid-size market segments.

As has been the trend of late, funds with specialized and focused investment strategies are continuing to emerge, such as private equity funds with narrow industry focuses, energy funds dedicated to oil and gas plays and infrastructure funds focused on particular sectors.

Private equity sponsors are also allocating more time to deepen relationships with their limited partners. Limited partners are increasingly concentrating on the number of sponsors they are prepared to invest with and this discretion is resulting in more co-investment opportunities for such limited partners. Another consequence of the deepening relationships between limited partners and sponsors is enhanced transparency in the industry (see “In The Terms—Private Fund Transparency Takes Centre Stage”).

Maximizing value on exit

Managing an effective sale process is also becoming an important focus for the private equity industry as a means of maximizing value on exit. Vendor due diligence reports, long popular in Europe and making headway in both the United States and Canada, are increasingly being prepared by private equity sellers for potential buyers to anticipate and manage buyer diligence issues and centralize costs. Sellers can streamline the sales process by supplying a single diligence report to prospective buyers on their business (rather than run separate diligence processes for each potential buyer).

Such reports are not necessarily restricted to legal matters, but may involve the preparation of specialized reports by independent accounts or consultants addressing target-specific issues such as environmental matters. Although a vendor due diligence report may help shorten the sale process, it can potentially be costly to the vendor—and if the report is not sufficiently comprehensive, buyers may insist on conducting their own diligence, risking delays to the sale process.

Seller-friendly terms are also being embraced in private equity transactions, and in some instances we are seeing sellers of private companies attempting to sell their businesses “public-company style”―that is, without offering a post-closing indemnity. For details, see “In the Terms—'Public-Company Style' Remains On Trend.”

The current market environment is set to sustain private equity dealmaking in the year ahead through a number of factors. From international investors looking to take advantage of favourable market conditions to retiring baby boomers divesting their businesses, private equity investors and strategics are ready and willing to take advantage of the opportunities in the year ahead—in the hope, of course, that buyers’ and sellers’ price expectations will align.

_________________________

1 Source: Preqin, Fundraising Update 2015, available at https://www.preqin.com/docs/reports/Fundraising-Update15.pdf.