Private Equity in Focus 2015: In the Deals

Authors

Neville Jugnauth

Neville Jugnauth

Derek Flaman

![]()

Current approaches dealmakers are using to seize new opportunities

With significant funds available for investment, private equity firms are looking for new and untapped investment opportunities in Canada. This development is manifesting itself not only in the nature of the deals being done, but also in the sectors that private equity is targeting.

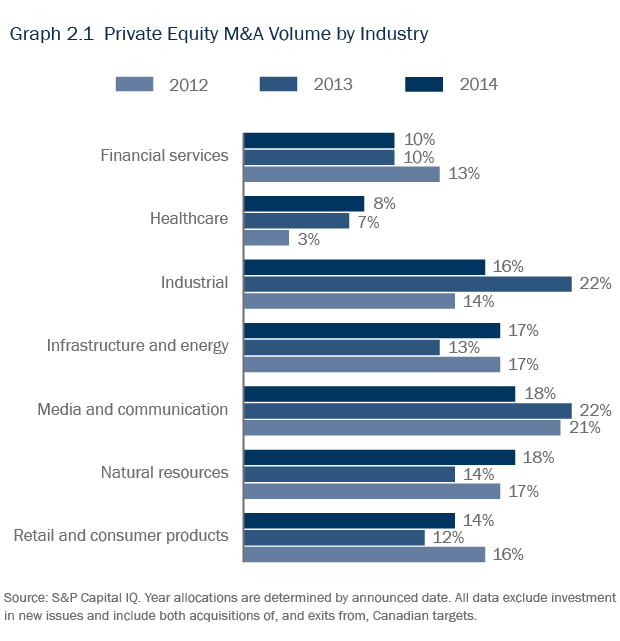

In 2014, private equity M&A touched a broad range of sectors in Canada, experiencing particular growth in the energy and natural resources sectors (see Graph 2.1).

Private equity explores alternative strategies

Ever-higher EBITDA multiples for targets in the Canadian market are motivating some private equity sponsors to offload risk. For example, we are seeing private equity firms deploy capital in minority investments to de-risk their exposure. With high valuations in the current seller’s market, more and more sponsors are also looking to partner to share the risks of any given investment.

Buy-out clubs comprised of two or more sponsors have become less common since the credit crisis in part as a result of both a highly competitive deal environment and a decrease in mega-buyouts. Sponsors are turning instead to “friendly” parties (often the sponsor’s own limited partners) as deal partners for M&A transactions (for detail, see Torys’ bulletin “Strong Demand for Private Equity Co-Investments Continues”).

Another important focus for private equity firms is the purchase of assets to complement their existing portfolios and enhance value through the pursuit of add-on acquisitions and consolidation plays. We have seen this strategy being deployed notably in the retail, healthcare and professional services sectors.

The investor relation function of private equity sponsors is also evolving in response to these changes in the industry. As limited partners become more sophisticated and shore up their in-house expertise, they are seeking more information from sponsors to monitor their existing investments, identify new co-investment opportunities and also potentially increase their stakes in select sponsors. This in turn is leading to heightened deal activity in the secondaries market.

Private equity explores oil and gas

Opportunities for energy-focused private equity investment in Canada’s oilpatch continued to be plentiful, notwithstanding the collapse in oil prices in the latter half of 2014. U.S.-based private equity funds and Canadian pension funds remain the dominant financial investors with early-stage exploration and production start-ups and midstream infrastructure plays being the primary focal points.

A number of large U.S. sponsors—including KKR, Warburg Pincus, Goldman Sachs and Blackstone—have recently completed fundraisings for funds dedicated to energy opportunities. In addition, it was reported in late January 2015 that Apollo Global Management was in the process of raising a new fund on a compressed timeframe to focus on buying distressed debt of troubled oil and gas companies as a means of capitalizing on the dramatic decline in oil prices.

Given the abundance of private equity capital and current depressed commodity prices, we expect a wealth of buying opportunities at attractive valuations and accordingly continuing strong appetite for deals in this sector throughout 2015.

Support of junior exploration companies in the oilpatch

While private equity investors continue to look at opportunities to participate directly in the development of established assets, such as the recent acquisition by Jupiter Resources, backed by Apollo Global Management, of assets from Encana, they are also turning their attention to opportunities to back proven management teams in private exploration and production start-ups. Recent transactions include Riverstone Holdings’ C$200 million investment in Canadian International Oil Corp, a Calgary-based upstream oil and gas company, and Lime Rock Partners’ C$300 million commitment to Imaginea Energy Corp. These investments illustrate a continuing theme for Calgary’s juniors where equity commitments from strong financial partners have proven to be the preferred alternative for the execution of their business strategies (rather than attempting to tap into tumultuous capital markets which have not been supportive of junior exploration companies with such higher-risk profiles).

Deal Spotlight

In June 2014, Encana Corp announced the C$2 billion sale of its Bighorn assets to Jupiter Resources, a newly formed entity funded by Apollo Global Management. The Bighorn assets cover about 360,000 net acres primarily producing natural gas, together with related pipelines, facilities and service arrangements. It was announced that total net proved reserves at the end of 2013 were approximately 1.1 trillion cubic feet equivalent, about 75% of which was natural gas.

The growing appeal of the midstream sector

Conditions in Canada’s midstream sector are also providing attractive opportunities for private equity investment. Lack of suitable infrastructure, incremental upstream development and a fundamental upward cost shift in upstream capital costs have caused producers to consider opportunities to monetize existing owned midstream infrastructure assets in order to raise capital to both redeploy to further develop upstream assets, and outsource new facility builds and expansions rather than expend their own capital.

Deal Spotlight

In late December 2014, KKR and Veresen Inc. announced the formation of a joint venture that will acquire natural gas gathering and processing assets in the Montney region of western Canada from Encana and Cutbank Ridge Partnership (a partnership between Encana and a subsidiary of Mitsubishi Corporation). Torys represented KKR and Veresen Inc. The joint venture will acquire the assets for approximately C$600 million plus actual costs accrued in 2015 and undertake up to C$5 billion of new midstream expansion for Encana and CRP in the Montney region under a 30-year fee-for-service arrangement.