Financial services dealmaking trends: developments and considerations in M&A transactions

M&A activity in the Canadian financial services industry has softened slightly in 2025 compared to 2024, but dealmakers are finding ways to adapt and transact. Several factors are contributing to the changing dealmaking landscape, including economic and geopolitical uncertainty and regulatory developments. We review the state of play, with insights into regulatory developments and deal considerations.

Canadian M&A deal environment

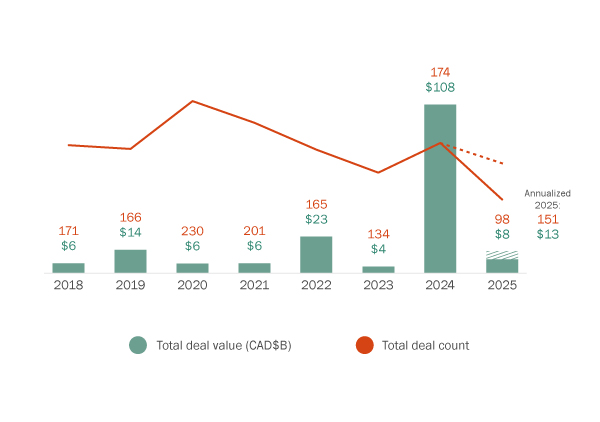

Market activity in the Canadian financial services sector has slowed modestly this year after a robust performance in 2024 but otherwise remains on par with recent years. Total transaction value in 2024 (see Figure 1) was skewed due to a single outlier transaction: the reverse merger of Brookfield Asset Management ULC and Brookfield Asset Management Ltd., which was valued at nearly $90 billion. That said, even after excluding that deal, the 2024 fiscal year still showed strong results, with a total deal value of $19 billion and a volume of 173 deals. Annualized transaction values for 2025 are projected to reach $13 billion and an annualized deal volume of 151, which represents above average transaction value and slightly below average deal volume compared to the previous seven-year period.

Figure 1 – Canadian financial services transactions by deal value and volume

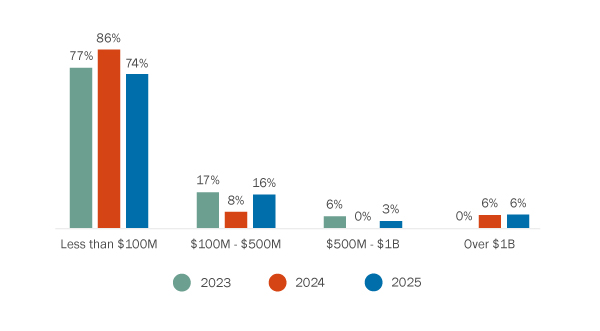

In 2025, there has been an increase in the proportion of mid-market deals (valued at $100 to $500 million) as compared to the last year, which is typical of the Canadian markets and, further, middle-market transactions are generally expected to increase to create value alignment amid ongoing economic and geopolitical uncertainty. Transactions in 2025 under $100 million accounted for 74% of market activity (see Figure 2), which is a decline from the last two years.

Ongoing consolidation across the spectrum of financial services sectors continues to drive dealmaking in the mid-market. In particular, strategic consolidations within the credit union space are gaining traction for a variety of reasons, including the ability to realize greater economies of scale, drive growth and access new markets and defray increased costs of technology and regulation. Recent examples include the announcements of the proposed mergers of Innovation Federal Credit Union with ABCU Credit Union Limited1; of Prospera Credit Union, Coast Capital Savings Federal Credit Union and Sunshine Coast Credit Union2; and of Conexus, Cornerstone and Synergy Credit Unions3.

At the time of writing, the proportion of deals valued at over $1 billion remains on par with 2024, reflecting sustained momentum for larger deals, despite ongoing market unpredictability. The top three transactions alone account for more than 80% of the overall deal value so far in 2025. The largest transaction to date is Definity Financial Corporation’s acquisition of personal and commercial insurance business of Travelers Canada for $3.3 billion. Notable announced deals in 2025 also include First National Financial Corporation’s agreement to be acquired by Birch Hill Equity Partners and Brookfield4 in a deal valued at nearly $2.9 billion and the acquisition of Burgundy Asset Management Ltd. by BMO Financial Group5 for approximately $625 million.

Figure 2 - Canadian financial services target transaction value range

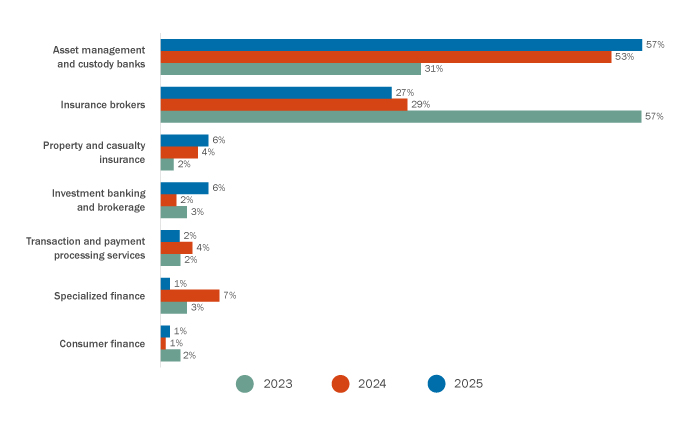

High-quality assets in the financial services sector remain in-demand, creating stiff competition among buyers. M&A transactions in the asset management and custody banking areas (as targets) accounted for over 50% of the deals. Some notable deals in this space include iA Financial Corporation’s announced acquisition of RF Capital Group Inc.6, BMO’s announced acquisition of Burgundy Asset Management Ltd.7, the take-private of CI Financial by Mubadala Capital8 and Guardian Capital Group’s go-private acquisition by Desjardins9. Strategic reasons stated for the acquisitions include strengthening the position in the Canadian independent wealth management space and enhancing ability to cater to high-net-worth and ultra-high-net-worth clients.

Figure 3 – Canadian financial service target sector

Regulatory developments and deal considerations

The financial services industry and regulatory landscape has undergone transformational change in recent years. Canadian regulators continue to build on their proposed changes to anti-money laundering (AML), banking, consumer protection, sanctions and payments laws, many of which were announced in Canada’s 2024 Fall Economic Statement. As a result, transactions in financial services and related spaces often require enhanced due diligence to meet new and emerging regulatory compliance measures, and lengthier deal times may be a result for some acquisitions.

Buyers and sellers will want to pay close attention to compliance matters in the due diligence process and interim period covenants given the trend towards more involved regulatory review processes and lengthier interim periods. Similarly, dealmakers may spend more time considering the drafting and use of bespoke termination rights than in the past.

Increased M&A activity involving companies developing, selling or leveraging artificial intelligence (AI) has raised a host of questions regarding how to best address the unique risks associated with AI. Buyers or investors may seek to enhance diligence in the area and include representations and warranties that address privacy and data use, unique cybersecurity risks, IP, AI functionality and training, internal AI governance frameworks and compliance with laws. Financial institutions (FIs) should also consider what will be required in interim and post-closing periods to bring any target AI systems up to the FI’s internal AI governance standards.

Similarly on the data front, FIs are increasingly required to engage in more intensive uplifting exercises post-closing to ensure targets with less sophisticated privacy, cybersecurity and data governance functions meet the FI’s standards (and often, newly applicable legal requirements). In the post-closing period, operational matters like consolidation of data and scaling the digitization of smaller targets can pose data retention and governance issues, such as the extended retention of data on legacy systems. This in turn can create interim privacy and cybersecurity risks until the operational matters are resolved.

Recent amendments to the Competition Act have also strengthened the Competition Bureau’s enforcement tools and posture towards merger enforcement and monitoring in Canada. In addition, federal FIs are seeing a heightened focus from regulators on integrity and security measures, which have been codified in recent amendments to the Bank Act, Trust and Loan Companies Act and Insurance Companies Act. In particular, FIs are now required to maintain policies and procedures to protect themselves against threats, including foreign interference (which OSFI must review annually). Further, penalties and enforcement actions are poised to increase as the regimes governing FIs continue to expand—specifically, in June 2022, the Bank Act was amended to expand the Financial Consumer Agency of Canada’s (FCAC) power and reach alongside increased consumer protection mandates, and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has been increasingly imposing administrative monetary penalties under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Finally, the Office of the Superintendent of Financial Institutions recently issued a letter to industry10 regarding its revised approach to its administrative monetary penalties, which includes a lower tolerance for contraventions of federal financial institution statutes.

- See ”Innovation Members Approve Historic Merger | Innovation Federal Credit Union” (Innovation, June 26. 2025).

- See “Prospera, Coast Capital and Sunshine Coast credit union members approve merger” (Coast Capital, July 9, 2025).

- See “Connexus, Cornerstone, and Synergy Credit Unions Recommend a Merger to Members” (Conexus, April 8, 2025).

- Torys is acting as counsel to First National’s founders, Stephen Smith and Moray Tawse.

- Torys is acting as counsel to Burgundy Asset Management.

- See “iA Financial Corporation to acquire RF Capital Group Inc.” (iA Financial Group, July 28, 2025).

- See “BMO to Acquire Burgundy Asset Management” (BMO, June 19, 2025).

- See “Mubadala Capital to Take CI Financial Private via Premium, All-Cash Offer” (CI Financial, November 25, 2024). Torys acted as Canadian counsel to Bain Capital as a holder of preferred equity in Corient Holdings Inc., the U.S. subsidiary of CI Financial Corp.

- Torys is acting as counsel to the special committee of Guardian Capital.

- See “Letter to industry - Revision of OSFI’s approach regarding Administrative Monetary Penalties” (OSFI, September 11, 2025).

To discuss these issues, please contact the author(s).

This publication is a general discussion of certain legal and related developments and should not be relied upon as legal advice. If you require legal advice, we would be pleased to discuss the issues in this publication with you, in the context of your particular circumstances.

For permission to republish this or any other publication, contact Richard Coombs.

© 2026 by Torys LLP.

All rights reserved.