How Fair Is Fair? The Spotlight Will Be on the M&A Sales Process

Authors

As M&A activity revives in 2014, we expect to see greater focus on building a sales process that establishes fairness and satisfactory price discovery.

One clear marker of this trend is the increased frequency with which target boards obtain two fairness opinions: one from the company’s adviser on the transaction and the second from an independent firm whose compensation is not tied to deal success, and which acts for the board or its special committee.

Market participants continue to debate the value of a second, independent, opinion. Concerns are sometimes expressed that the independent adviser typically has not been close to the negotiations and therefore may be at a disadvantage in assessing the deal or might slow down the sale process and add to transaction costs. Set against these concerns is the view often expressed by board members that there is considerable value in an opinion that is independent of the success or failure of the proposed transaction. It is important to remember, however, that one approach does not fit all deals. The incremental value of an independent opinion can vary depending on the circumstances of the deal. For example, how significant is the transaction adviser’s success fee? Was an effective market check on price conducted before the deal was signed? How serious are the conflicts of interest of board members or within the management group? What is the level of M&A experience at the board and management levels? Is there an effective post-signing procedure to perform a market price check?

Buyers have sometimes obtained fairness opinions when issuing significant share consideration. Although the buyer’s board must consider the fairness of any transaction to its own stakeholders, it is rare to obtain a formal fairness opinion, particularly if the value of the consideration is transparent. However, when there is substantial share consideration, the buyer’s board must also consider the potential dilutive impact on the buyer’s shareholders and may be required to obtain shareholder approval of the share issuance. Obtaining an opinion can help explain the deal to shareholders and acts as a discipline and a shield against attack.

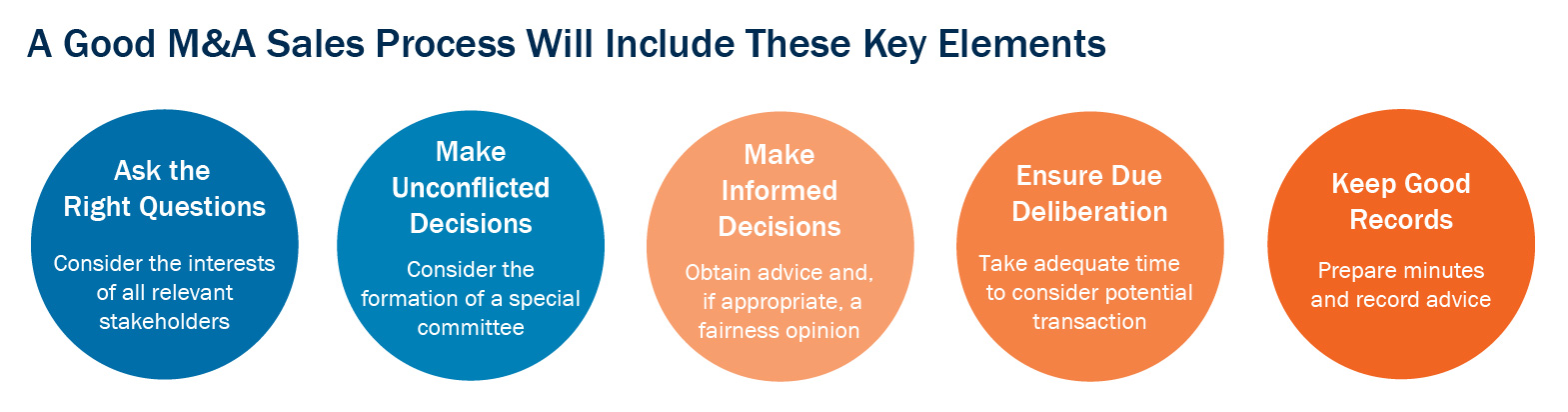

Although obtaining a fairness opinion offers evidence of reasonable board governance, the trend toward enhanced sale processes is also taking place at a more nuanced level. Boards are becoming engaged at an earlier stage, meeting more frequently and supervising management’s negotiations more closely, especially where conflicts of interest are prevalent. We anticipate that this will continue, with directors and their legal and financial advisers more rigorously challenging the sale process, the validity of the assumptions that support their adviser’s financial analysis and the appropriateness of deal-protection terms in the circumstances.

These developments are the natural outcome of improved governance practices (see article 6, Shareholder Activism Will Increasingly Influence M&A Governance Practices), shareholder activism, more extensive disclosure and recent cases, particularly in the United States, where sales processes have been challenged. Delaware courts have held that there is no single blueprint for a reasonable board process, and their judges are knowledgeable about M&A transactions and scrutinize board actions in great detail. They have criticized boards for failing to adequately test the market and waiving standstills before signing an exclusive deal. They have also questioned the financial adviser’s discounted cash flow analysis, management’s negotiating tactics and the degree to which the board has supervised management.

Although Canadian courts tend to be more deferential, boards in Canada are facing greater scrutiny than in the past. Criticism of the sale process increases execution risk and jeopardizes reputations. With the continuing increase in U.S.-based shareholder activism and cross-border M&A, we expect Canadian boards to heed this trend and become similarly focused on establishing a robust sale process.